How Adoption of Blockchain in Real Estate Changing the Scenario?

Blockchain is proven to hold the potential to revamp every business vertical. The technology has given a clear indication that it has various applications beyond cryptocurrencies and can be the right weapon to tackle the prevailing industrial challenges.

A ripple effect of which is that various industries have adopted Blockchain technology, even the most traditional ones like Real Estate.

Real Estate is witnessing a disruptive evolution with Blockchain acting as the driving force. What was historically considered as a ‘pen and pencil’ business has now begun expanding to the global market with better and long-term outcomes. This has made numerous entrepreneurs and traditional investors interested in understanding the use of blockchain for real estate. Something we will talk about in this article in detail.

In a hurry? Jump directly to-

Challenges faced by real estate industry

Areas revamping with the adoption of blockchain technology in real estate

Blockchain-based real estate companies turning hype into reality

How to incorporate a blockchain in real estate business apps?

Challenges you might face while introducing blockchain in your processes

Challenges faced by real estate industry

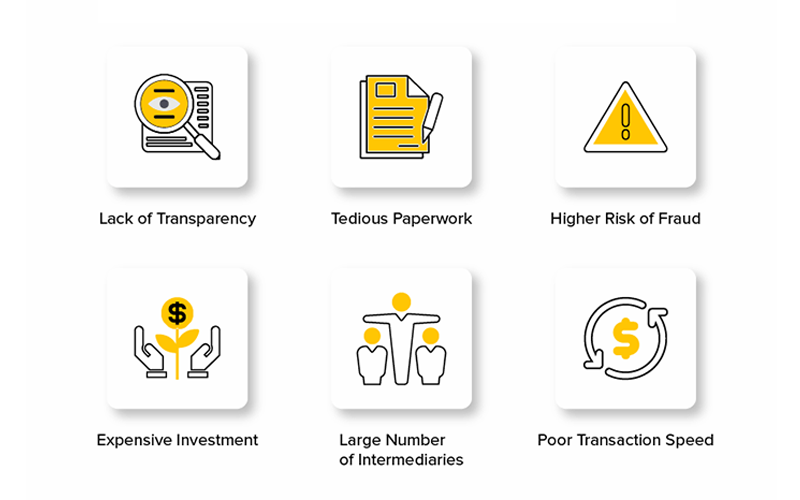

1. Lack of Transparency

The Real Estate industry is not open to everyone due to the involvement of various factors like citizenship, cash requirements, accreditation, credit score, etc. Additionally, there is no market database or a concrete way to access the information required for taking the buying and selling decision.

This, as a whole, makes the sector unclear and turbid for all.

2. Tedious Paperwork

In traditional Real Estate economy, every transaction involves a stringed set of tedious and time-consuming paperwork. Because of this, many a times real estate companies end up losing their money and potential customers, along with getting distracted from the main goal.

3. Higher Risk of Fraud

Since all the property agreements are in paper form and the trust is based on humans, there’s a higher risk of fraud in the Real estate industry. A proof of which is that around 1.48B records were found vulnerable between 1st Jan, 2005 and 31st May, 2019.

Another indication is that California, the state with 12% of the total U.S. population, creates 24% of all reported mortgage fraud cases.

4. Expensive Investment

Due to the involvement of a wider number of intermediaries, various fees like broker fees, attorney fees, exchange fees, taxes, etc. are added to the Real estate cost, which ultimately makes real estate investments expensive.

5. Large Number of Intermediaries

Another problem associated with the traditional Real Estate economy is that trust is based on human factors. Any two parties have to involve third-parties at different levels to build trust in the process. This is again one of the challenges in real estate solved by blockchain.

6. Poor Transaction Speed

Last but not least, real estate processes suffer from poor transaction speed due to the involvement of multiple people.

As per a Chinese global travel survey, 44% of travelers fix an appointment with real estate agents before going abroad. Also, 74% among them meet two or more experts to be sure of their decision to purchase property in the city they’re traveling to.

Blockchain technology, with its incredible features, are entering different areas and processes of the real estate industry and solving these problems.

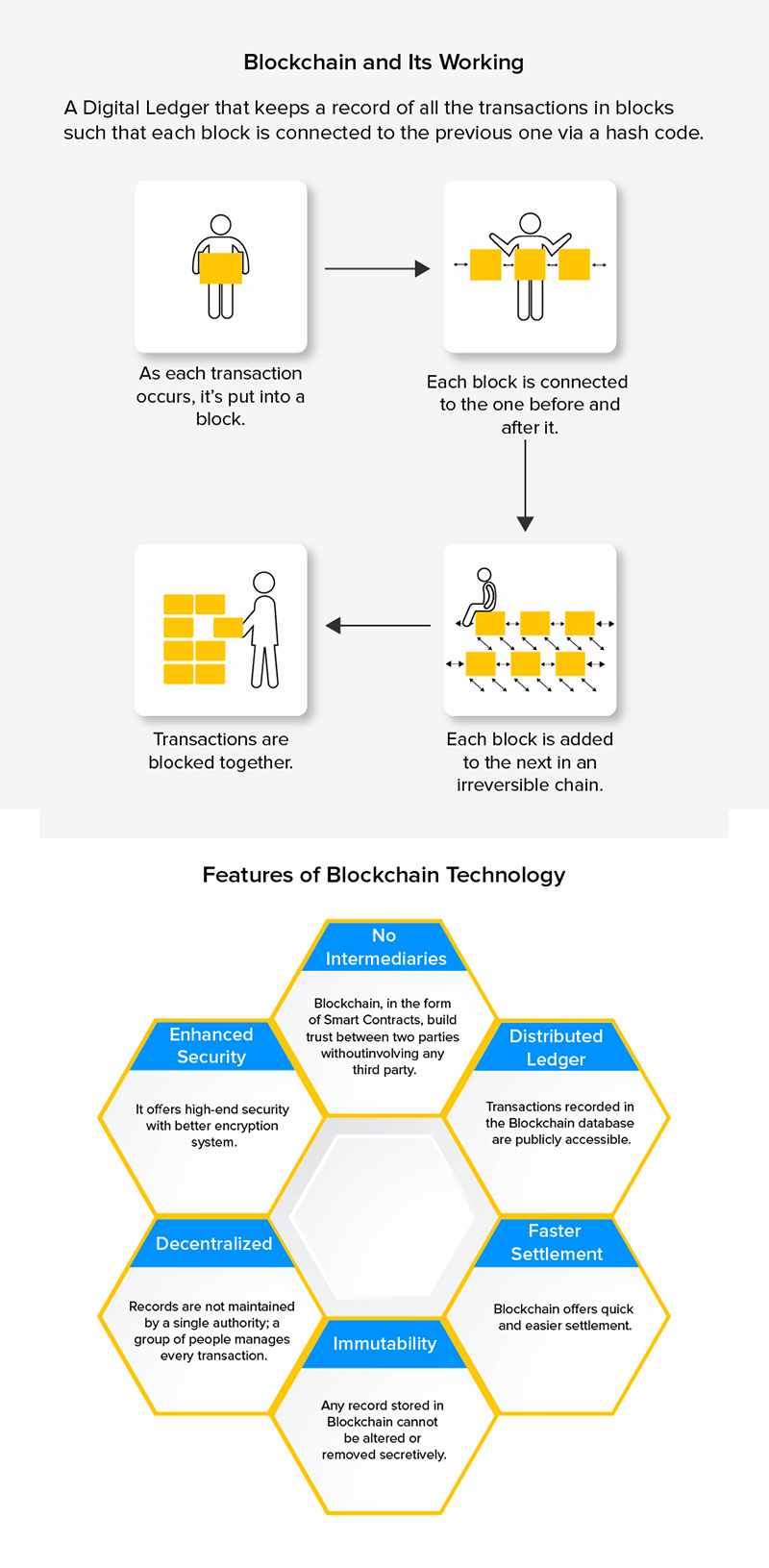

Before we talk about the benefits of blockchain in different areas of real estate, let’s have a quick recap of the basics of Blockchain – how does it work and the features it comes with.

With this attended to, it is a good time to dig deeper into the industry and see how blockchain is one of the key technology helping real estate thrive even in COVID-19 times.

Areas revamping with the adoption of blockchain technology in real estate

1. Property Search

Currently, brokers, owners, tenants, and buyers turn towards multiple listing platforms like Zillow to search for any property information.

These platforms are subscription-based and demand high fees. Besides, the property data provided by them is often inaccurate, outdated, or partially distorted. This increases inefficiencies in the process and many a times, results into disputes.

But, all this can be prevented using a Blockchain-based real estate app.

A Blockchain-backed application can decentralize data and enable everyone to share data in a P2P network. It also facilitates brokers with an opportunity to receive additional data monitoring options and eventually, helps to cut down the associated cost.

2. Due Diligence and Financial Evaluation

In Real estate sector, a major time is spent on diligence activities before buying/renting any property. Various intermediaries are involved in the process of inspecting property documents to prevent any kind of legal, technical, or financial issues in the future.

Currently, all the property data is kept on papers which can be easily changed or corrupted by anyone.

However, with the adoption of blockchain technology in real estate app development , this subdomain can also be improved.

All the property-related papers can be kept stored digitally in blockchain-powered platforms, such that they can be accessed publicly but can’t be altered. This will make due diligence and financial evaluation process automated, quick, and less inaccurate.

3. File and Payments

A significant impact of blockchain on real estate is also experienced in the field of File and Payments.

At present, the extensive documentation and involvement of third party intermediaries are making the process lengthy, troublesome, and costly. And this effect is becoming more significant when international transactions or mortgages are involved.

Now here, Blockchain technology can simplify the filing process and bring innovation in real estate processes by introducing verifiable digital identities for properties.

Likewise, introduction of cryptocurrencies can lower down the barrier of different currencies used at different places. It can even minimize the involved taxes and fees, alongside streamlining the payment process.

4. Property Management

In the traditional real estate economy, the process of property management is highly complex, especially when multiple stakeholders are involved.

The management of property is either done offline via manual paperwork, or some independent softwares is used. Because of this, the information remains confined to a particular database or person.

However, with the increasing role of blockchain for property transactions, the future of real estate can be changed.

A blockchain-based property management system that uses smart contracts can ease the whole process – right from signing lease agreements to regulating cash flow and filing maintenance requests.

A Smart contract can automatically set up lease payments between a landlord and a tenant. When the lease terminates, the smart contract can automatically transfer the security deposit back to the tenant’s account and deliver a seamless experience to both parties.

5. Deed Management

Another field where you can see the impact of Blockchain on the real estate apps market is Deed management.

Currently, property titles are paper-based. Because of this, there is a higher risk of errors and fraud cases. In fact, it has been revealed by American Land Title Association that 25% of all the titles are found to be defective during the transaction process.

The presence of any defect makes it illegal to proceed with the deed management process unless the issue has been resolved. This makes it imperative for property owners to pay high legal fees to ensure accuracy and authenticity of their property titles.

This issue can be easily resolved with the use of blockchain in real estate as immutable digital records – making the whole process transparent and secure.

6. Real Estate Investing

Last but not least, a blockchain-based real estate platform can also streamline the investing process – using the concept of tokenization and fractional ownership.

Tokenization is termed as a process in which the owner can give digital tokens to those having a share in property. They all can track their investment using blockchain, with each transaction being immutable and time-stamped.

This concept of tokenized real estate can make it possible to reduce the risk of fraud associated with the industry. An impact of this is that soon 66M buildings will be tokenized on Ethereum Blockchain in record deal.

Whereas, Fractional Ownership will reshape the future of traditional real estate economy. The process of making unrelated parties come together to share and eradicate the risks associated with the ownership of a high-value tangible asset can help small investors enjoy ROI without waiting for months or years. And eventually, make trading of real estate properties possible beyond the geographical boundaries.

While this would have given you an idea of the endless opportunities of blockchain technology in the real estate industry, let’s go through some real-life examples to understand it better.

Blockchain-based real estate companies turning hype into reality

1. UBITQUITY

UBITQUITY is a SaaS (Software-as-a-Service) blockchain platform that helps track the lifecycle of any property. The platform provides title companies, government, and value added resellers a clean record of ownership. And in this way, leverage the advantages of blockchain like lower future title search time and enhanced transparency.

2. ATLANT

Founded in 2016, ATLANT is a blockchain-backed ICO that enables tokenization of real estate ownership and P2P rentals.

3. Propy

Propy is also one of the real estate companies using blockchain technology for serving the world with better opportunities and benefits. The company provides a global real estate marketplace that empowers buyers, brokers, sellers, and notaries to come together and ensure better transactions by utilizing the power of Smart Contracts.

4. PropertyClub

PropertyClub is another platform that refines the way we think about the role of blockchain for real estate progress. It relies on smart contracts to perform digital transactions in the real estate ecosystem using cryptocurrencies like Bitcoin or PCC (PropertyClub Coin) and thus, enhance customer experience.

5. Harbor

Harbor is a digital platform that employs blockchain to create a series of tokenized securities powered by real-world assets. Founded in 2017, this platform certains that tokenized security go with existing security laws on trades depending on the regions they are working in.

6. RealtyBits

RealtyBits is also a blockchain-powered Y-Combinator-backed finance platform to invest in American commercial real estate. Founded in 2018, it aids real estate investment funds to raise capital via verified and authorized investors in a streamlined, compliant, and cost-effective manner.

7. Brickschain

Brickschain is a data management platform that digitizes the main overview of construction supply chain. Also known as briq, it facilitates introduction of protocol layers to easily manage the flow of building materials and eventually, streamline real-estate development.

8. ShelterZoom

SelterZoom is also a real-time real estate platform that embraces blockchain technology to simplify transactions and management process. It enables users to track their offers, get rid of manual documentation, and perform any transaction in real-time via mobile app.

9. The LendingCoin

Founded in 2017, this startup focuses on exploring the potential of blockchain in commercial real estate in the form of a P2P-driven funding model.

The LendingCoin offers the facility to make payments using its token and also encourages the resulting monthly payments through any refinancing conducted on the platform.

[While we talked about Blockchain-based funding model in general here, you can get detailed information about it from this article: An Introduction to Blockchain Funding Models Beyond ICOs]

As we have seen so far, blockchain is bringing innovation in real estate via different characteristics, including transparency, simplification, and security. Various companies have already integrated the technology into the business model and many more will be joining them in the future.

This makes it obvious to conclude that blockchain is the future of real estate and thus, it won’t be affordable to exist in the market by overlooking it. Something that proves that it is high time for real estate companies to hire a blockchain development company and upgrade their business model.

So, let’s move towards how to add blockchain in your existing real estate business model.

How to incorporate a blockchain in real estate business apps?

When it comes to investing in Blockchain app development for real estate, there are basically two approaches you can go with:-

1. Build a Smart Contract using LISK

LISK is a platform for Blockchain application development that acts as a PaaS (Platform-as-a-Service). It offers operating systems, database, cloud infrastructure, programming language runtime environment. This helps in bringing your own code to create a side chain or a crypto token.

2. Develop an Ethereum-backed Real Estate Platform

In this approach, Ethereum platform, which has reached Ethereum 2.0 level, can be employed for building a blockchain app for Real estate.

While both approaches are profitable in terms of how to build a Real Estate app on Blockchain, it is best to contact reputed Blockchain app development service providers to enjoy a better ROI.

Now while we are familiar with the uses of blockchain technology in real estate and the companies embracing it, it is good to be aware of the fact that there are still some challenges hindering the evolution of blockchain-based real estate economy. Something we will end our article with.

Challenges you might face while introducing blockchain in your processes

1. Widespread Adoption

It’s true that blockchain is one of the top technology trends in the real estate domain. But, the technology is still evolving. Because of this, many entrepreneurs are finding it tough to understand its potential thoroughly. This is acting as a barrier in the process of integrating Blockchain technology in real estate business.

[Bonus Read: An Entrepreneur’s Handbook to Blockchain]

2. Scaling

In real estate economy, billions of global transactions are made annually. This demands a network that can handle large transactions volume. However, there are still not many options available in the Blockchain space to meet this need.

While Bitcoin is able to handle 5 transactions per second, Ethereum is offering the opportunity to manage 15 transactions every second. Likewise, Ripple’s XRP – which is one the cryptocurrencies trends, is hoping to perform 1,500 transactions per second.

However, this is still not close to the need of large-scale companies that requires ultra-speed processing in real-time.

3. Chain Interoperability

Another challenge that real estate companies are facing while embracing Blockchain is chain interoperability.

There are various blockchains existing in the digital market, many of which are not able to connect or work together. This lack of interoperability is making it tough for real estate companies to use different data available on public and private Ethereum blockchain simultaneously and streamline their processes.

Frequently Asked Questions

1. How will Blockchain change Real Estate?

Blockchain will change Real Estate industry by providing advantages like:

- Higher Transparency and traceability,

- Elimination of third-parties,

- Faster transactions, and

- Lowered cost of every transaction.

2. How to use Blockchain in real estate business?

Blockchain can be used in different areas of real estate in different forms, such as:-

- a smart contract,

- a decentralized and immutable ledger, and

- in the form of cryptocurrencies.

3. How will blockchain technology affect the real estate industry?

Blockchain technology in the real estate economy will help overcome the existing challenges and bring better opportunities. It will:

- make the real estate process transparent,

- reduce the cost involved,

- simplify the process of property and deed management,

- enhance security level, and much more.

strategies your digital product..