Asset Tokenization on the Blockchain {A Complete Guide}

Blockchain has poised to bring a transformative difference in the finance world. The technology, with its characteristics like decentralization, immutability, transparency, and distributed structure, has added new forms of benefits and applications into the ecosystem.

One of which is asset tokenization on blockchain surface.

This concept has emerged to be one the top Blockchain technology trends by opening new doors for tokenization of anything and everything in the marketplace – be it diamond, paintings, or property.

But, how far will it take the market? Will it become a key addition to every business?

Let’s talk about it in this article – starting with a simple definition of what is tokenization.

Tokenization of Assets – Its Definition and Types

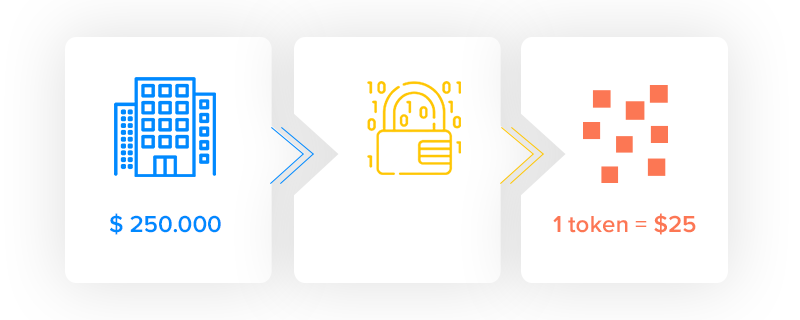

The simplest answer to what is asset tokenization on blockchain is that it is a process through which a blockchain token is issued to digitally represent any real tradable asset in a way that you can trade with a single fraction of the asset as well.

The process sounds much like Securitization and Fractional Ownership, but it holds some key differences – something we will cover just before diving deeper into the tokenized world and discussing the token types.

Tokenization vs Securitization

When talking about how tokenization is different from securitization, the former turns all the real world assets into high-liquidity digital token, whereas the latter converts low-liquidity assets into higher-liquidity security instruments that could be traded in markets and over-the counter.

Tokenization vs Fractional Ownership

Fractional ownership, unlike Tokenization, provides an opportunity to bring unrelated parties together to enjoy trading in a digital world.

With the basics of Tokenization of commodities now clear to you, let’s look into what are the types of tokens operative in the Blockchain environment.

Types of Tokens Circulated and Used in Blockchain World

To ensure that you get the best perks of investing your efforts into the development of tokenized asset, tokens are broadly divided into two basis:

1. On the Basis of Nature

- Tangible Assets – The term represents a set of assets that holds some monetary value and is available usually in a physical form.

- Fungible Assets – These digital assets are created such that every token is equivalent to the next. Meaning, one bitcoin is equal to one bitcoin and is interchangeable with one bitcoin only.

- Non-Fungible Assets – They are designed as unique and can’t be interchangeable.

2. On the Basis of Speculation

- Currency Tokens – These tokens represent currencies in digital form.

- Utility Tokens – The term refers to a digital token that is issued to support funding for the development of cryptocurrency and can be later employed for purchasing a particular product or service offered by the issuer of the cryptocurrency.

- Security Tokens –Security tokens, one of the cryptocurrency trends, is basically the digital representation of traditional securities.

Now as we are familiar with the types of tokenization of assets via distributed ledger blockchain technology, it’s the right time to look into what are the benefits of this process.

Advantages of Considering Tokenization

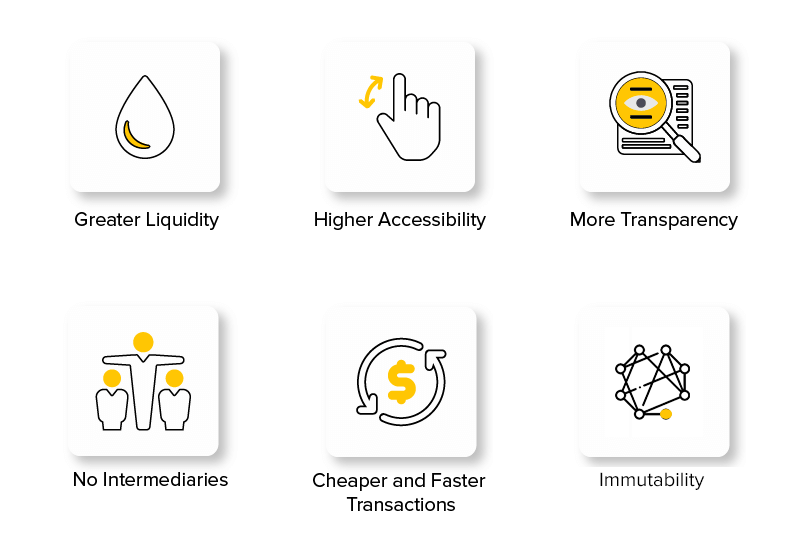

1. Greater Liquidity

One of the prime benefits of Asset Tokenization is enhanced liquidity.

Presently, the market for privately held firms is illiquid. Because of this, it takes more time for buyers and sellers to know about each other and the services they offer.

They also have to spend considerable time deciding the factors for doing business together and hiring lawyers, and other service providers for building a contract for executing the transaction.

But, with the adoption of asset tokenization, this process becomes smoother and streamlined. It introduces a blockchain platform where tokens represent private company securities and are sold to participants who would have pre-vetted in such areas as authorized investors with adequate capital to take the risk.

These investors can exit the platform anytime by selling their tokens on a secondary market easily and efficiently. They won’t have to suffer from the hassle of early redemption which is an expensive affair.

This, as a whole, will encourage high net worth individuals and agencies to make an investment in private company securities. And ultimately, build a global market for these private securities.

2. Higher Accessibility

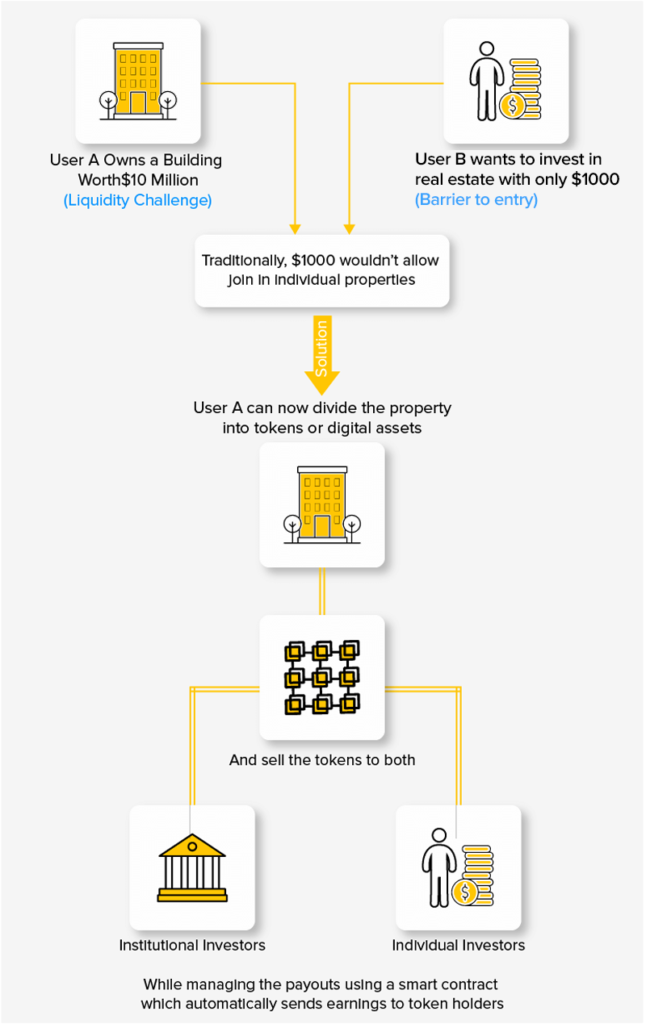

Accessibility is also one of the prime benefits of asset tokenization on blockchain surface.

The adoption of asset tokenization on blockchain allows fragmentation of assets to the minimum possible amounts in the form of tokens and encourages investors to get a small fraction of shares. This opens doors for different investors and cuts down the minimum investment period and amount.

3. More Transparency

Transparency is yet another advantage of tokenization.

In tokenization of assets, the token-holder’s rights and responsibilities are embedded in the contracts that define token attributes, along with a complete record of ownership. This gives you an idea of whom you are dealing with, what power they have, and whom they have purchased this token from. Something that adds transparency to the whole process.

4. Immutability

The data stored on blockchain cannot be changed, deleted, or corrected. So anyone interested in buying or selling tokens can be assured that the asset information and transaction records are accurate, as they are verified and cannot be changed once recorded onto the blockchain.

5. No Intermediaries

With the introduction of Smart contracts and characteristics like immutability, tokenization has also reduced the number of intermediaries required in a transaction.

6. Cheaper and Faster Transactions

Since transactions of tokens will be done using Smart contracts, a major portion of the process will be automated. This will cut down the number of intermediaries and the efforts required in administering the whole process. This will eventually result in faster and cost-effective transactions, which will be yet another advantage of tokenization of assets.

Now, while these are the pros of Tokenization in general, let’s dive into the business side of it and see what it means to different sectors.

Industries That Are Embracing the Concept of Tokenization of Assets

1. Finance

Tokenization, one of the applications of blockchain in the fintech industry, is changing the landscape in different ways – be it margin lending, product structuring, investment, or payments.

The concept facilitates finance organizations with an opportunity to turn all the assets into digital crypto-currencies that could be exchanged seamlessly. It gives merchants an escape from storing the actual credit card numbers in POS machines and other systems. This, as a whole, introduces liquidity in the market and lower down data security breaches.

Likewise, tokenization of equity shares provides users with more than one token issued for the same credit card. Meaning, even if you have used any token on an online website and that portal gets hacked, it won’t be easier to reverse engineer the code and learn the actual credit card number.

A real-world example of this emerging trend in investment strategies is AlgoZ partnership with OmiseGo.

2. Real Estate

Real estate is yet another business domain that leverages higher benefits of development of tokenized assets.

The concept of real estate tokenization streamlines the investing process. It eliminates the intermediaries, making it easier and cost-effective for buyers and sellers to interact with each other. It also lets anyone invest any amount, which further results into a better marketplace for all.

Besides, this concept reduces the risk of fraud. Something because of which 66M buildings will be tokenized on Ethereum Blockchain in record deal soon.

When talking about real estate tokenization, there are various platforms offering exceptional services in this direction. Some of them are Harbor, Slice, and Meridio.

3. Healthcare

Healthcare sector is also turning towards the idea of adoption of tokenization to settle down some major challenges prevailing these days.

Tokenization replaces sensitive patient data like PANs, NPPI, and ePHI with unique and non-sensitive values, which reduces the data breach cases. It also transfers the power to create, access, and share sensitive data from the intermediaries like insurance companies to patients and medical organizations. And in this way, tokenization of healthcare processes and information empowers patients to validate the accuracy of their data, while saving a hefty amount offered to these third parties.

Clincoin is a perfect example of understanding the scope of tokenization and token economy in the healthcare domain. This Blockchain-based platform, besides connecting users, providers, and developers, pays rewards to users for engaging in healthy activities. Users can then use these tokens to buy digital tools, products, and services in decentralized marketplace.

4. Sports

Another industry that experiences significant positive changes with the emergence of asset tokenization is the Sports industry.

Asset tokenization on blockchain platforms decentralizes the whole marketplace, making it easier for investors and fans to invest in their favorite sports players and clubs trade the gained benefits. This further helps sports clubs and players to meet their financial needs and perform in this field more effectively and profitably.

Various sports clubs and firms have already started looking into this direction, while many are planning to embrace the concept. And one such example is the recent Manchester City and Superbloke partnership.

5. Enterprise

Enterprises also harness the potential of tokenization of real-world assets in its monumental shift to Blockchain. They consider this concept to extend their approach to new markets, evaluate employee performance, ensure proper resource allocation, introduce better incentive models, and add transparency to all the internal processes.

Additionally, Enterprises introduce different tokens for different assignment types to give a tailored experience. They set an award for a particular amount of tokens which helps in showing their importance in concrete terms. Something that is beyond the scope of labels ‘high-priority’ and ‘urgent’, which product managers were using earlier.

6. Art Industry

Blockchain can make art more accessible not only to art lovers but to artists as well because they can now tokenize their works and sell them around the world without intermediaries. One of the recent examples that made headlines was the successful tokenization of the first multi-million dollar work of art. It was a painting by Andy Warhol named “14 Small Electric Chairs (1980)”. The main purpose of the beta auction was to test the Dutch auction process and generally check how the artwork tokenization and blockchain technology work.

The concept of management of tokenized assets will enter many more business verticals. The global tokenization market size is expected to grow from $ 1.9 billion invested in 2020 to $ 4.8 billion by 2025, at a CAGR of 19.5% over the forecast period, which gives an impression that introducing this concept into your business vertical is not a bad idea.

Risk and Challenges to Adoption of Tokenizationn

1. Not immune from attacks

Like any other technology, blockchain is unfortunately targeted by hackers. For instance, in 2020, blockchain hackers launched 122 cyberattacks and stole $3.78 billion. Though the statistics aren’t positive, there has been a downward trend in the number of cyberattacks on the blockchain platform. In 2019, there were 133 attacks targeting various applications, so in 2020 the number of attacks decreased by 8%. While this is not a significant drop, it still reflects the increasing security of the technology.

2. Regulatory issues

Most of the obstacles in asset tokenization are related to regulatory issues and current technology constraints. Blockchain has a borderless nature and offers several opportunities for businesses and individuals. At the same time, countries haven’t developed common regulations that would apply in different jurisdictions.

However, this is a completely normal situation faced by any new global trend or technology. Regulators, politicians, and even developers need to begin work on defining the legal framework and drafting global laws and regulations regarding tokenized assets and the activities associated with them.

Now let’s look into what approach does blockchain development services providers like those at Appinventiv follow for designing tokens, followed by what all factors must be taken into consideration.

How Appinventiv Introduces Tokenization in Your Existing Business Model?

At Appinventiv, we understand that the process of creation and management of tokenized assets that suit your business needs depends on various factors (something we will uncover in the next part of this article). We then make a plan and prepare the right infrastructure for the tokenization process. Later, we launch an asset in the blockchain environment and make it publicly available for performing different exchanges.

With this attended to, let’s turn towards the factors that we and various other blockchain application development companies and asset tokenization companies consider when focusing on asset tokenization.

Factors to Consider Before Entering Token Economy

1. Business Model

When it comes to focusing on being a part of the future of asset management, the foremost decision is to determine the right business model depending on different factors, including:-

- The decision of acting as an advice issuer on how to build a token or be a keeper of token.

- The decision of whether to reap higher benefits being a custodian to develop life cycle event transactions using distributed ledger, or introduce smart contracts into the tokenized world.

- The choice of performing as a central distributor for providing access to transact on various tokenization platforms or maintaining user accounts on cryptocurrencies.

2. Platform Integration Process

Depending on the business model selected, you can execute different operating models. This includes choosing the right platform users will employ or collaborate with.

Now, this decision again varies with different factors, such as:-

- Type of Products/Services to be offered,

- Nature and Size of the target audience,

- Infrastructure involved, and

- Regulations to be followed.

3. Cybersecurity

With the growing implementation of cryptocurrencies in the business world, the risk of cyberattacks is also increasing. Though the distributed ledgers themselves offer a higher degree of security using the concept of consensus and cryptology mechanisms, there are still various weak points.

So, it is again imperative for companies to focus on regulating the right security measures into the process of tokenizing intellectual property at different levels.

4. Compliances

In the token economy, business interactions are unswerving, quick, and immutable. Because of this, it is imperative to implement the right operational measures that comply with the regulations. It is required to bring the new participants like KYC utilities and blockchain analytic software vendors forward for implementing better operational measures.

When focused on the aforementioned factors, the process of tokenization of loans and assets can bring better results. It can create better opportunities and solutions to existing challenges, resulting in a better future of asset management.

However, the potential of blockchain-backed tokenization will not remain confined to business domains. It will also help other technologies like AI and IoT etc. deliver a better experience.

Frequently Asked Questions about Tokenization

Q. Why asset tokenization seems to be one of the most promising blockchain applications?

The concept of asset tokenization emerges out to be the most promising blockchain applications for investors, creators, and users.

For creators, it brings out better crowdfunding opportunities to creators and enables them to upgrade their solutions in an effective manner.

For investors, it opens new markets by lowering down the barrier of minimum cost for entry.

For users, it comes up with better facilities in terms of exchange of tokens.

Q. How exactly does asset tokenization work?

In the process of tokenization of assets, a real-world asset like gold, property, or money is converted into digital tokens such that one can perform actions on a fraction of the real-world asset as well.

Q. What Do Security Tokens Offer for Entrepreneurs?

Security Tokens offer a myriad of benefits to Entrepreneurs, including increased crowdfunding, low barriers to market entry, enhanced liquidity in the processes, and better employee management.

Q. How to Tokenize an Existing Business?

Tokenizing an existing business involves a step-by-step process, which is as follows:-

- Understanding the existing business and revenue generation model.

- Once the traditional model and the payment gateways are identified, the next step is to look ahead towards tokenization. This includes determining what type of tokens to introduce for establishing a token business model and how. The next step is to integrate the token into your existing business model and launch publicly.

Q. Why is real-world asset tokenization a game-changer?

Real-world asset tokenization is a game changer because of the several benefits it offers such as enhanced liquidity of assets, reduced entry barriers, attracts new investors, lower risks thanks to better market transparency, and more.

Final Note

We hope this blog was helpful in understanding what is asset tokenization on blockchain and how it is impacting various industries. In case you still have any questions, contact us. Our experts will help you in understanding the concept of asset tokenization and what factors you should consider before entering the token economy.

strategies your digital product..