How Blockchain Technology is Transforming the Insurance Industry

Blockchain innovation is disrupting the insurance industry. And, for good!

As per a report by Markets and Markets, the global market for blockchain in insurance is expected to reach USD 1,393.8 million by 2025 from USD 64.50 million in 2018, at a CAGR of 84.9%.

Blockchain technology is helping the insurance sector radically transform operations by providing a myriad of benefits in the form of reduced costs, enhanced customer experiences, improved productivity, increased transparency, and more.

The use of blockchain in the insurance sector is expected to grow dramatically in the years ahead. According to Gartner, blockchain is estimated to be more heavily adopted by organizations by 2023 and lead to $3.1 trillion in new business value by 2030.

Therefore, it’s the perfect time for organizations to unlock the potential of blockchain, understand how to apply the technology effectively, and grow businesses.

Keep reading the article to know the benefits of blockchain for the insurance sector and the various real-life use cases.

Let’s dive in!

How can Blockchain benefit the insurance industry?

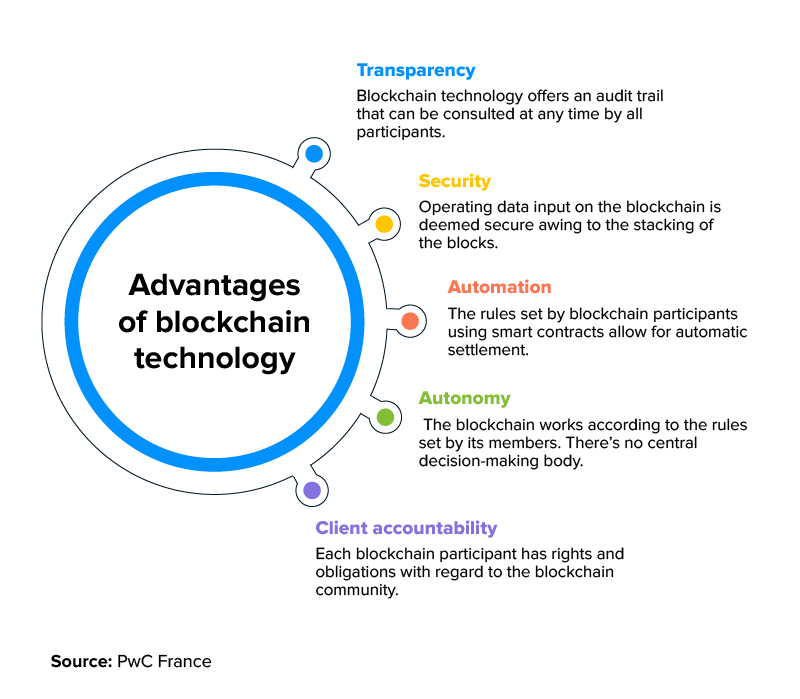

Blockchain technology can bring about significant efficiency gains, transparency, faster payouts, cost savings, and fraud prevention while allowing for real-time data sharing between several parties in a trusted manner. Blockchain can also enable new insurance practices to build better products and markets.

So, on that note, here are a few key benefits of Blockchain in the insurance industry:

1. Blocks false claims: One of the biggest pain points of the insurance industry is fraud. According to the Coalition Against Insurance Fraud, Americans suffer $80 billion worth of damage every year due to insurance fraud.

Though insurance companies use smart analytics and other methodologies to deal with false claims, fraudsters continue to develop more sophisticated ways to dupe companies.

Blockchain’s innate feature of capturing time-stamped transactions with complete audit trials makes it extremely difficult for fraudsters to commit fraud.

For instance, a blockchain-powered ledger can be used to track data around high-value items like jewelry. This ledger can replace authenticity certificates in order to avoid duplicate claims, fake replacements, and fake insurance claims.

2. Enhances customer experience: Continued loyalty to one service provider is no more a given. Customers look forward to providers who offer lower premiums. Intense competition from new players operating innovative models such as on-demand insurance coverage has added to traditional insurers’ woes.

In such situations, winning customers’ trust without compromising heavily on price margins has become crucial.

One way to address this is to use blockchain to enable automated processing using smart contracts. Business agreements are built into the blockchain in this model, and payments are auto-triggered when certain conditions are fulfilled.

3. Improves trustworthiness: One of the significant advantages of using blockchain in insurance is to create trust between different entities. The inherent feature of consensus algorithms built into blockchain allows immutability and auditability.

These algorithms make it easier to create smart contracts on the blockchain, benefiting the insurance industry. Moreover, as blockchain is an immutable ledger, smart contracts enable timely, transparent, and trustworthy transactions.

When the industry uses a shared claims ledger for inspection with no per-transaction charge, it can reduce fraud. Regulators can monitor all insurance variables in real-time on the ledger, making auditing more seamless.

4. Empowers more automation: Smart contracts streamline the insurance process and enable transparent transactions. The entire insurance claims process works smoothly as the blockchain executes on the smart contract terms.

What makes it more exciting is that blockchain does it automatically, which makes automation a massive benefit for insurance companies. As a result, blockchain saves time, effort, and money by lowering administrative costs for insurance companies.

5. Helps collect and store useful data: Insurance companies thrive on data. Blockchain can collect a wide range of usable data using technologies such as artificial intelligence (AI) and Internet of Things (IoT).

Data collected by IoT is stored on the blockchain and then read by AI, helping your company make informed decisions on insurance premiums.

IoT devices can also help monitor a vehicle to qualify insureds for safe driver discounts and give your insurance company more data on vehicle performance and driver habits to work with.

With such exceptional benefits, the insurance industry can look forward to leveraging the new technology for positive change and growth.

In case you want to know more about IoT and how it works, read, What is IoT and How it Works.

Top use cases of Blockchain in the insurance industry

Now that you have seen the benefits of blockchain for the insurance sector, let’s take a look at some top use cases to see how it can actually help organizations.

1. Smart contracts: The insurance industry has relied on trusted intermediaries such as underwriting agents and insurance brokers to distribute and arrange contracts of insurance. However, smart contracts eliminate the need for human intervention.

Smart Contracts are basically self-executing contracts that are executed automatically via underlying blockchains to ensure that the terms of agreements are met/unmet. In the context of insurance, the terms of agreements between policyholders and insurers are written into the code upon which smart contracts are built.

As all transactions related to smart contracts are recorded on a blockchain, there is a high level of transparency. This is because each transaction is publicly viewable on the blockchain.

Moreover, as there is no human interference, the risks of unauthorized manipulation and errors in contracts are significantly reduced. Also, claims investigation, coverage analysis, and processing are dramatically quicker as the need for manual assessment is removed. This increases the efficiency of the insurance sector and builds consumer trust and confidence in the industry.

2. On-demand insurance: It is a flexible insurance model, where policyholders can turn on and off their insurance policies with just a click. The more interactions of all stakeholders with the policy documents, the greater the hassle of managing the records.

For example, on-demand insurance requires underwriting, buyer’s records, policy documents, risk, claims, and so on much more.

But, thanks to blockchain technology, maintaining ledgers has become simpler. On-demand insurance players can leverage blockchain for efficient record-keeping from the inception of the policy until its disposal.

[Also Read: How much does on-demand insurance app development costs?]

3. Fraud and abuse prevention: Fraud costs the insurance industry a monstrous amount of money, mostly because it’s impossible to detect fraudulent activities with regular methods. As per a report by the FBI, the total cost of insurance fraud (non-health insurance) is estimated to be more than $40 billion per year.

With blockchain, insurers can eliminate such common types of insurance fraud. When you move insurance claims onto a blockchain-based ledger, all the executed transactions are time-stamped and permanent. This means no one can modify the data due to the immutability feature of the blockchain. Thus, it can eventually reduce fraud.

Moreover, blockchain makes coordination easier among insurers. When all the insurance companies access the same shared blockchain ledger, they know if the specific claim has been paid or not. They can easily identify suspicious behavior by using the same historical claims information.

4. Reinsurance: Reinsurers offer insurance to insurance companies to protect them in the event of major disasters like hurricanes or wildfires.

The current reinsurance process is extremely complex, lengthy, and inefficient. Insurers typically engage multiple reinsurers, which means that various parties have to exchange data to settle claims.

When insurers and reinsurers share a blockchain ledger, detailed transactions around premiums and losses can be updated on an insurer and reinsurer’s computer systems at the same time. This can save time as well as money, and reinsurers can also automate settlement and claims processing. A report by PwC estimates that blockchain can help the reinsurance industry save up to $10 billion by improving operational efficiency.

5. Microinsurance: Microinsurance provides security against specific perils for regular premium payments. It delivers profits only when distributed in large volumes. However, microinsurance policies don’t get the deserved traction because of high distribution costs and low-profit margins.

With blockchain, claims handling and underwriting can be automated based on defined rules in microinsurance schemes.

6. Health insurance: Blockchain in health insurance enables fast, secure, and accurate sharing of medical data among insurers and healthcare providers.

Sharing patient data between health insurance providers and hospitals can make the process of health insurance claims expensive and time-consuming.

When encrypted patient records are recorded on a blockchain, insurers and healthcare providers can access patients’ medical data without compromising confidentiality.

The synchronized data of all patients in one place can save the industry a large sum of money annually. Moreover, changing patients’ medical records stored on the blockchain would be impossible without creating an audit trail.

7. Auto insurance: This is another area where blockchain and insurance can bring payouts to the next level. Let’s understand this with an example. If a car accident takes place, both the insurer and client can get the requisite information with blockchain.

While the client can expect to get an immediate payout, the insurer can see getting the car repaired by a licensed service provider.

8. Life insurance: The death claim process today is a tedious and time-consuming process. It can take anywhere from a few weeks to over two months.

Blockchain could help automate and simplify the manual claims registration process when filing a life insurance claim. This technology also allows for greater trust among both insurers and insured by increasing transparency.

Real-life examples of blockchain in the insurance industry

Now that we have seen blockchain in insurance use cases, let’s get into real-life examples of companies that have used blockchain for its transformative benefits.

1. Lemonade: Lemonade uses both AI and blockchain to offer insurance at low prices to homeowners and renters. They take a fixed fee from each monthly payment done by policyholders and allocate the rest towards future claims. When a claim is made, the smart contracts insurance in blockchain verifies the loss immediately so that the customer gets paid quickly.

2. Ryskex: Ryskex is a blockchain insurance startup that helps insurers an easier way to assess and handle risks accurately through its blockchain-based platform.

3. B3i: Incorporated in 2018, B3i helps the insurance market with top-notch solutions for consumers through faster access to insurance and reduced administrative costs.

4. ClaimShare: It is an app that uses blockchain technology to deal with double-dipping. It is a practice wherein one claimant fraudulently receives a payout from multiple insurers on the same incident. ClaimShare aims to help prevent these payouts by allowing multiple insurers to share data related to claims filed.

Limitations of using Blockchain in insurance

The adoption of blockchain in insurance isn’t without challenges. Here are some snags of using blockchain:

Complex to understand: Blockchain and its complexities make it hard for users to understand and comprehend its benefits. Before diving into this revolutionary technology, one needs to understand the principles of encryption and distributed ledger.

It’s advisable to hire blockchain development services. The experts will not only help you understand the immense benefits of this innovative technology but will also help you adopt a robust solution as per your business needs.

Nascent technology: As the technology is still in nascent stages, coping up with issues such as data limits, transaction speed, and verification process will be critical in making Blockchain widely applicable.

Uncertain regulatory status: Insurance regulations are dynamic, uncertain, and need to be updated frequently. As the landscape is unsettled, blockchain struggles in extensive adoption by insurance carriers.

Costs: Blockchain offers massive savings in transaction costs and time. However, the initial costs are high, which act as a deterrent. Know how much it costs to develop a blockchain app.

How Appinventiv can help overcome these challenges?

Blockchain in insurance can be a game-changer. It can reshape the way physical assets are tracked, managed, and insured digitally. At Appinventiv, our highly-experienced team of professionals not only helps you step into the world of decentralized solutions, but also helps you deal with complex situations in your journey.

We offer a wide range of blockchain and crypto insurance development services that add scalability, transparency, and security to your business. We are also helping insurers across the globe to determine how blockchain can transform the way they do business. Our team of blockchain developers will help you understand the principles of distributed ledger and encryption and make sure to create winning solutions for your organization.

So, in case you want to build robust and scalable solutions in blockchain for your insurance business or want to know what blockchain insurance is, get in touch with us.

Final thoughts

While blockchain technology is still in its infancy, there are already a number of use cases and applications for it across the insurance industry. The technology offers accuracy, efficiency, privacy, and more to the insurance industry. However, it’s important to understand that insurance companies that adopt blockchain services must agree to operate under ethical standards.

Standards and processes must be aligned so that blockchain can provide insurers with better tools for sharing data, collaborating, and making insurance processes less cumbersome for users.

Plus, insurance companies must provide regulation frameworks to safely use blockchain technology. Once these needs are met, blockchain technology can transform the insurance industry for both insurers and customers.

FAQs

Q. How will blockchain change the insurance industry?

Ans. Blockchain technology collects and stores data more securely for the insurance industry. The use of blockchain in insurance can also lead to increased automation. Blockchain-based smart contracts can also increase customer satisfaction and reduce costs.

Q. What is smart contracts insurance on a blockchain?

Ans. Smart contracts are programs stored on a blockchain that run when predetermined conditions are met. They are used for automating the execution of an agreement so that all participants can be certain of the outcome.

Q. How much does it cost to build a blockchain app for insurance?

Ans. The average cost of developing a blockchain application for insurance can be somewhere between $30,000 to $90,000. However, this is a very rough estimate. There are a number of factors such as the complexity of the project and the type of platforms you use that can increase or lower the final price.

strategies your digital product..