Digital Transformation: Accelerating The Change In Fintech

Fintechs are taking advantage of digital transformation by bringing a start-up mentality to corporates to drive growth in businesses.

Coronavirus was a random economic test that no one could have fully anticipated and as social distancing, lockdowns across the globe and work from home rules became common around the world; companies that had seen the writings on the wall became accustomed to the digital age and were the first winners. In this article, we will be discussing in detail how digital transformation in financial services is accelerating the change in Fintech. You can also know the ways financial services are rethinking their security approach with SaaS growth.

Startups and small and medium enterprises (SMEs) have had to reorganize their digital transformation strategies and look to the lending regulatory agencies for quick funding to restart and adapt to the digital ecosystem.

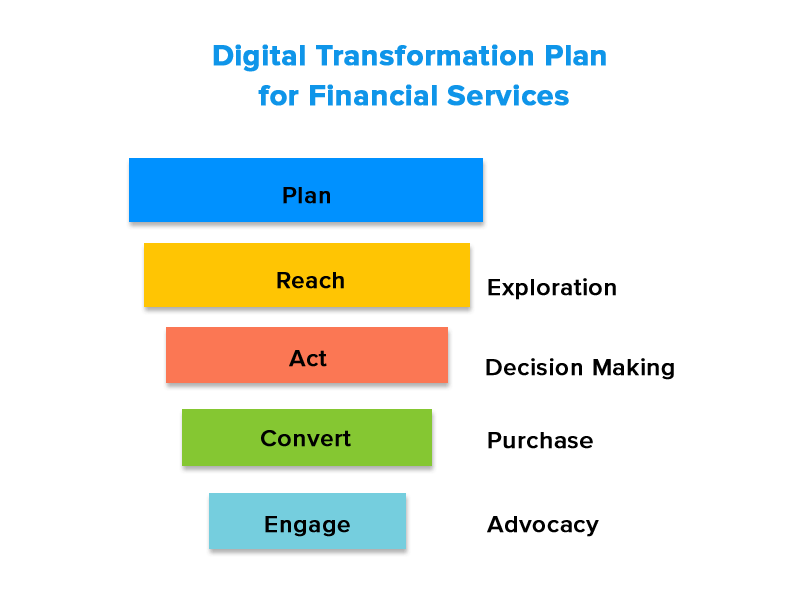

Fintech is not just limited to startups; as its business model forces large, well-funded enterprises to continue to compete and innovate if they want to stay afloat. Fintechs creates new ways for customers to access and deliver financial services, with simple ways to make payments on investments with quarterly advice and create a personalized budget with the help of the app. To bring difference using digital transformation, a plan with a strategic approach is required that helps to tackle digital transformation without downtime.

Professor Anne-Laure Mention, Director of the Global Business Innovation Enabling Capability Platform at RMIT University, Melbourne, Australia, in her 2019 paper- “The Future of Fintech” highlights the ways Fintechs are disrupting the industry with their faster, cheaper, and attractive service models that are inviting interest from the regulators.

Rapid Growth in Fintech Brought By Digital Transformation

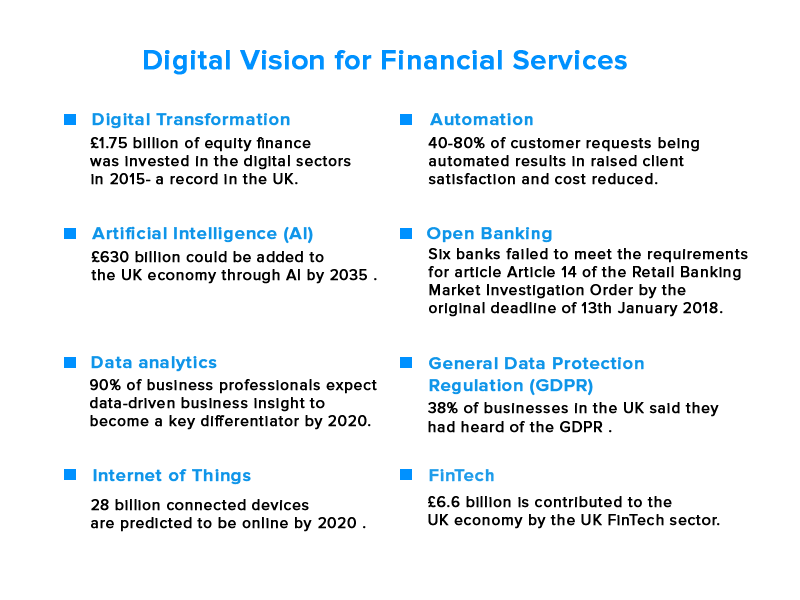

While we know that the financial services industry has a traditional perspective and takes time to adapt to innovation, the pandemic has created a different picture. It has accelerated tangible change by adopting rapid physical and digital transformation, which requires the fintech industry to meet the challenge of equipping businesses with powerful computing systems.

Changes can also be attributed mainly to the rapid change in consumer behaviour and new emerging patterns set by the clear will of cash-less and contact-less activities.

Some stats below describe the rapid adoption of digital transformation.

- According to a survey by ZDNet, 70% of companies either have a digital transformation strategy in place or are working on one.

- Another report by PTC and CorporateLeaders states that 60% of companies which have undergone a digital transformation have created new business models.

- The IDG’s Digital business research includes the top industries for digital-first business strategies with services (95%), financial services (93%) and healthcare (92%) being at the top.

How is Fintech Digital Transformation Making SMEs Efficient?

Greater lending flexibility

In the current system, traditional lending models make themselves ineffective because they are not designed to measure and therefore, seem to impose a barrier on SMEs to earn money. Legacy systems are more expensive compared to fintech companies, which boast a reduced performance model designed to reduce costs. There is also a lack of flexibility in this system.

This is where a cloud-based lending approach can make a difference. Creating an application programming interface (API) that will integrate seamlessly with asset systems and provide an awesome and sustainable digital model that can drive a well-designed lending solution.

Channelling digital fintech offerings

With the increasing pace of digital platform acquisition during the pandemic, digital payment platforms and digital wallets and credit cards have seen a rise in demand in SMEs’ transactions. Additionally, SMEs and startups from across the globe have started taking advantage of the digital profits and loans available through simple, fast and secure fintech solutions backed by robust infrastructure processes. By informing high-end consumers and warm-hearted SMEs they have come up with the idea of using fintech solutions to drive their financial operations.

Processing data for operational efficiency

With innovative digital lending platforms, such as knowing your customer (KYC) and personal identity or KYC based on social security, financial consultants can easily access customer data and get their approval, thus ensuring better efficiency. Data Analytics can be used to improve the understanding of customer portfolios to enable better credit processing. Another useful area where data can be used to detect fraudulent detection, where customer behaviour is recorded and used to analyze potential fraud.

Digital Transformation Trends in Financial Services

Among all industries affected by the pandemic and changed by the digital transformation wave, the finance sector experienced one of the most drastic changes in its transformation. Fintech being one of the industries completely dependent on manual work and person-to-person contact, the road to digital transformation and fintech has been a new journey in this sector. The evolution of digital transformation in finance industry has become a business imperative to improve customer experience through development of new products and services.

According to Binder Dijker Otte (BDO), 97% of financial services firms are putting their resources into digital transformation after reshaping their business models to stay competitive in an evolving sector.

Growing enterprise agility

After the numerous experiences gained from the previous financial crisis, an organization’s ability to expand its agility has become a vital trend in the industry. However, to support the type of constant advancement and improvement that shapes the foundation of agility, financial organizations need quick, reliable access to growing amounts of information without making tedious manual work processes.

Increasing mobile banking

The worldwide pandemic has seen customers rushing to mobile services for their financial requirements and bringing digital transformation in banking industry. While mobile banking is not a new concept, but as the first lockdown was imposed, according to Fidelity National Information Services (FIS), that works with the world’s largest banks, said that there was a 200% rise in new mobile banking registrations in April 2020; while mobile banking traffic rose 85% increasing the need for digital transformation in banking.

The universal utilization of smartphones in our day to day lives has increasingly shifted our choice to digital banking for everyday banking services like electronic bill payments, shared payments and instant transfers.

Increased collaboration

As entrepreneurs and business leaders across different industries embrace the team structure as an operational model and acknowledge the democratization of information, there is nowhere required to work together as solidly as in the financial sector. Since, financial enterprises need to adhere to administrative guidelines that implement a siloed way to select business units. But for other business units, the ability to effectively communicate and work can mean the difference between getting to the end goal first.

Risk assessment

The collection, storage and analysis of big data is extremely important to financial services and digital transformation consulting firms. For instance, the quick and perfect finish of a due diligence process before a huge merger and acquisition can make great differences for the financial investors, organizations and employees influenced by it.

Mobile pay utilities

A decade ago there was a time, when mobile wallets were a totally new concept to the people. As times are changing, thus, so are the methods of putting away riches and making payments. Mobile wallets have become the rule of the payment, be it merchants, shopping malls, and other sellers like to utilize mobile payments versus traditional cash and checks. All thanks to the comfort, security, and ease of availability have provided a route to digital development in finance sector over the years, which keep on developing as the time goes on.

Challenges Faced In Fintech Digital Transformation

The first challenge they face is how to present investors and other stakeholders with a clear view of their proposal, especially if their offer is not in a certain way in the existing markets, and is not allowed by a certain number of customers. These difficulties present challenges in raising funds for commercial investors. These participants will want to see clear evidence that fintech digital transformation is innovative, capable of measuring and mitigating its risks as much as possible.

Fintechs faces a major hurdle in building relationships and trust within clients working with traditional financial services providers. Fintechs needs to fight the myth that their new invention calls for security and data management.

Fintechs needs a very supportive control framework that aligns boundaries, to be able to scale globally with minimal collisions.

The fourth digital transformation challenge comes in the form of international action; 95% of Fintech firms failed when trying to scale up. The reasons for this is that Fintechs are failing to operate beyond regional and national regulatory limits, and are failing to reach customers at critical times.’

Conclusion

Financial innovation presents an important opportunity that exceeds its impact on financial services firms; the whole economy can benefit. It embraces changes in the supply of banks, insurance companies, investment funds and other digital strategy financial services firms, as well as the transformation of internal structures and processes, management systems, new ways of communicating with clients and distribution channels. emerged as the cornerstone of new financial institutions.

Digital strategy consulting firms and Fintech provides new ways for customers to access and deliver financial services, with simple ways to make payments on investments with quarterly advice and create a personalized budget with the help of the app. Fintechs brings corporate thinking to the forefront while also increasing competition, customer focus, and collaboration. These fashions bring clear benefits to consumers in the form of competitive pricing, as well as new and easier services to manage their finances.

After getting to know the growth of fintech through digital transformation, now it is time to select the appropriate digital transformation companies to reach your goals. For any information or query you can contact us at Appinventiv- a known digital transformation consulting services company.

strategies your digital product..