How Can Insurance Enterprises Innovate Themselves to Beat the Competition

It is no surprise that the insurance sector at large has been guilty of negligence at one particular front, industry Innovation. Although, Insurtech startups have come thick and fast in the nick of time, yet their broad impact on the industry is marginal at best and meager otherwise. Given the era of uncertainty that we are scraping through, the rate of innovation in insurance segments needs to pick up if the underwriters of today are to thrive tomorrow.

In this article, we’ll be focusing on the possible measures they can implement to do so.

How has the Insurance Industry changed?

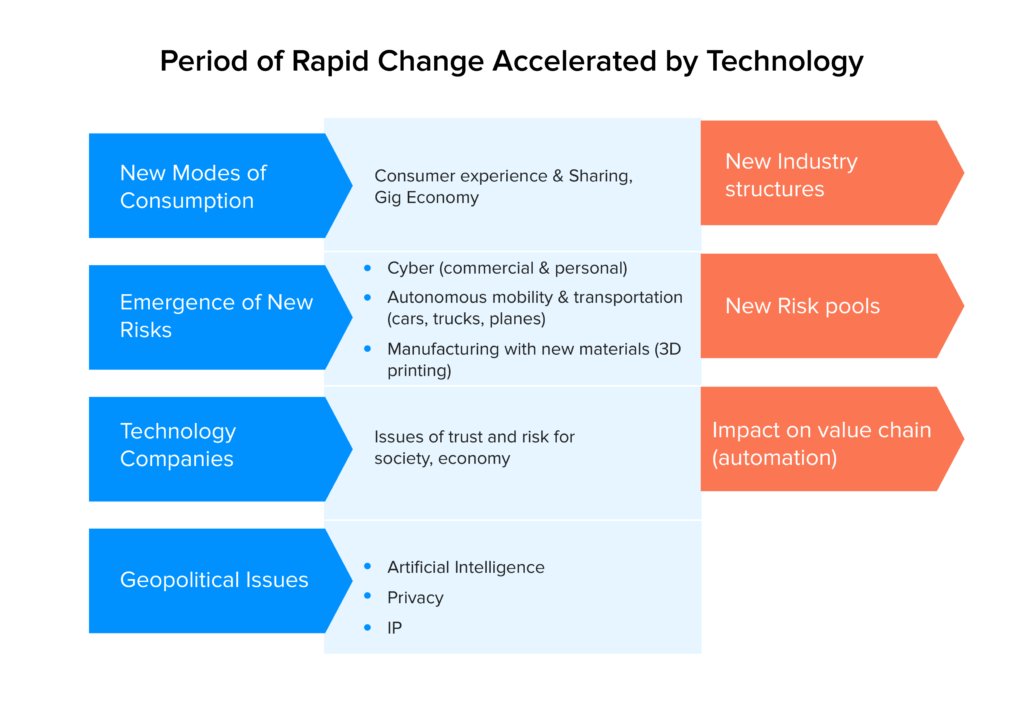

Insurance is not the ball game it once used to be when the incoming customer used to feel indebted to a company for assured support in challenging times. Technological disruption has made entering the marketplace rather easier, giving rise to a legion of adversaries, making it one of the most investment friendly Fintech domains. And that is just a quarter of the rising events that legacy insurers need to be concerned about. Below, we mention 4 critical changemakers:

1. Customer experience

The entry of insurance startups into the fray makes meeting customer expectations a labyrinthine challenge to solve. That’s because more players now offer similar products at cut-throat prices, squelching the profits out further. An abundance of choices makes loyalty prone to swings causing nightmarish customer churns. Customer-centricity needs to be revisited.

Quality post-sales service tops the agenda for most insurers and that in turn rests on two pillars. First, employing an efficient frontline with updated product expertise and relationship management acumen. And second, packaging exciting add-ons as part of the insurance deal for policyholders.

2. Product Development

Innovation in the insurance industry is low in relation to other professions. At the time being it is spurred by evolving customer demands. Financial biggies in the sector have to understand low-cost, short-term solutions will land them nowhere. There is a colossal shift in introducing new service delivery models that overlap and extend beyond traditional insurance schemes for life. In other words, technology innovation for sustainable development. For instance, if you are selling car insurance, why wait for the car to run its course, pun intended. Try coupling roadside assistance with 24/7 customer service. Over the last three years, insurers have benefited from injecting such service-based packages to their product lines.

3. Business Restructuring

You might wonder if the same household names have been dominant here to fore then why should they even consider changing anything. Precisely because of the pointers mentioned above. Fintech insurance startups are raising eyebrows with their quick to market schemes by leveraging new age innovation. Although they are not enough on their own to shake things up, yet their rising traction is noticeable.

The way forward for key insurance players is, therefore, to enter partnership agreements. You could join forces with niche players and/or insurance tech startups. The reason you do this is part survival part progress.

4. Digital Transformation

Legacy insurance businesses are shy in swiftly adopting the technology. There has been a sharp rise in the demand for mobile app development in the insurance sector. Some of it has to do with a lack of level headed solution architects that can predict change and integrate it into the system. Much good would transpire if only the companies could timely welcome upcoming technologies such as blockchain, AI, and data science. Which brings us to our next section.

Technologies Impacting the Insurance Industry

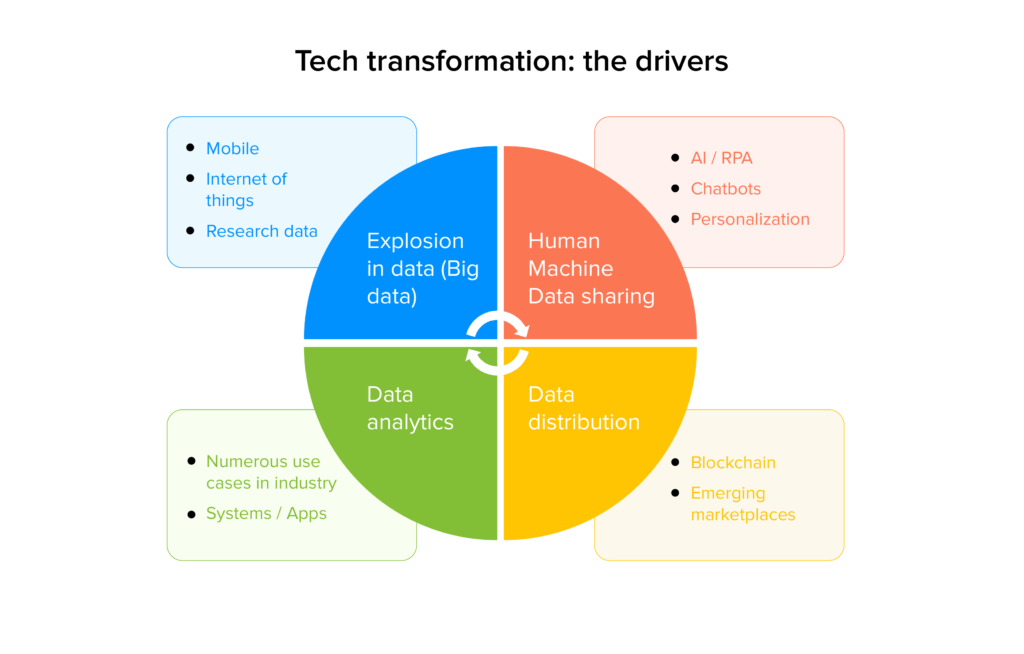

Having factored the changemakers let us now familiarize ourselves with the technologies responsible for most commotion in this field. Needless to say, the more this industry is flexible in working with such tech, the higher its chances of outreach to new customers cohorts.

Predictive Analytics

Insurance companies can be singled out for collecting extreme amounts of sensitive information on their customers. And though they deeply analyze their numbers before creating a new scheme, data analytics can further refine and augment that research. Value-adding discoveries in Big Data analytics can lead to breakthrough predictions that prevent fraudulent transactions, indicate associated risk exposure in customer profiles, identifying patterns in claims volumes, and target lead prospects with pinpoint accuracy.

Artificial Intelligence

There’s no telling how much paperwork is involved in filing a claim. Not to mention, the chances of human error as typos which could be disastrous. Artificial Intelligence has the potential to remediate this and more. AI can be deployed to enhance customer service and quick filing leading to shorter revert-times. It can add that wee bit of personalization in software-driven interactions that help customers convey their message clearly. The 21st century marks the beginning of the age of innovation and if insurers intend to propel, so must their backend systems.

Augmented Reality/ Virtual Reality

Lately, fintech app development has been focusing on integrating AR/VR-based specs in their products. Be it a customer buying insurance and or investing on part of a business into a new portfolio, AR/VR can suffice for both. They add an extra level of comfort and convenience in claim handling (for customers) and accident recreation (for insurers). Insurance ventures will find it useful to educate and make-aware their leads about related topics if their fintech application development can run AR/VR-powered video demonstrations.

Blockchain

Blockchain technology has made inroads in Finance to a good effect. Financial companies that rely on Blockchain can safeguard their records to an immutable extent, and mitigate cyber risks. They could automate the process of claims handling with smart contracts and process settlements in near real-time with instant payment release mechanisms. Theoretically, this infrastructure would have the capability to reduce or wipe-out, middlemen.

Telematics

Telematics refers to the use of installable, GPS-enabled hardware that can analyze the use of an asset, such as a car, truck, manufacturing equipment etc., to recommend areas where one can save maintenance costs. Telematics devices can alert users at times of asset-overuse thereby preventing an impending disaster and possibly saving lives. Drive Safe & Save offered by State Farm is an example of a telematics product, bringing a rise in the demand to know how much it costs to build an app like the auto insurance app.

Innovation Standards – A work Under Progress

Technology innovation in the insurance industry is a bull that few insurers want to hold by the horn. A framework must guide digital innovation in insurance to speed the introduction of new standards. But the million dollar question remains, what are the ways that insurers could vent in a fresh air of regeneration?

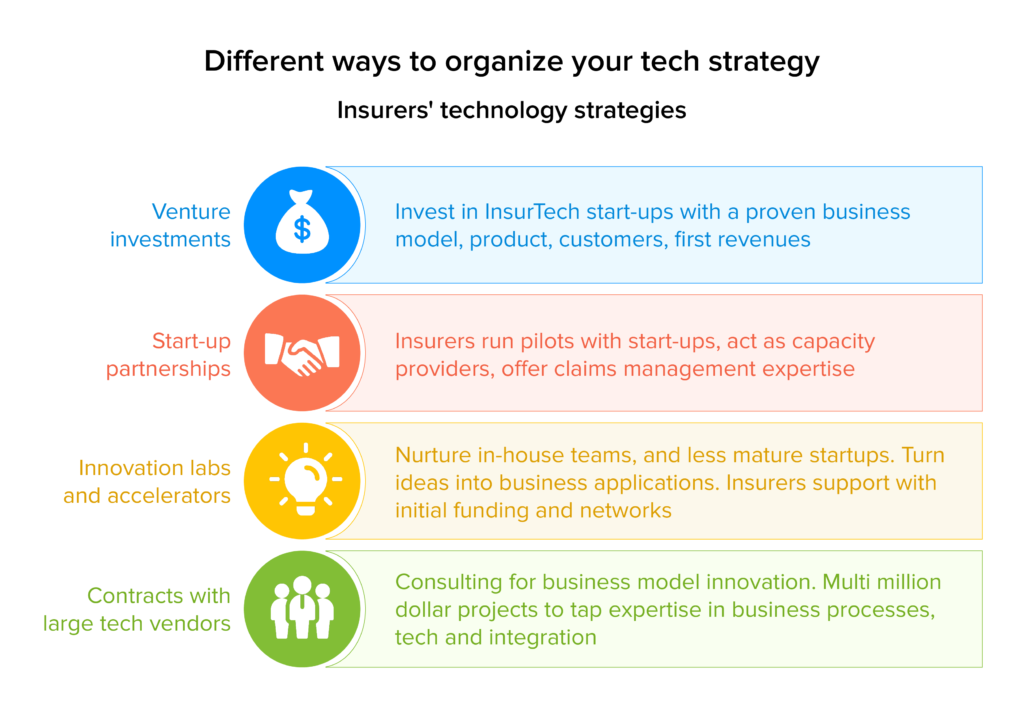

Incubate Insurance Innovation Partners – Legacy financial companies must prowl for start-up partners and act as their guardians in maneuvering tactical business steps. Technology and innovation in the insurance sector could tick forward if such trade-offs include sharing technical expertise, benefitting both the parties.

Invest in Insurtech – It is an undeniable reality that Insurtech, today, are flag bearers of the title insurance innovators. Their operations are uninhibited by traditional policies stifling newage growth in the industry. Infusing capital and relishing in profit-sharing is one way of bettering revenue lines.

Inhouse Investing – While keeping an eye out for developments, do not forget to allocate sufficient budgets for upgrading your inhouse capabilities. The ultimate ball-game is to make your IT teams sustainable and independent of any vendor assistance.

Outsource – Finance app development is sometimes best-handled by fintech app development companies. Such niche vendors possess quick turn-around development time-frames that are hard to replicate, even remotely. Appinventiv has had tremendous success in all the technologies that are spanning their effect in finance be it AI, chatbots, wearables, or Blockchain. Our service catalogue is one that we are immensely proud of and which is sure to impress you.

Taking Legacy Systems from Lackluster to Powerhouses

Notwithstanding this sector, innovation and industry are not distinct from each other but two end points of the same line. Financial biggies could rejuvenate themselves but they need to ask serious questions.

- Enterprise systems are being modernized with new capabilities and therefore witnessing a wave of adoption amongst the established players. To begin the purchase and installation of such software in your company, calculate its plus and minuses and explore all options of ownership.

- Once installed, such systems are sure to let you provision stylistical methods for financial application development. You would begin by experimenting with a single business unit at a standalone geographic location to mitigate risk. Once successful, your next aim would be to extend such capabilities to off-shore bases. Remember to have your numbers intact to justify such a migration.

- Information system migration should be effectuated at the lowest possible costs. Therefore, avoid commencing end-to-end coding sprints to get such a system up and running. Try and find a minimalist solution for getting started with projects such as a finance mobile app development.

- Don’t just look for software that fits into your processes, but also processes that will be compatible with the software. Careful attention at this step will cut short the back-propagation you might have to perform in a scenario if things go south.

The Future of the Insurance Industry

Based on what we’ve discussed so far, the future of the insurance industry lies in fostering partnerships with promising startups, building associations with peers and welcoming top-down innovation within the organizational structure. Financial app development companies, the likes of which Appinventiv represents, can assist renowned financial giants with plug-and-play software systems portioned to their scale of operations. On most occasions, our portfolio speaks for itself, on others we do! If that’s the case, drop in an enquiry and we’d be happy to connect.

strategies your digital product..