8 Features to Add in Your Mobile Wallet Application

When we talk about the digitalization streak the financial service industry is on, it can get difficult to not mention the role of digital wallet apps. The functions of e wallet have single-handedly helped a number of fintech-based applications gain success in the uber-competitive sector.

Following the popularity that digital wallet apps come with, a number of startups have started connecting with sound fintech app development companies in USA to build solutions around e wallets. The demand has grown all the more after the popularity that applications like Paytm, PayPal, Robinhood, etc. enjoy.

In this article, we are going to look into the e wallet app features that will make yours the best digital wallet apps in the sector. But before we get on that road, we will first look into the market size that mobile wallet apps have found for themselves.

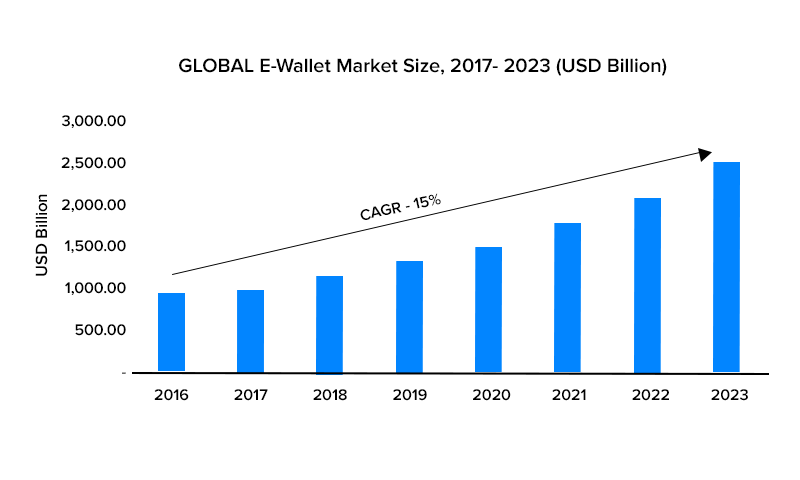

Key Statistics Around Mobile Wallet Apps

- According to a recent study, the mobile wallets market is poised to grow at a 28.2% CAGR rate from $1043 Billion to $7580.1 Billion in 2027.

- It is also estimated that by the end of 2023, the global e wallet market will rise to $2.1 trillion.

- 38% of men admit to spending more when they use a digital wallet, compared to 34% of women.

- It is estimated that by 2022, mobile wallet apps will replace cash and credit cards.

The growth trend that e wallet app development has found itself to be a center of is something that is the culmination of the different types of digital wallets. Let us quickly look into the key factor of the mobile wallet app development before we move on to the features of mobile wallet app.

What are the Different Types of Mobile Wallet Apps?

Types of a mobile wallet are one of the first questions that every entrepreneur research when they are looking for answers on how to create a digital wallet app.

1. Open Wallets – Open wallets are used directly in a third-party application or in a bank app. It enables customers to use the funds in their mobile wallet apps to make payments or withdraw the funds deposited to the account and keep them in the wallet for future use.

2. Semi-closed Wallets – These wallets allow users to make use of the funds in their wallets to make payments for transactions on websites or apps their merchant has partnered with.

3. Closed Wallets – These wallets are specially designed for a merchant. The users can only use the wallet for that particular merchant. Take for example an ecommerce app – it enables you to store money in the app’s wallet and use it to pay for an item in the cart.

Now irrespective of which mobile wallet app you are planning to build, the mobile wallet features are more or less the same across all of them. Let us get into them next.

8 Must-have Features of a Mobile Wallet App

1. Make payments to and from the bank accounts

Mobile wallets must enable seamless transfer of money to a bank account as well as get money credited from a bank account. The process of getting money in and out of the wallet to a bank account should be made to be extremely simple and convenient.

2. Make bill payments

You should ask your fintech software development company to enable bill payments through the wallet app. It should enable your users to pay bills online – rents, electricity, gas, mortgages, etc. However, in addition, to make it a success, you will have to partner with multiple service providers in the category to give users an easy option to make the payments.

3. Management of virtual cards

The wallet application should enable users to save their debit and credit card data ensuring high security. It should allow people to add money to their wallets through a one-click system. Moreover, users would be given the option to remove or add cards to their list.

4. Payments through contactless technology

Contactless technologies like QR codes and NFC etc. are becoming extremely common with retail chains. Considering their growth, it can be very profitable for your brand to have a QR code and NFC functionality integrated into it.

5. Fast self-registration

Mobile wallets have come into existence to ease people’s lives and make the transaction-making process speedy. One way of ensuring this is to offer a fast self-registration process.

Usually, when our fintech app developers build wallets, we keep this self-registration process –

- Download the application

- Follow the KYC process

- Confirm registration through OTP

- Set up the password and login

- Link cards

- Add money to the wallet.

6. Rewards and discounts

Rewards and discounts are something that converts one-time users into loyal users. You should offer your users rewards and discounts for using the wallet when making purchases or bill payments.

7. Analytics-based dashboards

There should be a dashboard in the wallet app to give your users information on where they spent their money, the upcoming bills, etc. You can even go an extra step and have a budget management and expense tracking module in the application.

8. Chatbot

Integrating a chatbot that tells users of their account balance or transfer money from their bank account to wallet or vice versa can prove to be extremely useful for the wallet app users.

Now that we have looked into the feature set that every financial software development company integrates into the wallet application, let us conclude the article by looking into the technology stack that powers such a robust application.

Technology Stack for Building Robust Mobile Wallet Applications

- For Phone Verification: Nexmo

- For Payments: PayPal, Braintree, Stripe, and PayUMoney

- For frontend: Angular, CSS, Javascript, and HTML5

- For database: HBase, Cassandra, and MongoDB

- For cloud environment: Salesforce, Google Cloud, AWS, and Azure

- For push notifications: Push.IO, Amazon SNS, Twilio, Urban Airship

- For real-time analytics: Hadoop, Apache, and Spark

- For QR codes: ZBar Code reader.

strategies your digital product..