Uber Introduced its Digital Financial Service “Uber Money”

Not many days have passed since Uber dropped its Uber Works in the market for shift-workers, and within the same month, it has announced the launch of its own digital money.

On Monday, in a fintech conference, Uber announced that it is launching its own financial products line under the name of “Uber Money”.

This long-awaited initiative is directed towards facilitating Uber drivers to manage and access their money in real-time or in the words of Peter Hazlehurst “cash right away,” while also rewarding regular Uber customers.

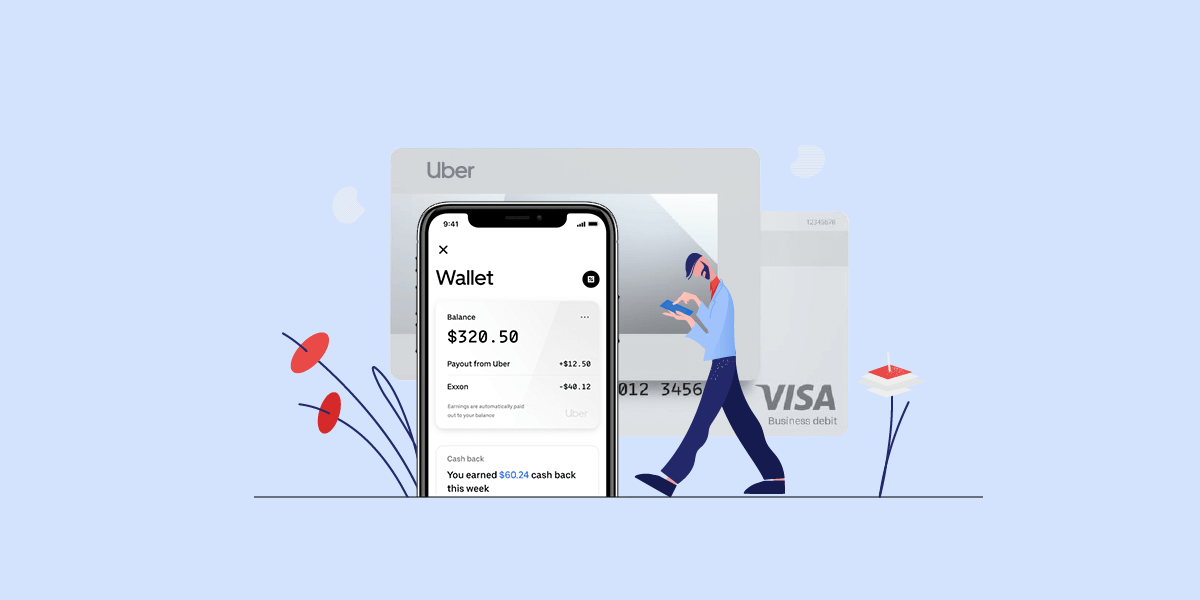

Uber payment service will enable drivers to get their earned money instantly (after every trip) via Uber debit account rather than waiting a week for their income, which was the case up to this point. This initiative includes three financial products – Uber Wallet, Uber Debit Card, and Uber Credit Card (revamped).

The Uber’s cash digital wallet will allow drivers a no-fee $100 overdraft protection, which they can use when in a cash-strapped situation.

Peter Hazlehurst, the head of Uber Money said in the blog “For drivers in the US, and expanding to more countries soon after, we are updating the no-monthly-fee Uber Debit Account, powered by Green Dot, to integrate seamlessly into the Uber Driver app.”

He also mentioned that the company wants ‘every dollar earned on Uber go further’ for which they have revamped Uber Debit card launching with the cashback facility on gas beginning from 3% up to 6% only for highest level Uber Pro drivers.

It is bought under speculation that this new initiative might be the result of years-long criticism on Uber. The company was accused of showering all the attention on riders at the expense of its drivers. But now Uber has come clean and has introduced Uber Money for drivers to manage and save money while also earning reward points.

He also announced at the conference that the company is putting efforts into expanding its financial services for the unbanked drivers in the markets namely, Brazil and Mexico.

Uber Cash digital wallet comes packed with amazing features, including the facility for earners and spenders to keep a track of spending and earning history, move and manage the money, and also find other new Uber financial products – ‘all in one place’. The Wallet will roll out first in the Uber Driver app in the coming weeks and will then expand its way to Uber and Uber Eats apps in the time to come.

The company mentioned in the blog post that it is relaunching the Uber Credit Card, a flagship consumer product by partnering with Barclays. The Uber Credit card owners will now enjoy 5% cashback in Uber Cash when they spend anywhere on the Uber platform i.e., Uber Rides, Uber Eats, and Uber JUMP scooters and bikes. What is more, they will receive rewards upon hailing an UberCopter from Manhattan to JFK.

It is observed that 40% of the Uber rides payments globally are handled in cash, which is not a preferred situation for drivers as they don’t want to be carrying around change while their drive places or may sometimes run out of it. This is where Uber Money launch comes in to save the day. Drivers can accept the payment in cash now and settle the rest later, digitally.

In the words of Hazlehurst “Drivers don’t generally want to carry change,”… “They don’t want to be accumulating a bunch of cash that’s sitting in their physical hand while they’re driving around. And it’s slower, so they can’t go on to their next trip.”

Additionally, this $100 overdraft also works as a protector for drivers against the $34 penalty imposed by institutions like Chase Bank, which in 2017 earned nearly $2 billion by such penalties.

On the same matter, he stated: “Everything that we launch will be either fee-free or as low fees as we possibly can,” and that “Best price, best value for a customer, full stop.”

Uber Money launch is nothing but another initiative from Uber to enter the financial market after conquering various other. It is too obvious to not notice the main goal of Uber which is to immerse the market and make Uber a one-stop platform for all the daily needs of users.

It is without a doubt that Uber is continuously emerging as an inspiration to those who are seeking to enter the ride-hailing on-demand app development economy.

strategies your digital product..