How Does the Fintech and Banking Sector Use APIs?

Back in 2018, a small initiative by the UK government has now spread globally.

Open banking has been a concept immersing and influencing many financial institutions around the globe – popularity owed to the rise of open banking startups.

It is essentially a system in which banks and other institutions open their APIs (Application Programming Interfaces) to allow third parties to access users’ financial data. This is then used to create new services and applications around it which offers transparency options to account holders.

However, one has to keep in mind that APIs are just one piece of the whole open banking ecosystem.

It is this wide adoption of open banking that inspired fintech companies to come up with ways in which these banking APIs can serve the financial sector. In fact, this is one of the most influential Fintech trends for 2021 and beyond.

So, let’s begin by discussing them along with how the fintech sector uses APIs.

What is a Banking APIs?

APIs are essentially a set of protocols and codes determining how various software components and elements should communicate. They are used to communicate different software applications with each other. Due to the widespread usage of open banking now, the use of APIs in fintech has also become mainstream and they are being used to issue commands to third-party service providers.

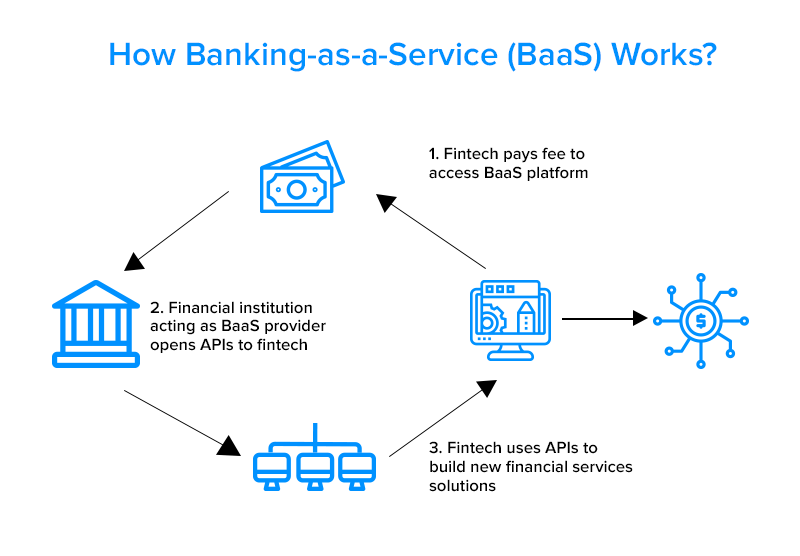

Moreover, as per Insider Intelligence reports, APIs have been in use for connecting developers to payment networks along with displaying billing details on a bank’s website. They have become a necessary tool when it comes to BaaS (Banking-as-a-service), which in itself is a crucial part of open banking.

{To learn about APIs in detail, please refer to our detailed guide to API development}

Since we are now clear about the notion of APIs, let’s analyze how APIs Benefit Fintech.

How Do APIs Benefit the Fintech and Banking Sector?

Boost overall cost-effectiveness

When it comes to offering a plethora of various banking services, as much beneficial it is for users, it becomes as expensive or rather cost-prohibitive for banking institutions. This is where we see one of the benefits of APIs for fintech.

However, open API development has proved to be a life-saver in this regard since users can now enjoy numerous services via different applications integration. For instance, a user can easily save its banking information in third-party bookkeeping software, tracking every crucial information about the transaction and alike for one place.

Promote data sharing for a better experience

Previously, banks were so possessive of the user information and a lot picky when it came to sharing the data. However, the scenery totally changed, primarily in the European Union due to PSD2(Second Payment Services Directive), and then globally. Now, users with full control of their data are in a position to demand banks to allow their data to be shared with their desired third-party provider. And how is this facilitated? – of course, via open APIs. This is just one use of APIs in fintech among many.

APIs are future-proof

Since fintech app development is on a rise, there is a low possibility of API in banking industry to become obsolete. There are hundreds of fintech startups emerging every once in a while which only shows that the customer demand is plenty for businesses to keep striving to offer improved services by integrating APIs and more. In fact, a query on ProgrammableWeb revealed that there are 1956 Financial APIs whereas 290 were listed on in the first half of 2019.

Higher competition means more services

The emergence of APIs has increased the competition in the market to the benefit of customers at least. Due to this, the prices in the financial industry are going down juxtaposed to the variety of services being offered. For instance, users can use financial services aggregators for comparing offers between banks and other institutions. Moreover, they now have access to the facilities which were only available in branches before.

Fast and efficient operations

By adopting an API empowered methodology, banks can serve their clients quickly and proficiently and provide them a seamless experience. APIs empower clients to manage banking transactions through mobile banking, online banking and wallet services on their devices in no time and safely from any place. So the clients need not physically visit the banks for going through with the transactions, thus saving their important time.

With practically 90% of transactions occurring today outside the physical bank branch, they can save significant resources and expenses, which subsequently assists with improving their financial health and wellbeing.

Augmentation of Product Portfolio

API in banking are expanding their portfolio of the growing products by allowing them to offer complementary products such as insurance or products that they co-create with their partners and financial tech and innovation firms. Such portfolio growth is possible because of the flexibility of APIs that connect with varying frameworks and provide exchange across businesses and industries.

For example, the ICICI-Paytm relationship for short term instant credit is an incredible example in this context. It shows how API-empowered connections are assisting financial institutes by interpreting experiences taken from clients’ digital behavior and credit check into real-time loan offers.

APIs are additionally enabling banks to offer non-financial products alongside financial items. For instance, Emirates NBD, a bank owned by the Dubai government is empowering its cardholders to get access to hospitality, entertainment, and retail items through its API driven e-shop.

Now that we have known the API banking benefits in the fintech industry, let’s move on to API banking use cases.

Open Banking Use Cases in the Fintech Sector

Price comparison

Price comparison websites like MoneySuperMarket have embraced the API in fintech economy in order to become a direct online distributor of financial products. The said website has built API service layers to power its sites and allow commercial partnerships to grow. The company has a single view of its customers now across their key interactions, allowing them to serve better services and experience to the customers.

Peer-to-peer currency exchange and lending

P2P network innovation was born out of the sheer need and demand for simplicity in the processes, especially when it came to transactions. Now, there are thousands of P2P payment apps by financial institutions offering numerous services.

Now this concept has finally found its calling in currency exchange. Since the orders of buying and selling currencies are distributed among the interested clients (with some orders canceling out others such as an order to buy dollars to be canceled with a future sale from another user), it gives plenty of opportunities to fintech companies to expand.

Fintech startups like TransferWise have found ways to eliminate the intermediaries in this process with their new APIs. TransferWise API offers tools and guarantees open and modular APIs which are independent of providers- something that has allowed many banks to integrate and offer this service to its users.

As for lending, these P2P platforms became a boon instantly as they arrived in the market. This helps in connecting lenders and borrowers with each other to negate the need for any intermediaries. LendingClub is one such popular platform that is known to offer an API to execute searches, perform orders, configure lending portfolios as an investment, and monitor loans.

Investment management

Before open banking, it was a challenge in itself for financial advisors to gather the client’s information in order to offer optimized services. However, now investment management APIs offer access to portfolio information of individuals, eliminating the need to guess or cobble together a picture of clients’ assets and net worth from numerous sources.

Developing open banking ventures

ING is among the few organizations that are entertaining the concept of launching various independent ventures focusing on creating new products, later to be integrated with the help of APIs. Three products surfaced, namely, Yolt – a personal finance management aggregator, Payconiq a digital wallet, and a financial service aggregator. Moreover, the company also figured out how to connect with external developers via an API-based developer portal.

Creating API market platforms

Seeing the unprecedented popularity of APIs, banks like BBVA took an initiative – BBVA’s API Market. This is a platform that offers several kinds of APIs, tools, and various other services making it easy for developers to build a partnership with the bank in commercial opportunities. Another major player competing in the same field is TrueLayer, a fintech startup aiming to become a leading financial API development provider.

Payment processing APIs

Since it is the age of complete globalization, where even startups are reaching out to an international clientele, there is a high need for more developed modes of accepting the payments. Diversity in this regard always plays to the benefits of the parties involved.

The APIs for payment processing increase the options in which merchants can accept payments easily. This not only facilitates the payment process but also streamlines the check-out process in terms of online shopping.

The checkout experience plays a prominent role. For instance, eBay used to use PayPal, however, it switched to Adyen since its APIs rendered a seamless checkout experience. It is a web-based Terminal API operating behind any point-of-sale system. Unlike PayPal, Adyen APIs allow users to stay on the page as they navigate through the checkout process.

Promotes regulation

Fintech and Regtech go hand in hand nowadays, especially when it comes to involving third-party open APIs. When offering numerous banking and financial services, it is a priority to first confirm the identity of the user every time. This is something non-negotiable since the whole open banking ecosystem depends on the data of users that they have allowed to be shared. So, it is an obligation of the institutions to offer robust verification.

In which case, Regtech APIs can offer solutions in this regard. They offer a range of programs from biometric identification to iris scanning to KYC programs. It helps avoid repetitive form filling and renders a better user experience. One of a top fintech API examples is Trulioo that offers an API in fintech that verifies data entered by customers with the help of a JSON interchange.

Enables to offer white label services

In the market, there are many branded APIs that are owned by other firms already. Nonetheless, there are other white-label APIs available as well for banks and other fintech companies to use. These APIs allow them to utilize the benefits they have to offer without the need to develop their own platforms and programs.

There are firms using APIs or granting permission to access their cloud-based exclusive BaaS technology. Similarly, Starling’s API allows users to easily integrate into the UK and European payment schemes to access Faster Payments and SEPA. The Starling bank has now expanded its fintech API Marketplace to allow small businesses to combine the banking transactions with the cloud computing platform. With its API, businesses and fintech app developers can build products with this ecosystem along with instantly reaching the Starling Bank’s client base.

Gaming

A critical part of making effective games is the process toward ensuring winners get rewards, and quick. Dependence on net-banking and manual techniques were not ideal for progressive gaming organizations. RazorpayX has assisted gaming organizations Mobile Premier League, RummyCulture, Pokersaints, and many others to transfer rewards promptly, and easily.

Smart contracts

The decentralized applications addresses a change in outlook, where applications are executed through a P2P network utilizing smart contracts. For instance, a hotel room card reader may connect with an API to confirm the customer’s credentials and report effective room access. Said data would self-execute an API call to finish the authoritatively agreed payment.

Future of APIs in Fintech

After witnessing the current reception and usage of banking APIs, the future seems promising reflecting the API integrations between established businesses and larger communities- something which will probably be hosted on third-party infrastructure.

For instance, future banking APIs may help banks in connecting with e-commerce websites facilitating the process of online payments. Moreover, they might integrate with brick and mortar banks and stores to help offer financing and lending options at POS locations.

For someone who is interested in API financial solutions, choosing the right fintech software development company and a solution provider is a necessity. Appinventiv has worked with various fintech business models and can simplify and customize API integration platforms. It is an expert financial software development company in USA that provides quality app development services to clients around the globe.

Frequently Asked Questions

Q. What is Open Banking?

Open banking is a system in which financial institutions open their APIs (Application programming Interfaces) to allow third parties to access users’ data. Which is then used to design new services and applications around it offering transparency options to account holders.

Q. What is API?

An application programming interface a.k.a. API is an interface that provides interactions between multiple software applications or mixed hardware-software intermediaries. In simple words, it is a software intermediary that provides two applications to talk to each other.

Q. What is smart contract?

A smart contract is a computer program or a transaction protocol that self-execute, control or document containing the terms and conditions of an agreement once the agreed conditions are set up, with contracts secured in a blockchain.

strategies your digital product..