How is IoT changing the scenario of Financial Services?

Speaking of banking and finance in particular, we have towed our cart from the barter system to the current monetary system. And now, we have reached a stage of another evolution – the evolution by technology.

Digital money is unprecedentedly taking over the old-school bills and cryptocurrency is steadily climbing the ladder to replace fiat currency altogether (still a postulation though).

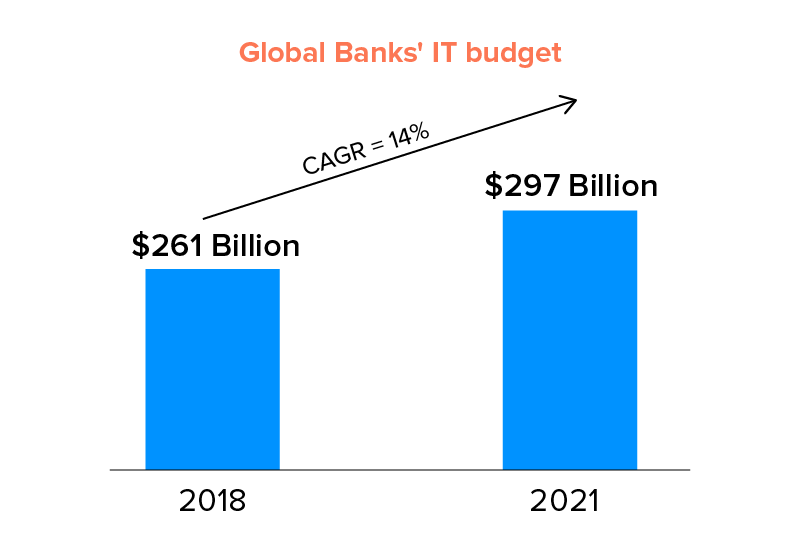

Accordingly, banking and other financial institutions have started to pay more attention in this direction. Reports by Business Insider Intelligence support this statement as it predicts by 2021, global banks’ IT budgets will rise to $297 billion, a 14% increase from $261 billion in 2018.

Another study by Absolute Market Insights reports that the global IoT banking and financial services will grow at a CAGR of 55.3% between 2019 and 2027. So how is IoT set to change the way we bank?

Among these revolutionary technologies is the impact of IoT in financial services industry.

The widespread adoption of IoT in the financial market has given birth to concepts such as Bank of Things, among others.

More so, the IoT in finance technology is known to offer data that is useful for banking and insurance institutions for improving services.

There are many other advantages of integrating IoT in financial services. So, let’s demolish the curiosity and see how IoT in Fintech is doing.

Real World Examples of IoT in Banking and Financial Services

Payments gone cashless

Off the top of my head, the way we use to pay has become the change of the decade. A major contributor to this cash-less trend is no less than the fintech mobility solution providers that develop P2P apps.

{Bonus read: Read all about the cost of making a P2P app like Venmo}

Next to these payment mobile applications is the iot app development company for wearable devices.

Instead of cash or even credit/debit cards, IoT wearable payment systems have become viral. Now, users can easily pay with their wristband, check credit history and balance, and more.

Reports by prime Indexes predict almost 60% of financial organizations and institutions are planning to make wearable devices a commonplace payment method.

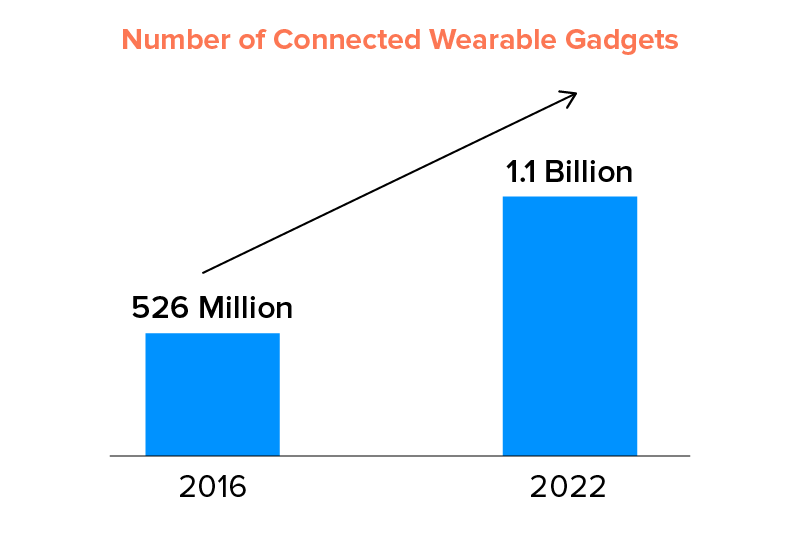

This trend in finance is going to become huge so much so that as per Statista, the number of connected wearable gadgets will become around 1.1 billion by 2022. It is without a doubt that IoT technology in the financial services is going to introduce new methods of payment in the coming years such as smart cards, biometrical tokens, and so on..

Immediate support and personalization

What may seem far-fetched is rather right around the corner. With the help of IoT technology, banks can personalize their services to another level. In fact, 79% of the banks’ IT spending budget revolves around improving customer service and experience.

For offering immediate customer support, fintech institutions are using AI with IoT. The IoT devices (smartphones) work as a beacon in notifying the branch managers of the arrival of customers. This can prove to be helpful in the auto-allocation of customers to service providers. It is an absolute way to increase customer experience and satisfaction.

Moreover, with the help of context-aware smart devices, financial services can optimize customer service. For instance, they can send personalized messages greeting customers as they arrive and whatnot. While these are enough as a reason as to why you need IoT in your financial business, there are many other benefits of IoT innovation in financial services.

Smart bank branches and ATMs

In truth, IoT can be the long-awaited renaissance of traditional banks. Its scope is boundless. Taking the above-mentioned point of personalization forward, with IoT, banks are able to create a more connected environment, where everything is focused on providing value to the customers by using the data accumulated by this technology.

Some instances are – Upon entering a branch, the details of clients’ accounts could be delivered by an IoT-based mobile app or device for real-time services. Not just this, but a customer also schedules cash withdrawal from the ATM in close vicinity.

Additionally, by analyzing the tracking patterns in the data obtained by IoT, banks can more strategically place ATMs and branches keeping the demand and needs of the customers at the core.

Using IoT for optimizing Voice technology

The voice technology has gone leaps and bounds since it was first introduced. Fintech companies have played an interesting card in putting this technology into innovative uses. In fact, Business Insider Intelligence reports state that by 2022, these AI voice assistants may offer operational cost reductions of around $8 billion across the global banking institutions.

In 2016, Capital One pioneered the practice of developing qualities in Alexa which enable users to process sensitive financial data such as credit/debit card balance, information on pending transactions, loans, and related instances.

Improved spending visibility

Well, sure there are many financial mobile applications that tell users of how much they are spending, how they can save money, etc. but the integration of IoT technology can take this process even further. It can help users in identifying their spending patterns and even break out of them if need be. This is way better than those payment statements which only provide the information just for the sake of it.

Authentication and security

Since the advent of biometric technology, nothing has ever been the same – thanks to IoT devices such as Smartphones and wearables. The security and authentication game, making IoT in banking sector quite strong since clients can now log into their IoT-enabled mobile apps, make payments, etc. with just their fingerprint or a selfie.

One worthy example of IoT wearable technology is Nymi smart wristband. The product analyzes and records the heartbeats of users as biometric authentication. It cleared all the tests and now is deemed secure for such authentication.

Though some may be skeptical of the storage of such sensitive data, to which, Blockchain in Fintech can really come in handy because of smart contracts. IoT has allowed banks to employ these smart contracts to store the credentials of the users which cannot be tampered with. Ipso facto, financial and banking institutions are investing around $1.7 billion yearly on this nascent technology.

Blockchain-Based smart contracts

As indicated by Business Insider Intelligence, the advantage of using blockchain for identity confirmation is that, because the identity credential has already been logged, it can’t be changed or modified.

Blockchain’s potential to keep a protected record of authenticated exchanges has been highly examined, in financial administrations and beyond. Few banks are already testing the technology: Commonwealth Bank of Australia, Wells Fargo and trading firm Brighann Cotton guarantee to have finished the principal worldwide trade transaction between two banks utilizing blockchain, smart contracts and the IoT. The transaction included a shipment of cotton from Texas to Qingdao in China.

Fraud detection

Carrying this security thought forward, because of the amalgamation of AI in IoT ― one of the highly popular AI tech trends 2020 ― it is possible to make IoT devices more secure and immune to cyber threats and attacks. An AI-powered IoT device would be able to detect any unauthorized activities aimed at extracting the data from the devices which can instantly alert the respective financial institutions to take protective and proactive measures.

For example – if a cyber fraud is trying to make any payments using the user’s stolen credentials from a device which isn’t the one user uses generally and is in a different location, this could alert the institution to block any further transactions.

Risk assessment for insurance and loan

Identifying and eliminating risks in insurance and load domain has always been a manual process – until now. IoT in the fintech industry has come to become the transformation it was waiting for.

How?

Well, IoT sensors carry crucial pieces of information about an individual, which IoT technology-enabled insurance companies can use for monitoring and analyzing one’s habits and past patterns relating to health, driving, etc. This will allow them to distinguish the candidates that can qualify for the insurance based on the data accumulated by the IoT device.

A suitable examples of IoT in financial services model is- vehicle guarantors/insurers will be able to provide customized protection bundles by reviewing customer’s driving conduct and other factors such as normal speed, time, and whatnot. And all this data can be accessed by IoT sensors in and out of the vehicle.

Note: These sensors may add to the maintenance cost of the vehicle which insurers could have to cover.

Connected cars in retail banking

Smarter vehicles are not a boon to just users but also are a promising prospect for banking institutions too. One appropriate example for this is the Idea bank which has taken the initiative of ‘mobile ATM’.

A fleet of cars has been customized using a security deposit box and an ATM which any user can ask to come to them and use it. This saves a trip to an ATM every time users need cash – so much for personalization.

Smart housing

IoT solutions have opened doors to new opportunities for insurance companies around the world. With the advent of smart products by Google and Amazon, insurers have become more open to try smart housing and health segments as well. Insurers like Allianz have started to sell integrated products via Google Nest, offer insurance discounts for people who integrate their homes with smart-home devices.

Banking on wearable

Wearable devices have apparently been the most effortless ‘win’ for banks till now, because of a developing system of devices and the relative low cost associated with getting started. Presently numerous banks provide applications for famous wearables like Apple Watch and FitPay, which is working with the Bank of America. A few banks have even dispatched their own gadgets, with Barclays revealing bPay wearable contactless payment solutions and other wearable bands coming from Caixa Bank, Hellenic Bank and Australia’s WestPac.

Applications of IoT in Banking and Financial Services

1. Kontakt.io

The company Kontakt.io is known for making low-energy beacons running on Bluetooth. They are used for making mobile payments and so on. This is a great IoT and finance alternative for traditional point-of-sale technology.

2. Armis

Armis Security offers IoT security to banks and other businesses. It helps them see and contain every device on the network. Some of its highlighted benefits include automated identification, disconnecting of unmanaged devices, faster deployment, simple integration with a business’s existing infrastructure and lastly, agentless tracking.

3. Dynamics

Dynamics Inc. has gained much attention for producing IoT-connected and battery-powered interactive payment cards. They offer two-way communication between customers and banks in real-time. These cards possess a display screen that can be used to ask questions and get responses. Additionally, this “Wallet” also sends notifications to the respective banks around transactions.

4. Metromile

Metromile uses IoT-connected trackers to provide per-mile insurance plans that are easy on the pocket as well, based on mileage and driving behavior. The brand is an example of IoT and finance done right.

How to Begin the Adoption of IoT in Finance

Designing a solution around the internet of things financial services calls for the inclusion of a highly strategic plan. Here’s how we approach IoT use cases in financial services at Appinventiv –

- Validation of concept – Our business managers start with researching the market and ensuring that the solution would bring them growth and revenue, while giving their users complete value. This is where our product design sprint approach comes in very handy.

- Data structure – our engineers analyze the kind of data which would be generated and how it would be gathered and processed. As a rule of thumb, you must narrow data down to a set which is vital for the functionality of your product. To this extent, everything from storage requirement to data processing must be set in stone.

- Hardware dissection – All the application of IoT solutions revolve around the hardware choice. And inclusion of IoT in finance industry is no different. Our system architects dissect the hardware sensors, IoT wearable, and BLE beacons etc. in an ode to ensure that the connection is extremely seamless and glitch free.

- Software development – For businesses to make best use of IoT in the financial services industry, it should have a multi-layer backend. Our engineers integrate the product with third party solutions in a way that your application does not become an example of the IoT in finance industry and security challenges.

- Testing & Maintenance – The true benefits of IoT in banking can only be availed when it follows the right testing and maintenance practices. Our QA experts work on the IoT solutions in a way that they set an example for the IoT fintech startups across the globe.

Future of IoT in Financial services

From where we stand, the future and scope of IoT in Banking and financial services is limitless. IoT technology can be further explored to create robust interconnected systems that protect against information attacks and fraud. We can see how incredibly IoT is changing banks and FinTech companies.

The humongous amounts of data collection, from current IoT solutions and upcoming devices, is going to become a huge financial IoT trend in the coming future. Distributed stream computing platforms are coming forth as the future of IoT since they offer real-time analytics with pattern identification.

In fact, according to Markets and Markets, IoT’s market size in the financial and banking industry is projected to grow to over USD 2 billion by 2023.

With our global platform in IoT app development company USA, and other countries, we assist our customers and clients to leverage the latest technology to the utmost and provide better ROI for your business.

FAQs Around IoT in Fintech

Q. What is IoT finance?

Also known as the Bank of Things, the concept is what defines the applications of the combined power of IoT and Fintech domain.

Q. What is the Internet of things and how does it affect the banking industry?

IoT enables devices to get linked with the internet and with each other. In addition to transforming our lives at workplaces and homes, the IoT technology is also fast changing how fintech companies and banks work. Here are some of those ways: better customer financial habits, personalized banking, and enhanced credit card experience, etc.

Q. How are financial institutions making use of IoT technology?

There are a number of ways IoT is making the fintech domain better: improved security, enhanced customer experience with better privacy, omni-channel transactions, and possibility of availing proactive services through the mode of data gathering and insights generation.

strategies your digital product..