Top 17 Finance App Ideas For Startups to Consider in 2021

Okay, let’s admit.

The adoption of technology in the banking and finance industry has changed the landscape by 180 degrees. Fintech, aka the amalgamation of finance and technology, has not solely added convenience to the ecosystem, but has also made it more secure, quick, and profitable. It has offered a new set of opportunities, cater to the needs of the unprivileged audience, and even bring a significant effect on other businesses.

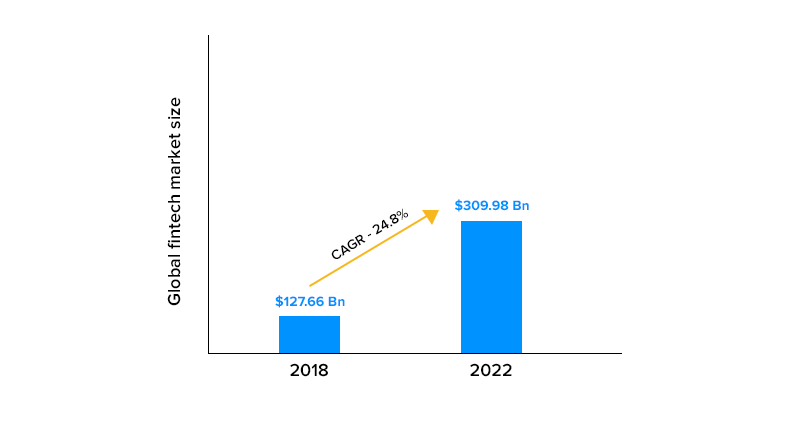

With all such benefits and opportunities, the global fintech market is predicted to grow exponentially and be worth $ 309.98 Bn by 2022.

This has not just given an indication that the financial global economy is heading towards fintech, but has also attracted various Entrepreneurs and traditional investors to become a part of this space.

According to AliPay, it is the widely used mobile payments app globally with 650 million users worldwide.

[Since we have made a statement here that the global finance economy is heading towards fintech and not TechFin, you can check our blog on Fintech vs TechFin to find the justification of the same.]

Assuming that you are also an Entrepreneur who also wants to be a part of this mushrooming market, but are clueless about what fintech business ideas will rule the space, here we will be discussing 17 different opportunities. You can also make your business successful by preparing your fintech startup from not failing.

So, sit on a comfortable couch and start scrolling down.

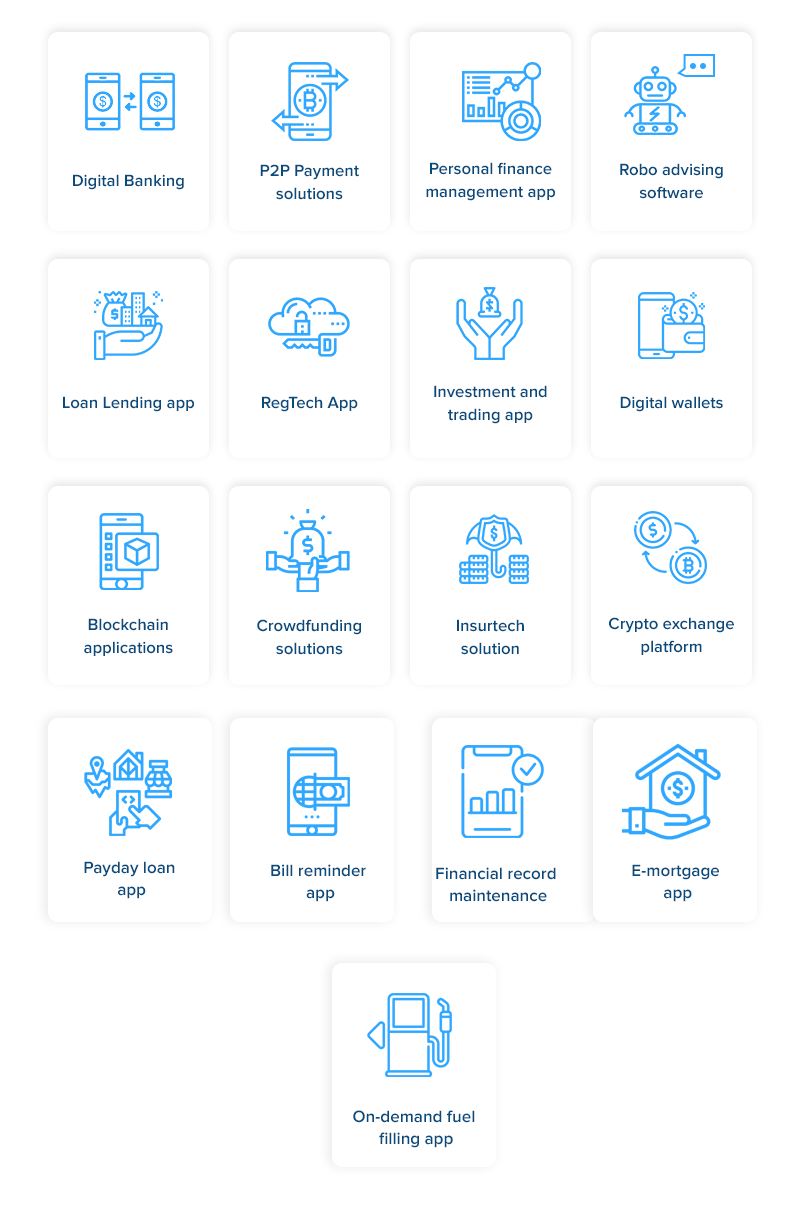

17 Profitable Fintech Development Fields For Starting A Business

1. Digital Banking

The foremost and most important fintech app idea you can invest in is digital banking.

In the past few years, a dramatic shift has been found in the way people interact with their banks and relish banking services. Users no longer appreciate the need to visit their local banks or ATMs for money transfer and other purposes. They rather are enjoying different advantages of digital banking like the ease of making transactions, investing, opening accounts and deposits, blocking cards, adding beneficiaries, and much more with a few taps on their devices.

With these facilities, the concept of investing in digital banking app ideas have grown a huge momentum in the market. The sector was catering only 9% of the online audience in 2011. But, in just 6 years, it became a part of 69% of the online audience. And what’s more interesting is that it is just the beginning! Various factors like Coronavirus are acting as a catalyst for the market growth.

[As we mentioned about COVID-19 here, you can learn more about the impact of Coronavirus on banking fintech platforms and other industries here.]

2. P2P Payment solutions

Seeing the rise in the peer-to-peer payment market, looking ahead to how to develop a P2P payment application is also a nice idea.

The P2P payment apps like Venmo, Google Pay, Zelle, and PayPal are providing consumers with an unmatchable facility to transfer money between bank holders instantly – even when registered with different banks and payment systems. They are cutting down the need for any third-party intermediaries or pay any commission fee for performing any transaction.

Also, these fintech mobility solutions are using the latest technologies like NFC and face and voice biometric technology to streamline the POS processing, enhance risk management, and deliver an optimal customer experience.

3. Personal finance management app

Personal finance management application is again one of the best financial app ideas to consider for diving into this market effortlessly.

With consumers getting more conscious about their earnings and savings, these applications are gaining traction in the market; making both investors and startups look ahead to developing personal finance app ideas.

These applications are acting as a weapon by which app users can categorize their expenses and incomes, and track them in real-time to get a better understanding of how to manage their finances smartly and effectively.

These personal finance app ideas, built on the rulebook of how to develop effective personal finance apps, are also offering them an ease to connect all bank and credit card accounts to automatically get the data updated, along with payment reminders. And the best part, the data is displayed in a visually appealing format, which adds to their convenience.

4. Robo advising software

Robo-advising, which is one of the proven ways fintech is attracting millennials, is also a great area for making an investment in the financial application development economy.

These machine-learning driven software are serving users with the finest of personalized and future-centric financial advice at lower costs. They are also analyzing their expenditures and investments to aid them in increasing their after-tax returns. In addition to this, they are adding convenience to the process with minimal-to-no human intervention.

What’s more interesting is that as per a Business Insider Intelligence report, they will be managing about $1 trillion of funds this year and nearly $4.6 trillion by 2022. Something that’s a clear indication that one must pick this among the ample of fintech startup ideas to rule the market in 2020 and beyond.

5. Loan Lending app

Creating a finance app for P2P lending is also one of the trending app ideas that are getting popular in the fintech market.

A loan lending app (also called P2P lending app) acts as a marketplace where lenders and borrowers can connect and cater to each others’ needs without using the product discovery services of any financial institution. On one side, these applications enable borrowers to set the maximum loan rates they can manage. While, on the other side, they let lenders bargain with each other to offer funds at the lowest rate. And this way, get more customers or borrowers.

6. RegTech App

RegTech applications also come into the category of best mobile app ideas for top fintech startups.

These mobility solutions help financial companies comply with all the local and global standards. They enable organizations in automating a major fraction of their processes, including customer identity verification, reports compilation and submissions, transaction monitoring and reporting, etc., and increasing the customer retention rates.

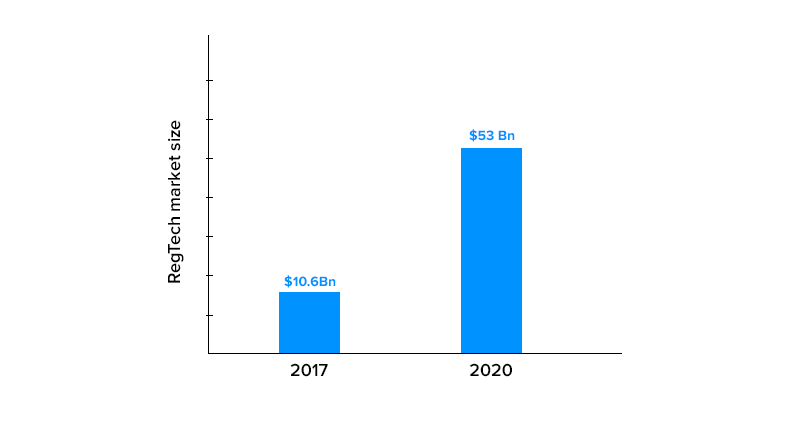

A ripple effect of which is that Regtech apps have landed among the top fintech trends for 2020 and are expected to make a market of $53Bn by the end of this year.

7. Investment and trading app

Putting efforts into the process of app development for investment and trading is yet another decision that can make you enjoy limelight in the marketplace.

Users, these days, are showering love on platforms that let them get a comprehensive knowledge of shares, stocks, forex, and funds, and invest in them efficiently. They are paying more attention to applications that gather investment data from different sources and empower them to calculate the asset valuation and make the right decision.

Considering this, if you are eager to invest in stock trading app development, it is advisable that you firstly get a clear idea of the budget requirements. This is so because shortage of money can halt your project, compel you to remove the must-have fintech app development services features, delay your app launch plan, and much more.

8. Digital wallets

Since digital wallets are giving users an escape from carrying physical wallets or credit/debit cards, their market is also rising significantly. These applications are offering users the ability to make payment in a few taps or using biometrics, while getting lucrative coupons and offers in return.

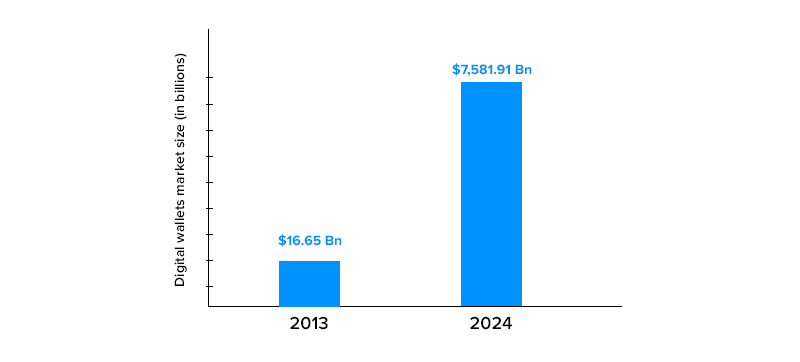

It has been forecasted that the digital wallet market will be worth $7,581.91 Bn by the year 2024. Something that is enough to let you know why to pick this among various innovative app ideas for entrepreneurs to step into the financial market.

9. Blockchain applications

Seeing the growing impact of blockchain in fintech , embracing this technology for starting a business is also an undeniably profitable idea.

Currently, various fintech startup 2021 and establishments like We.trade, Circle, LAToken, Veem, and PayStand are relying upon this technology to offer a myriad of options to their targeted user base. This includes:

- Performing transactions using cryptocurrencies,

- Paying for transportation only once they receive an information that the cargo has reached to the port,

- Acting as a decentralized autonomous organization (DAO), where members work as per the programmatically defined rules that tells who their members can be, what business or activity is allowed, and how tokens or funds can be exchanged.

10. Crowdfunding solutions

Crowdfunding is also emerging as one of the most successful fintech startups ideas to go with.

These digital financial app solutions are proving to be one of the best alternate funding models for Entrepreneurs. They are helping them with raising funds for their new or existing enterprises via collective efforts from different individual contributors and venture capitalists.

Currently, there are a limited number of crowdfunding platforms such as Indiegogo and Kickstarter and the concept itself is popular across the US and UK regions only. However, it has been found that these digital solutions are getting traction in the market, and are predicted to have a market of USD 28.8 Bn by the year 2025.

11. Insurtech solution

As you might be familiar with, insurance has always been a co-running business with banking in the finance sector. They have operated in synchronization with each other in various cases. And now, when finance has turned into ‘fintech’, insurance has also come up with its upgraded solution version – Insurtech.

This subdomain, with the incorporation of latest technologies like AI, IoT, Blockchain, Open API, and Machine learning, is enabling insurance companies in delivering impeccable customer experience by analyzing a heap of user data, checking the market trends, understanding user emotions and needs, offering customized yet quick policy comparison options, managing risks, and much more. And that too, without relying upon any third party insurance broker.

Because of this the global insurtech market, which was valued USD 1.5 Bn in 2018, is anticipated to flourish with a CAGR of 43.0% between 2019-2025. Also, many insurtech firms are gaining significant fundings – a real example of which is that WeFox raised $110M in Series B extension funding round.

It is safe to assume that to bring all the technologies and innovations together, the insurance sector will start deep-diving into insurtech mobile app development guides hand-holding them towards digitalization.

12. Crypto exchange platform

Last but not least, developing a crypto exchange platform like Coinbase is also one of the best finance startup ideas to work on.

These platforms are giving users an opportunity to step into the decentralized market by trading crypto currencies for other assets like fiat money or other digital currencies. In other words, they are letting users exchange one crypto currency for another, get crypto tokens in return of fiat money, and even buy/sell their crypto coins. All while enjoying perks like transparency, lower fees, higher security, and faster processing.

13. Payday Loan App

Another fascinating application idea that one can invest and earn money is payday loan application. Through this financial application, you can provide their app users with a specific sum as a loan in their crises like bill payments, hospital expenses, or EMIs.

App users simply need to add data about their work and connect the bank account. The application monitors the working hours, so users can cash when they need to. Also, your application will deduct the cash once the users will get the paycheck. Here are a portion of the proposed features to include in Payday loan application:

- Take a particular sum as a loan with just a few clicks

- No hidden fees or charges

- Alerts and notifications of forthcoming payments

- Safe and secure protection of bank details

14. Bill reminder app

A bill reminder application can prove to be bill saving to those individuals who frequently forget to pay their electricity, water, phone, credit card, and different other bills on schedule, and thus, have to bear unrequired late payment charges. You can consider making such an application that reminds users about the bill due dates.

15. Financial record maintenance

Keeping the payment receipts, tax invoices, and other financial records can be a troublesome errand for many. Thus, to make financial record maintenance an easy job for busy individuals, designing such applications can fill in as a great financial business idea.

16. E-mortgage apps

This is another new fintech app startup idea that arose after the COVID-19 pandemic. Getting a mortgage was hard for people, so now electronic loan applications have made the loan application process easy and simple so that individuals can get contactless loans rapidly without much hassle.

17. On-Demand Fuel Filling App

To start with, no one can tell when you would run out of fuel in the event that you are stuck in a jam. Although it doesn’t look like a big thing, but it can be a major issue for you particularly when you are with a family or going to the workplace or on any trip. Thus, if you are in the oil business or a vehicle serving company, then developing an on-demand fuel delivery application can be a trend setting mobile application idea in 2021.

Now as you know the types of finance app ideas you can work on, it is quite obvious that you would be eager to learn where to start. Considering the same, here we have picked up some crucial steps that you must follow to be a part of the future of the fintech industry.

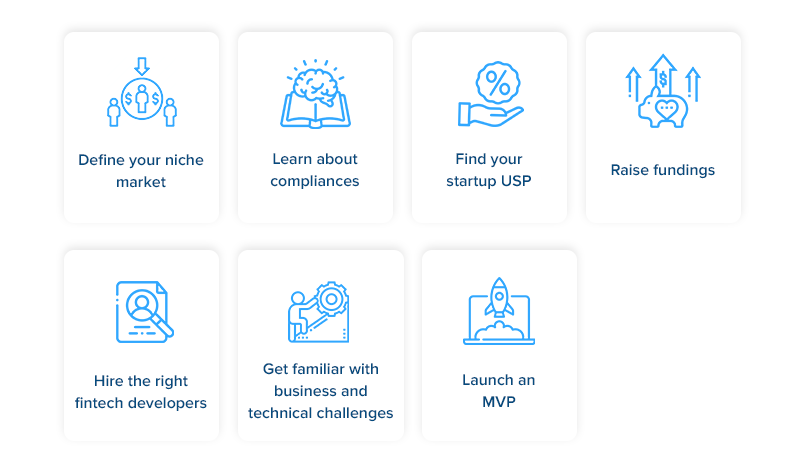

Things To Consider While Launching Your Fintech Startup

1. Define your niche market

As hinted earlier, fintech is a big sphere to explore. Striving to rule the complete finance world at once can be tricky and nearly impossible. So, it is advisable to pick a particular niche among the different subcategories of the market, which are as follows:

- Payment and international money transfer,

- Mobile banking,

- Personal finance management,

- Insuretech,

- Trading and lending,

- Crowdfunding, and

- Data analysis and financial decision making.

Once the niche market is decided, do market research to determine the specific audience your product/service will target, i.e, based on age, gender, occupation, and country. This will help you to launch your top fintech startup locally first and then, enter the global market with better success ratios.

2. Learn about compliances

When it comes to the banking and fintech industry, they are highly regulated. So, it is must for one to be familiar with all the specifications and characteristics of this highly complex sphere, which includes legal regulations, limitations, laws, and requirements.

3. Find your startup USP

Due to the increasing set of opportunities and profits, the fintech market is becoming competitive day by day. In such a scenario, it has become even more important for anyone coming up with a new finance app development idea to be sure that his idea beats the existing ones. Aka, the idea they formulate is not something generic; it offers a functionality that is better than ever existed before. Something that could become their brand’s USP.

Now, while doing customer surveys and going through different reports would help, it is a profitable decision to invest your effort in competitive analysis. This approach will help you with finding the common success factor among all the top players, their business and revenue model, the pain points they fail to see, and thus, refine your idea.

4. Raise fundings

While you might have some savings with you, there are various fundraising ways like bootstrapping, crowdfunding, venture capital, and angel investment that are prevalent in the market. So, look forward to these methods for raising enough money to make your fintech app ideas financially-backed.

5. Hire the right fintech developers

Believe it or not, even the finest idea can’t survive the market without the right team of financial app developers. So, do not keep your app idea confined to you and look around giving it a shape on your own. Rather, look ahead to hiring a reputed fintech software development company.

A team of professionals who have an expertise in app development and have prior experience in your niche subdomain can help you with choosing the right technology stack, revamping your business strategies, coping up with the hidden barriers, and scaling up your fintech app idea. And that without making a hole in your pocket.

6. Get familiar with business and technical challenges

Like that in the case of any other startup, there are various challenges associated with establishing a fintech business, especially those associated with the transformative nature of digital technologies. For instance:

- Cybersecurity

- Integration of AI and Blockchain

- Big data usage

So, it is advisable to gather comprehensive information about these challenges as well as connect with the financial app development companies that aid in mitigating them efficiently and effectively.

7. Launch an MVP

Last but not least, do not feel tempted to develop a full-fledged fintech mobile application. Rather, look ahead to testing water with a Minimal Viable Product (MVP) first.

An MVP not only gives you the privilege to enter the market at a cheaper and faster rate, but also helps to raise fundings.

Frequently Asked Questions

Q. What technologies are disrupting the fintech industry?

Blockchain, Robotic Process Automation (RPA), Augmented Reality (AR), Prescriptive Security, Artificial Intelligence (AI), and Quantum Computing are some of the technologies revolutionizing the fintech space.

Q. What are the best programming languages to build a fintech app?

Python, C++, Java, C#, C, and Ruby are some of the best programming languages to consider for finance app development.

Q. How do fintech apps make money?

A few of the fintech app monetization strategies that Entrepreneurs are focusing upon are in-app advertising and referrals, business collaborations, subscriptions, and introducing API as a product.

Q. How to validate fintech application ideas?

One of the easiest yet effective ways to validate your fintech app ideas is to launch MVP version. This app version, with the least possible features and functionalities, will help you to test the competition in the market as well as raise fundings, in addition to prepare the audience for the future.

[Also Read: Valuable Business Lessons That Fintech Startups Can Teach You]

Concluding Thoughts

The Fintech market is mushrooming at a staggering rate. Various fintech app business ideas are entering the market. However, not all startups are enjoying the same set of opportunities and benefits of developing financial apps. The pressure to deliver the finest combination of expertise, creativity, trust, and technology is making their journey tougher than expected.

However, by following the aforementioned steps, you can cut down hassles in your path and get into the list of top fintech startup 2021 in no time. So, keep implementing them.

And in case of any queries, feel free to contact us.

strategies your digital product..