What Are The Latest Trends in DeFi?

Technological advancements have taken over the world, and the year 2021 has witnessed advances that would have otherwise taken years to progress. The pandemic may have taken a toll on our everyday lifestyle, but it has definitely fueled tech and innovation. Just like the pandemic has given a push to technological advancements, digital currency trading is no exception.

The current generation is prone to digital currencies such as bitcoin, ripple’s XRP, ethereum, stable coin etc. Therefore, the year 2021 can be said as the year for decentralized finance (DeFi), especially for the blockchain sector. DeFi applications and DeFi platforms have ditched the traditional financial systems and paved the way for an all-new method of trading with digital currencies.

Whilst the rest of the planet had seized pandemic dread, Blockchain acquired a DeFi bug. Cryptocurrency lovers were angry with FOMO-ing for the liquidity of the mining industry, steady borrowing and protocol financing. In brief, DeFi trends dominated the discourse for much of the year, and in non-traditional financial institutions during COVID-19, notable development was witnessed.

In February 2021, the total volumes locked (TVL) crossed $1 billion. This is the dollar value for assets concluded in DeFi agreements and finished over $13 billion in financial years.

Despite witnessing such rapid DeFi growth, upcoming DeFi projects remain a very young industry with plenty of room for innovation.

If this is true, then what DeFi google trends are worth keeping an eye on in 2021?

Let us explore some of the best DeFi projects 2021:

However, before we go on exploring, top DeFi Trends, let’s address the most basic question regarding DeFi:

What is DeFi?

Decentralized finance is in its simplest form makes financial goods available to everyone on a decentralized public blockchain network instead of through intermediaries like banks or brokers. In contrast to a bank or brokerage account, DeFi does not require an ID issued by the government, a social security number or evidence of address. Instead, DeFi mainly refers to a system that enables buyers, sellers, lenders, and borrowers to engage with peers or a middleman based on rigorous software rather than a transaction-facilitating corporation or fintech app development agency.

Is Defi Growing?

Decentralised finance is still in its early phase of growth. As of March 2021, DeFi contracts have a combined value of over $41 billion. While DeFi’s overall amount may appear considerable, it must be noted as many DeFi coins do not offer enough liquidity or volume to trade in cryptocurrency marketplaces. In addition, there are infrastructure malfunctions and hacks in the DeFi platforms. The fast-changing DeFi applications also abound in scams. For this sort of legislation, DeFi’s transaction span is borderless. For example, who is guilty of a cross-border financial crime, of protocols and DeFi applications?

The DeFi regulation focuses on smart contracts. Besides the success of Bitcoin, DeFi is the best example of the theory of “code is law”, in which law is a collection of rules written down and enforced by unchanging code. The intelligent contract algorithm consists of the buildings and conditions of use required for conducting transactions among two parties. However, because of a broad number of circumstances, Defi platforms can fail.

For instance, what if a system crashes due to an erroneous input? Or if a compiler (in charge of building and executing the code) is erring. Who is responsible for these modifications? These and many other concerns must be dealt with before DeFi becomes a mainstream mass system.

Now that we know what is DeFi and why is it so popular, let us have a look at some of the latest trends in the DeFi world:

Trends of DeFi

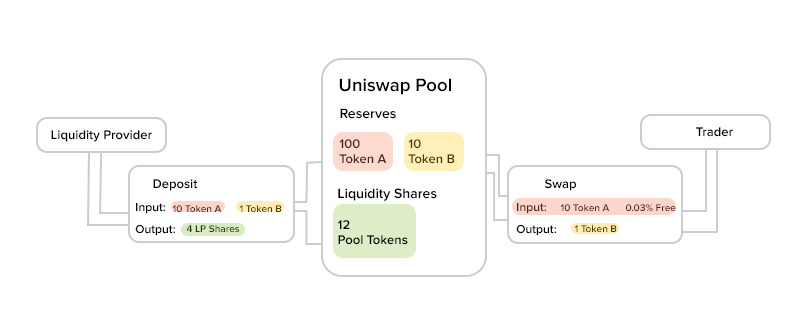

Trend 1 – Liquidity mining

The largest fad which evolved quickly was liquid mining, also known as yield farming. This incentive drives Crypto asset investors to secure a decentralised network for their currencies. Unfortunately, this supplies the required liquidity and inadvertently boots the protocol. Liquid mining is a DeFi trend that may never fade away.

A recent example of liquidity mining is the Compound Finance Protocol, a DeFi application that lets any user withdraw assets or offer liquidity in one of their liquidity pools as long as they possess an ethereum wallet. The users earn rewards according to tp Compound’s basic principles. Last year, Compound launched its governance token named COMP and since then liquidity mining has become an unbeatable DeFi trend. Everyone who either buys or lends using the COMP token gets rewarded as per the new protocol. This year with the development of better DeFi platforms automated production farmers such as yearn.finance liquid mining has been further revolutionized.

Trend 2 – Ethereum can be the next big thing

Ethereum is usually a part of conversations whenever decentralised funding and the latest DeFi trends 2022 are discussed. Ethereum best supported the DeFi in 2021 is anticipated to follow a similar path. The idea that DeFi is for everybody’s loyalty when it simply circulates prices from $5 to more than $30.

Cross-chain technology has become one of the newest forms of DeFi trend in 2021 because it allows transmission of information between different blockchain networks, making interoperability easier for the users. Matic, an Indian blockchain scalability platform also called ‘the Ethereum’s Internet of Blockchain’ is a vital effort to divide the DeFi sector’s load among several blockchains uniformly. It is a perfect example of cross-chain technology and the solution to some of Ethereum’s current issues – including high charges, poor user experience and less number of transactions per second (TPS). MATICseeks to build an ethereum-compatible decentralized blockchain multi-chain ecosystem and help traders trade better.

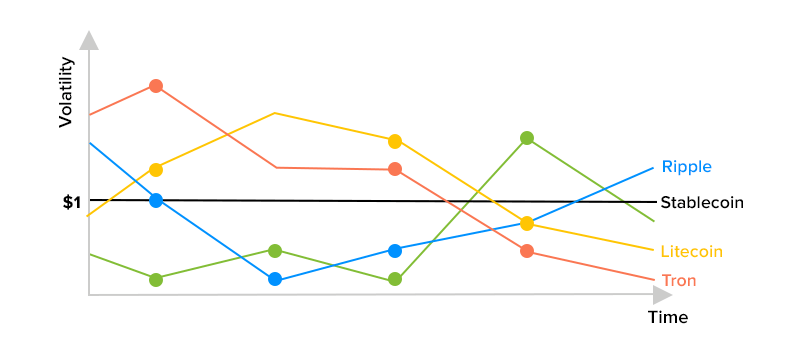

Trend 3 – Stablecoins are the top DeFi trend

The stablecoin business is another industry in which DeFi emerges at a robust pace. Stablecoin has been added to 20 billion dollars in one year, and stablecoin supplies have risen above 26 billion dollars. With approximately 79 percent of market domination, Tether USDT is the most significant participant. The US dollar is still dominating in a stablecoin market, with Circle USDC being one of the other most prominent figures. However, it is forecast that fat-packed stablecoins might start eating market share as the industry matures and government stimulus programmes materialise.

Trend 4 – Monetizing the gaming industry

More than 2 billion people keep themselves engaged in gaming worldwide and spend around $159 billion every year. With more and more people dedicating hours to this form of entertainment, the blockchain gaming industry will witness huge DeFi growth.

Blockchain gaming is based on the simple concept of gamers completing certain tasks to mine the tokens. Now, when the industry will be monetized, DeFi protocols will be needed in place to ensure in-game transferability. Last year, BitSport, the crypto gaming platform created a way for crypto owners to sponsor game tournaments. Such tournaments and more gaming platforms are expected to rise this year as well and become one of the best DeFi projects for 2021. By monetizing the gaming industry, DeFi will certainly set a new and engaging trend for the traders.

Summing It Up

With the advances in security in blockchain, 2021 is without question going to be the most exemplary year of decentralised finances. By extending its blockchain community, DeFi secures its presence. In the light of the tendencies described above for the fledgling industry, 2022 might prove a more significant year.

There are several reasons why DeFi fans and crypt lovers keep engaging themselves in the top DeFi trends 2022 and are eager to invest in the upcoming DeFi projects.

Are you prepared for such a change? If you think you are ready to imbibe the changes in your business ideas and make use of the blockchain app development technology to engage customers then you can refer to appinventiv, a trustworthy and reliable fintech app development company in USA. A financial services consulting that would help you expand your decentralized journey.

Frequently Asked Questions

1. Why is DeFi popular in 2021, 2022?

The pandemic paved the way for digital trade and cryptocurrencies to gain an edge in the market. The year 2021 witnessed DeFi trends that one could have only imagined. Liquidity Mining, Blockchain Gaming, Ethereum trading, and more kept the digital traders engaged. It has been estimated that these DeFi google trends will continue to witness the DeFi growth in 2021 as well as 2022.

2. Is DeFi growing?

DeFi can still be said to be in its infancy and is still being developed by the fintech software developers. DeFi Applications and DeFi Platforms still need a lot of improvement to become more robust and reliable for the users.

strategies your digital product..