A Beginner’s Guide to What is Decentralized Finance (DeFi)

Okay, let’s accept it.

Money and its transactions have been in existence, in one form or the other, since the beginning of humankind; Cryptocurrency is only an avatar perfecting it.

The industry leaders a.k.a banks have been holding their invincible position until now. But with the inequalities of existing global financial systems coming on the surface in the face of economic meltdowns, the Fintech domain is trembling.

A number of crypto startups have emerged with different ideas and models, and common intent. The intent to make financial services accessible on a global scale.

The adoption of blockchain technology in finance and the spread of decentralized financial services is shaping a new world and it’s called Decentralized Finance (DeFi). This world is characterized by global accessibility of financial services, safe transactions, low transaction price, and the latest DeFi trends revolving in the market.

Today, through this Decentralized Finance guide, let us walk you through the decentralized finance world and explain DeFi for beginners. One where no one is unbanked.

What is DeFi (Decentralized Finance)?

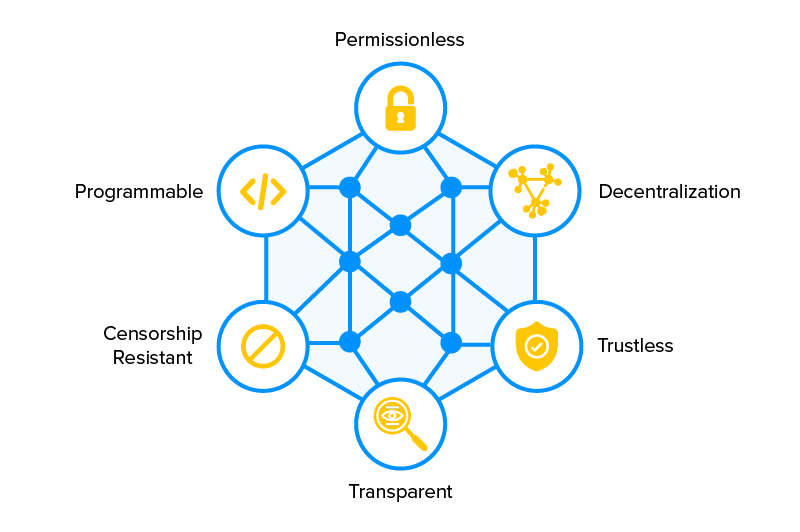

A simple answer to what is a decentralized finance definition or DeFi is that it is a brand new monetary system which is built on public blockchains. The components of open finance consist of protocols, digital assets, dApps (decentralized applications) and smart contracts, which are built on Blockchain.

While a number of us know Ethereum and Bitcoin as cryptocurrencies, very few of us know that they are open source, vast networks which allows users to develop apps which enable financial activity to brew sans centralized institutions involvement. In fact, decentralized finance Ethereum is one of the names that helped make the essence of open finance mainstream.

The intent behind the introduction of this new system is straightforward:

First, to help the 1.7 billion people who lack basic financial service access, and second, to introduc open banking through decentralization. This introduction and inclusion of decentralized financial technologies would mean that there is no point of failure for identical records that have been kept across multiple computers through peer-to-peer networks. Since it is permissionless thus, it is accessible and open to everyone.

Now that we know what is DeFi and the aim behind its inception is cleared, let’s have a comparative look at DeFi vs Traditional Financial system in our Decentralized Finance guide.

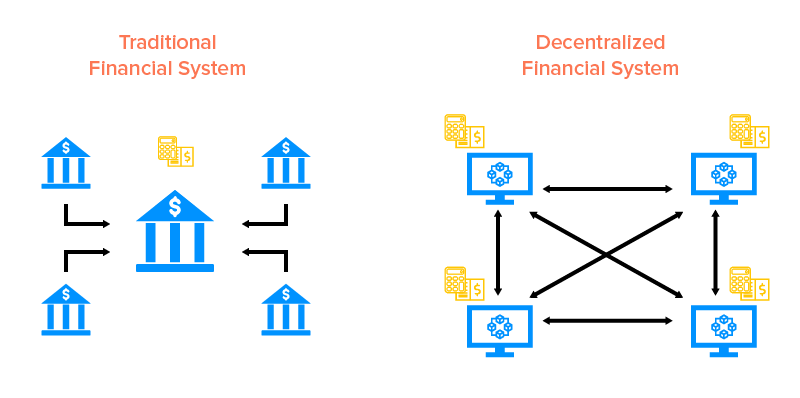

Traditional vs Decentralized Finance: How Different is DeFi From Other Banking Products?

While Decentralized Finance (DeFi) is only an advanced version of the finance structure with the same core working, lying in receiving and giving money, there are some inherent decentralized differences to consider for distinguishing between DeFi and fintech. The one that makes Blockchain app development services one of the key Fintech trends for 2021 and beyond.

1. At its center, the operations of DeFi are not managed by institutions and employees. Their role is played by algorithms written in code or via smart contracts in the DeFi environment. Once a smart contract is deployed to blockchain, DeFi apps run without any human intervention.

2. One of the prominent DeFi features that clearly defines the differences between DeFi and traditional banking apps is that the former comes with the power of code transparency. This makes it possible for anyone to audit, which develops a trust with users because everyone has the opportunity of understanding the contract’s functionality. And since the transactions are pseudonymous, the privacy questions never emerge.

3. dApps, another type of blockchain application used in the DeFi environment, have been designed to act globally from day one. Irrespective of which geographic location you belong to, the access of DeFi networks and services are the same.

4. Anybody can create decentralized finance applications and anybody can use them. Unlike present day finance, there are no accounts or gatekeepers on this front and the users interact directly with smart contracts from crypto wallets.

5. The new decentralized finance applications are built and composed by mixing other DeFi products like in the case of Lego. Example, decentralized exchanges, stablecoins, and the prediction markets can be mixed to develop new products.

Benefits Of Defi Apps

Traditional banks are administrative in nature and expensive to run. The process for transactions takes time and has removed numerous individuals out of the financial framework because of their rigid rules and requirements. . DeFi came to settle a large number of these issues. Some of its benefits are:

Permission-less

DeFi welcomes everybody to the financial system regardless of their pay, race, culture, wealth or geographic area. All that is required from every single user is a mobile phone or computer with internet access.

There are countless unbanked individuals globally. The World Bank estimated in 2018 that 20% of the total population of the world lack access to banking administrations. One justification for this is that the vast majority of the unbanked need genuinely necessary know-your-customer (KYC) documents like state-issued I.D. cards.

A few DeFi stages allow users to work without any of this. You can take out a maker loan, for example, with no ID or credit score assessment.

Interoperability

With decentralized accounts, developers can freely expand on top of existing protocols, customize interfaces, and integrate third-party apps.

Because of this sort of adaptability, DeFi conventions are often known as ‘Money Legos.’ New decentralized money applications can be built by consolidating other DeFi products. For instance, Stablecoins, decentralized trades, and forecast markets can be joined to frame completely new and significantly more progressed decentralized finance market size and centers.

Transparency

DeFi empowers a more prominent degree of openness and accessibility. Since most DeFi protocols are based on the blockchain — a public ledger — all exercises are available to the general population. Anybody can see transactions, however these records are not attached to anybody directly just like the case with traditional banks. All things considered, accounts are pseudo-anonymous, posting only numerical addresses. Users with programming information can likewise access most DeFi products’ source code to review or build upon since they’re open source. Open-source codes are safer and of better quality than proprietary software, on account of local area connection.

Finance control

With DeFi platforms, you stay in charge of your funds and finances. While you need to store your assets into the platform, you choose what happens to them. Rather than confiding in human intermediaries between to qualify you for a loan and how to deal with your investments, a smart agreement does that.

Nobody can prohibit you from a DeFi protocol. The underlying smart contract is a law, and it works indiscriminately.

Innovation opportunity

The DeFi environment provides valid possibilities to innovate and create DeFi services and products. DeFi is an open protocol and can be considerable help for developing another age of financial solutions. The DeFi significance gathers higher significance as it can use Ethereum and allows trailblazers to make new decentralized applications for the financial area.

How can DeFi Be Applied to the Real World?

The rising adoption of Open finance platforms and processes give the potential to transform the lives of everyone unbanked in the world.

On the remittance market front where foreign workers send billions across borders to their families, the fees that they have to pay are extortionate. The trends in Decentralized Finance services come with the potential to cut down these costs by more than 50%. This not just increases employee’s productivity but also helps grow economies.

Loans are the other challenging area that can be addressed by concentrating on the advantages of DeFi. Presently, it is impossible for the unbanked to borrow money because of a lack of credit score or bad history with a banking institution. The DeFi platforms connect borrowers with lenders, thus eliminating the credit check process.

These are just two examples scratching the surface of how blockchain shapes the fintech domain. By removing inaccuracies and middlemen and bringing in transparency and lack of central control in the picture, Blockchain is only getting prepared to devise newer use cases of DeFi in every Fintech real world application.

Challenges Associated with DeFi

Every high return financial product comes with attached risk. Thus, it is a given that there will be a list of challenges of DeFi as well.

Understanding and securely handling cryptocurrencies tools call for specialized knowledge and attached risk. It becomes a user’s responsibility to take care of their key and holding and follow the process of multi-factor authentication with utmost privacy.

Also, there have been far too many security related incidents, which have begged the interference of stringent security and privacy algorithms brought in by sound blockchain development companies. While the solution creators have been taking control of the task, as DeFi users you too must keep yourself updated with changed service terms between different wallets, exchanges, and other crypto projects.

Lastly, in the case of traditional currencies, investors have benchmarks and historical data to look at before taking any investment decision. The same privilege, however, is not given to the DeFi users. The lack of historical numbers makes it difficult for them to assess the associated risk. This, in turn, makes it necessary for them to perform extensive research on their own.

Famous DeFi Projects

MakerDAO: Decentralized reserve bank and stablecoin

Maker is a stablecoin project wherein every stablecoin is pegged to the US dollar and backed by the collateral in the form of crypto. Entrepreneurs can also develop their own DAI stablecoin on the Maker Oasis dapp platform. Maker is a lot more than a mere stablecoin project, it aspires to be the answer to how can DeFi develop into a reserve bank. The people who hold MKR can even vote on crucial decisions like Stability Fees – similar to how the Federal Reserve’s Federal Open Market Committee votes on Fed Funds rate.

Compound: Borrow and lend

It is a Blockchain powered lending and borrowing dapp – one of the most flourishing categories of open finance. Users can deposit their crypto in the Compound Contract as collateral and can borrow against it. It then automatically matched lenders and borrowers and adjusted the interest rate dynamically on the basis of demand and supply and open lending protocols.

Uniswap: Token exchange

It is a cryptocurrency exchange platform which runs completely on smart contracts, letting users trade famous tokens straight from inside their wallets. It uses a different mechanism called Automated Market Making for directly settling trades near market price.

Additionally, users can also become liquidity providers by supplying the crypto to Uniswap contract and earning a share of exchange feed.

Augur: Market prediction platform

It is a product for the decentralized prediction markets through which users vote on the outcome of events by attaching a value to the vote. Although the present prediction market platforms are new, they do offer a futuristic view into the future where users are able to predict the future by tapping into the crowd’s wisdom.

PoolTogether: Zero loss savings platform

The platform enables participants to deposit DAI stablecoins in a common pot. By the end of every month, one participant wins all the interests and everyone else gets their initially made deposits back.

The Future of DeFi

Crypto is the latest digital offering of an industry that has been around since the beginning of time. In the time to come, we are poised to see every single financial service we use today under the fiat scheme getting rebuilt in the DeFi and open finance ecosystem.

The first generation of types of Defi apps rely majorly on using collateral as a safeguard mechanism, meaning, you will have to own crypto and then offer it up as a collateral for borrowing more crypto.

We are also already seeing massive innovation happening in the insurance domain as a result of the latest iterations of DeFi apps. A number of today’s DeFi loans are overcollateralized – the loans are made inherently safe because of the massive asset cushion kept in the reserve).

In the future, we can also expect crypto wallets to become the portal of all the digital asset activities. You can imagine it as a dashboard which not just shows the assets that you own but also how much of it is locked up on different open finance protocols like pools, loans, and insurance contracts.

We are also seeing a shift towards decentralized governance and decision-making. Today, despite the focus on the word ‘decentralized’ in DeFi, the projects have master keys for DeFi platform development solutions providers to shut down dapps, for the sake of easy upgrade or to safeguard instances of buggy codes. The DeFi community, however, is looking for ways to enable stakeholders to vote on decisions, introducing a much wider range of DeFi use cases.

After all the speculations and POCs around new DeFi possibilities are being designed and made, something new is happening on the open financial system front – cryptocurrencies are bringing money online & giving people ways to make money on dapps. Our thought on the functionality of money is being challenged with every new disruptive launch.

The fact that the future of DeFi and the future of money lies in the hands of anyone who can code is nothing less than interesting for us bystanders.

Conclusion

Are you prepared for this upcoming change? If you think you are ready to imbibe the changes in your app or ideas, then you can refer to appinventiv, a trustworthy and reliable company dealing with Blockchain development Company USA. A company that would help you expand your decentralized journey through its top most blockchain development services.

strategies your digital product..