How to Increase the User Retention in your Payment app?

Mobile payment apps are driving us into a cashless, card-free, order-in-one-click, contactless-pay world. They automate and optimize everything: splitting bills, remittances, booking flights, and budgeting personal finances.

With a multitude of mobile wallet apps, m-commerce apps, cryptocurrency platforms, peer-to-peer payment apps at our disposal, Fintech is significantly changing how we deal with money on a daily basis.

The awareness of digital payment methods to increase mobile app engagement has grown steadily. With a steep rise in demand for hassle-free payments for goods and services, more and more consumers are moving towards digital payment solutions and opting for mobile user retention strategies for frequent routine transactions.

Table of Contents:

Future of Mobile Payment Applications

Ways to Improve User Retention

Moving to Mobile

Amidst the Covid-19 global pandemic, perception of cash as a carrier for Coronavirus may alter the way consumers choose to pay in person. The Coronavirus outbreak is causing people second thoughts on reaching for cash, making a coronavirus impact on finance industries and sectors a blessing in disguise.

The concern over the spread of the virus could possibly introduce mobile payments to those, who otherwise would not have seen the appeal. Contactless payments have emerged as a new choice for customers who are far more mindful of what they are touching.

This can also be seen as an opportunity to go digital. The Covid-19 crisis have encouraged people to make use of all forms of digital financial services and make them the norm for tomorrow.

The Future of Mobile Payment Applications

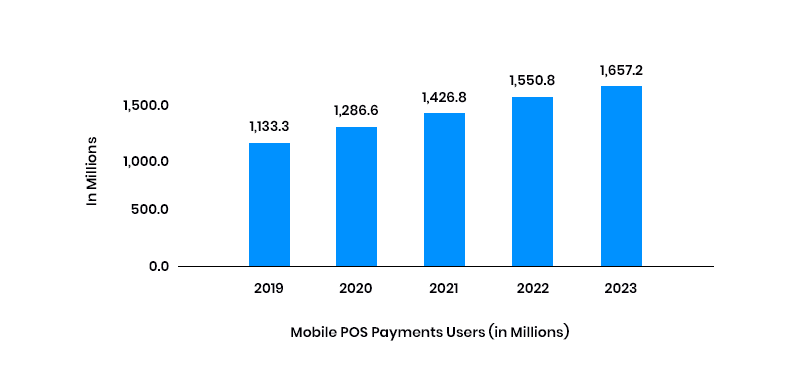

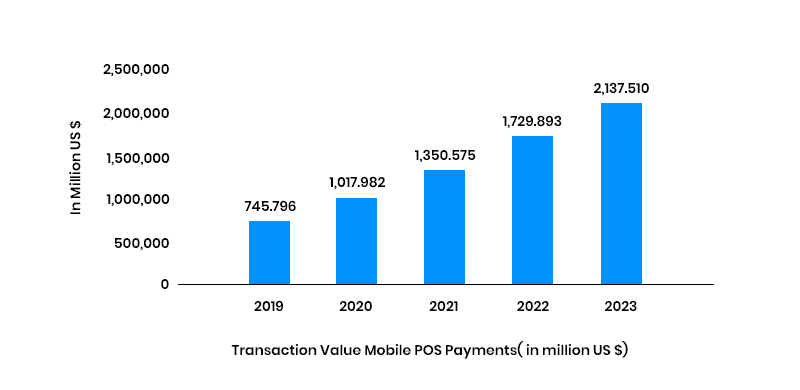

The use of mobile payments saw a consistent growth in recent years. The digital payment industry is projected to grow at a CAGR of 33.8% from 2017 to 2023. It is expected to hit a market size of $4,574 billion by 2023, and the mobile payment app sector is significantly contributing to it.

In India, demonetization provided the much-needed impetus to digital payments, including mobile payment wallet transactions. While global market leaders in the Fintech landscape are PayPal, Amazon Pay, Google Pay, Apple Pay, players like Paytm, MobiKwik, Freecharge, and PhonePe are scaling new heights in the Indian market.

A quick detour: List of Top 7 most frequently used mobile payment apps

- According to Statista, in 2021, more than four out of 10 U.S. smartphone users had used a contactless payment at least once.

- As per Mordor Intelligence, the mobile payments market value is expected to reach USD 5399.6 billion by 2026 from USD 1449.56 billion in 2020 and grow at a CAGR of 24.5% over the forecast period (2021 – 2026).

- As per various reports, Alipay is the world’s biggest mobile payment platform with more than 1.2 billion daily active users.

- According to a new research published by deVere Group, the Coronavirus has accelerated a huge 72 percent rise in the usage of fintech apps in Europe.

- At a time when most sectors of the global economy are starting to feel the impact of what could already be a global recession, the dramatic leap in the acceptance and usage of apps comes as a good news for the fintech industry.

- Mobile payment apps based on modern business models could impact up to 80 percent of established banking revenue by 2020, as per a report released by Accenture.

As users are steadily moving towards the use of payment apps for day-to-day transactions, the need is to lay emphasis on providing a seamless payment experience and mobile app engagement to your customers.

What Exactly is User Retention?

User retention, in the simplest sense, implies bringing users back to your app. While App store optimization, paid advertisements, influencer marketing and a variety of other user acquisition strategies can bring new users to your application, the real deal is keeping them meaningfully engaged and retaining them.

Retention is calculated by comparing the number of users at the start of a certain period with the number of users at the end of that period.

Retention for mobile apps is notoriously poor and that keeps getting worse. Only 32% of users launched an app over 11 times in 2019. That’s down from 38% in 2018.

Retention Over Acquisition

User acquisition is obviously important. In order to expand you have to add new users every month. Yet in most cases, businesses put so much focus on acquisition over app retention.

The user abandonment rate, which means that the user has removed the app right after one use is 23 percent. Furthermore, if the user has not opened your app once in 7 days post-installation, then the chances of uninstallation are 60%.

But if you have a robust payment app with an effective mobile app user retention plan then, becomes easy to keep users engaged, active, and profitable over the long term.

Tactics to Improve User Retention on your Payment App

Once you have started your app, the very question that comes to mind is- how to increase retention? Mentioned below are some mobile app retention strategies that will help you significantly improve engagement and app user retention for payment apps. It can help businesses lower the churn rate and see the desired results and ROI that they expect from their fintech application development investment while improving mobile app engagement strategy for payment app.

1. A Perfect First Time User Experience (FTUX)

A great on-boarding experience can improve user acquisition by 7x. A perfect on-boarding experience gives users their first Aha! Moment and lays the foundation for greater user acceptance. This gets them to perform critical actions quickly, such as registration, adding money, or using the app for payments.

The key is to consider the best mobile app onboarding practices, especially making the process as simple and intuitive as possible. The harder it gets to continue using an app, the more likely it is for users to abandon it.

Mentioned below are some steps that can help you simplify the onboarding process:

- Reduce the number of steps required to build an account or sign up, and have multiple registration options (for example, login with Facebook or Google).

- Demonstrate the features of the app during the onboarding process, but don’t overwhelm users immediately.

- Send attractive push notifications urging users to register, post 24-48 hours of app download, if they have not already. Encourage sign-up through offers and coupon codes.

- Welcome users to the app with personalized in-app updates after they have registered. Encourage them to add money to their wallet, use the app to transact, or highlight the main features to get them started quickly.

A significant metric to track is the time that users take to register and sign-in to your app. This will give you feedback on the effectiveness of the onboarding process.

Showing immediate value can help new consumers turn into loyalists and brand supporters. Onboarded customers who see an immediate value in your product are more likely to stay active, transact more, and create long-term brand loyalty to help your app achieve sustainable growth.

2. Keep Users Meaningfully Engaged

Successfully onboarded users are likely to stick to your app, use it for purchases on a daily basis and remain engaged when they see the value. It is quite important to keep the users meaningfully engaged for sustainable revenue growth and brand building, not just in the initial process, but continuously throughout.

To increase app engagement for payment apps, follow the below-mentioned steps:

- Diligently tracking app usage trends empowers you with useful data.

- Personalized app user engagement campaigns cultivate the relationship between your brand and your customers and drive repeat purchases. This sets the basis for app success in the long term.

- Use user-specific behavioral insights to drive tailored in-app notifications and push strategies.

- Keep reminding users to reload their wallets, complete their profiles, add new features, benefits and reward them for their loyalty, with vouchers, cashback etc. By providing compelling deals on the services and features that they use the most, you can improve customer relationships.

Drop-offs when adding money to the digital wallet and leaving the cart may be early signs of a user who is about to churn. This makes it important to engage with users timely.

3. Retain Users Before They Churn

An app ‘stickiness’ refers to the amount of users who are engaging with a product or feature. The higher the stickiness quotient for your product, the more often your active monthly users return to the app.

Churn refers to the problem where a user stops seeing value in your app and stops using it within a period of time. Studies suggest that a drop in activity, for instance, the number of transactions or addition of money to the digital payment app is a sign of churn. Inactive users or dormant users are highly likely to uninstall the app.

The smart thing to do when you witness churn rates is to regularly monitor the behavioral pattern of your users and re-engage proactively with these users at-risk. By monitoring churn, tracking trends, and interacting proactively with at-risk user groups, you can remind users of the value that your app offers and increase long-term app retention.

Use mobile app retention and engagement strategy for payment apps to target these users and pique their interest back into the app by offering substantial value. Engage users with timely and personalized in-app updates and push notifications that prompt them to relaunch the app, encourage them to take advantage of discounts and cashback deals, and urge them to transact more with their favorite merchants.

- Cohort Analysis helps in monitoring app retention rates for different segments.

- RFM analysis.is another important analytical tool for distinguishing different user segments based on the level of risk.

- Asking for feedback is also an effective way to show your users that you value them and their opinion.

4. Retarget Churned Users

Users abandon an app when they stop seeing value. While it’s a bitter truth that some users will churn, you should retarget those users to get them back to your product. Restore the relationship with users by reviving their confidence and trust in your app.

The reasons for uninstall can vary, from issues with the UI, features, efficiency or user experience. Yet tracking uninstall rates and asking for input from uninstalled users can provide you with useful insights into the user experience and tell you what you can do to avoid potential uninstalls.

- Re-engage users who have gone inactive by posting “we miss you” or “here’s what you are missing ” themed push notifications.

- You can send promotional emails to win back uninstalled users or initiate remarketing promotions to accelerate app reinstallations. Track the campaign ROI by measuring reinstall rates.

- The key is to retain and re-engage users with lasting experiences. Render an experience that people care about. Give them timely reminders for payment of utility bills and run personalized campaigns to drive repeat purchases, aimed at improving loyalty and long-term retention.

5. Two Way Communication

For your brand to be consumer friendly, users need to build relations with brands, they need to feel valued and appreciated. This is the reason opening a line for two-way communication is critical. To understand and know what your users want, you need to take their feedback. The replies and feedbacks help application to accumulate responses, tackle customer issues, and further develop product usefulness after some time.

The additional advantage of having a two way communication with users is being able to hear about the issues before any negative comment is posted in an app store. This permits you to work on the issue and develop a relationship before it influences future downloads. Showing responsiveness and resolving any inquiries or concerns will support the engagement and app retention rates, encourage positive reviews, and construct long-term brand loyalty.

Organizations ought to understand that users involved with natural application engagement are bound to remain than imposing your application on the users. For sustainable revenue development, it is necessary that your targeted customers meaningfully draw in with your digital payment application. To retain customers you need to:

- Cultivate personalized mobile user engagement app campaigns by tracking the app usage trends through the available data.

- The push notification technology will help in the above procedure and encourage the customers to repeat their purchases.

- Reminders about completing the user profile, updating wallet, benefits that the app will provide, etc. will keep the user on their toes and loyal to your app.

Importance of User Experience

It is extremely crucial to consistently deliver a superior customer experience through behavior-based, hyper-personalized, and contextual marketing for sustainable sales and business growth of your payment app.

If you believe that user acquisition is the key metric for assessing an application’s performance, let me tell you high download rates do not yield any business benefit without active users.

Brands invest massive amounts of money acquiring users; however, that is just the tip of the iceberg. The real value lies in engaging and retaining your users in the long run.

Mobile app engagement and mobile app retention rate are the two defining metrics that provide real insight into an application’s success.

However, achieving a sufficient mobile app engagement and app user retention rate is not an easy task.

Statista reports that after downloading, only 32 percent of users will return to an app 11 times or more. What is even more eye-opening is that 25 percent of users abandon an app only after one use.

Greater engagement and app retention result in more active and loyal app users. Infact, a 10% increase in app user retention can increase the value of a business by more than 30%.

Bottomline

Mobile payment apps are constantly growing and becoming the leading payment channel. With various user retention strategies, we are witnessing a new wave of disruption fuelled by leading FinTech players.

Besides creating a secure and robust FinTech app, in order to turn your app into the primary wallet for your users, you need to provide them with a compelling user experience after proper ux review that benefits them at every stage of the user lifecycle-from acquisition to mobile app retention, for online as well as offline transactions.

strategies your digital product..