How is Technology Changing the Future of Consumer Lending?

Dive into the many changes that now stare at the lending centric consumer financial services landscape and how technologies are fueling the shift.

Every once a decade, technology innovation and customer demand merge in a way that drastically changes the consumer-facing financial service sector.

For instance, when The Motley Fool, eTrade, and Intuit came into the market some decades ago, consumers took it upon themselves to personally manage their finances and invest their savings in places that would get them maximum returns.

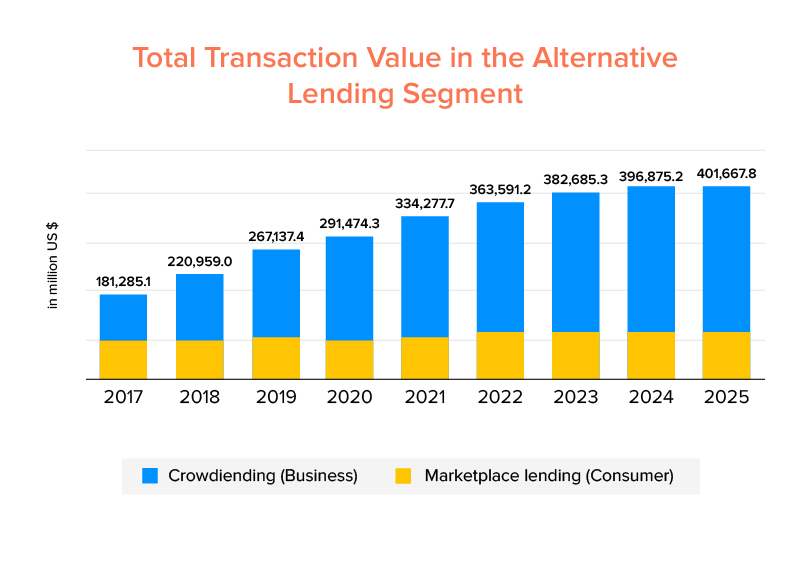

In 2021, the financial service industry is again staring at disruption. A number of technological and economic factors have developed a perfect situation where people are deciding how they want to manage their pay, pay for services and goods, finance a car or home, or even how they want to borrow.

To answer these changes and shape the future of lending, a number of tech-driven consumer-facing financial services companies have entered the market to address this consumer behavior shift. The entrants have become the reason why lending has become one of the most profitable finance app ideas.

In this article, we will be diving into the many changes that now stare at the lending centric consumer financial services landscape and how technologies are fueling the shift.

What is Contributing to the Evolving Landscape of Digital Lending?

The changing space of digital lending transformation is bringing a remarkable shift in credit analysis and bank loans. The rise of technology progress and big data has led to a series of alternatives coming into the market questioning the credibility of credit score – a prime factor driving the lending industry.

When we dive into the changes that are taking place in one of the slowest transforming financial services, we can find four factors fueling the digitalization of the consumer financial services space –

- Changing consumer behaviors – especially the COVID-19 driven behavior

- Rapid technological changes

- Changes in compliance and regulations

- Innovations happening in the space of simplification of operating models.

The combination of these four factors has given birth to a time where consumer insights are blended with product innovations to make fintech consumer lending a lot more inclusive. In addition to serving only the high credit-worthy consumers, the future of credit industry is now powered to involve consumer segments with low credit history (low-income households, students, freelancers, etc.).

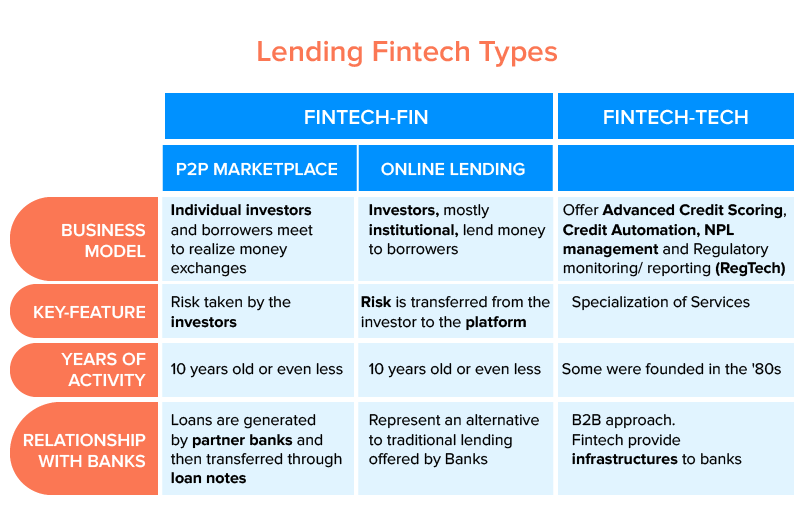

The digital lending landscape has grown to an extent that it can now be categorized into three sectors –

The ultimate aim of the technology-induced digitalization innovations happening in the sector – across the three subsets – is to digitize the entire customer journey (from KYC to reporting) at speed and at scale at a level where the traditional lending system could never reach.

How is Digital Lending Changing With Technological Advancements?

1. A new way of vetting applicants have come on the surface

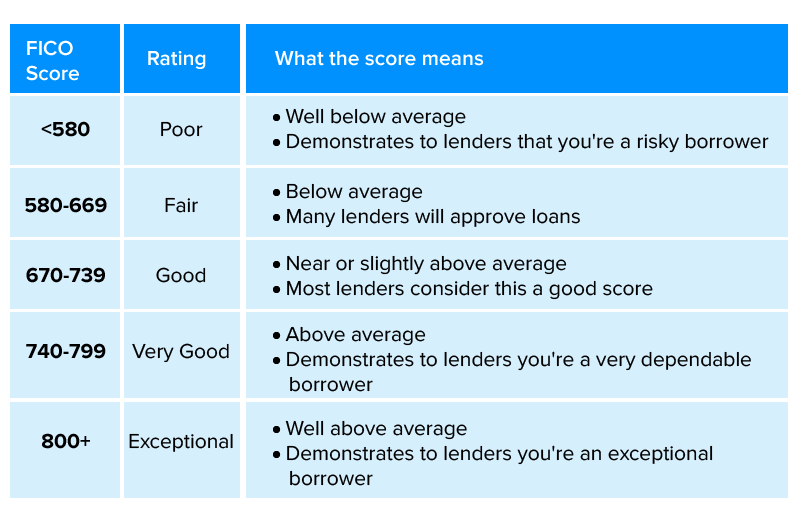

New credit mechanisms are building on the proposition that traditional ways of applicants’ approval on the basis of FICO credit score is an incomplete sign of applicants’ creditworthiness.

By using artificial intelligence, new models are being developed. These models factor in information surrounding thousands of data points like employment history, education details, and spending habits to verify if an applicant will be able to clear the debts on time. On the basis of these insights, a new credit score is coming to the surface as the future of consumer lending.

2. AI-backed strategy and sales streamlining

Digital lenders have started asking their partnered fintech app development companies to use machine learning for enhancing loans by making underwriting decisions. The algorithms can help validate if the applicants are telling the truth about their income level.

The process is best suited for people having an insufficient credit history, less income, or anyone who is charged higher interest because of the lack of financial data. Machine learning is also being used heavily for its ability to detect fraud through analysis of customer behavior backed by the time they spend answering applications’ questions, looking at the price options, etc.

3. Blockchain eliminating the need for intermediaries

Through the mode of blockchain, digital lending companies can develop a high trust, low-cost platform. With the complete loan process existing online, people will be able to keep a record of documents and transactions on an anonymous digital ledger platform thus eliminating the need for third parties and intermediaries.

4. Cloud computing solving digital lending sector uptime concerns

The most common corners of the lending sector are – security, storage, and 24*7 upkeep time. Cloud computing solves all these issues in addition to offering a series of additional benefits like

- Secure connections

- Cost-effective and time-efficient management

- Disaster recovery

- Simplified online processes

- Automation of processes

While these technologies are playing a key role in bettering the state of digital lending, what is important for the sector to keep evolving. A way the sector can keep getting efficient is by knowing the trends that are waiting for them in 2021 as the future of consumer credit.

Digital Lending Market Trends 2021-22

1. NLP will better customer experience

Smart lending systems will be using NLP for recognizing and understanding customers’ questions and converting them into actionable data. There are multiple applications that the digital lending companies will be experimenting with in 2021 –

- Lenders will be able to offer advice to basic queries through a chatbot

- They will use the technology for analyzing customers’ feedback, getting insights that can help them improve the customer experience.

- Analyze the data to better the credit scoring accuracy

2. Regulatory sandboxing

While the consumer lending sector needs constant innovation in order to develop and grow, it also needs regulation for ensuring security, safety, and ethics. Sandboxing is how both factors can be respected in the modern lending system.

It is the mode f testing innovative services in a controlled setting for the regulators to conduct their assessments before a complete rollout. The Compliance Assistance Sandbox (CAS) Policy, announced in 2019 highlights the process.

“After the [Consumer and Financial Protection Bureau or CFPB] evaluates the product or service for compliance with relevant law, an approved applicant that complies in good faith with the terms of the approval will have a ‘safe harbor’ from liability for specified conduct during the testing period. Approvals under the CAS Policy will provide protection from liability under the Truth in Lending Act, the Electronic Fund Transfer Act, and the Equal Credit Opportunity Act.”

3. Greater omnichannel capabilities

Technology will be seamlessly connecting the lender with borrowers through a self-service holistic digital experience. The year will see borrowers picking up on the half application form which they started on their phone, on their laptops.

Omnichannel capabilities that make it easy for them to jump from one platform to another without any shift in experience is what would help the digital lenders rule the year while becoming one of the key mobile app development financial services.

4. Non-banking institutions will continue entering the space

We have already seen Amazon offering loans to small businesses and Apple announcing its credit card. All of these innovations are the advanced stages of companies’ capabilities and how they help their customers reach their goals.

The year will see the consumer finance market getting introduced with a greater number of P2P consumer lending organizations. Backed by the abilities of new-gen technologies like Blockchain and AI, consumer financing companies will be giving banking institutions a tough competition.

Now that we have looked into the many ways consumer lending businesses are getting prepared to rule the sector through their partnership with a skilled fintech application development company, let us close the article by looking into some ways you can become the next big digital lender.

How Can You Become a Digital Lender?

There are a number of brands that have placed themselves in the future of the consumer financial at the back of their digital inclination.

Shifting from a traditional lending mindset to a digital bank oriented one is not an easy task. There will be resistance to change, an unacceptance towards risk, and other things. A digital bank transformation will require a strategic foundation-supported across all organization levels. As a lender, you will have to focus on offering an exceptional digital experience to your consumers. The last thing you would want is getting axed by Google on Play Store at the back of a bad experience and lack of regulations-compliance assurance. Here are some things that we recommend on the basis of our extensive skill set as a financial software development company –

- Provide transparent information on the approval guidelines

- Develop new training material, gen-z inclined communication about new policies

- Provide alternate channels to your consumers. Don’t force them to visit branches.

The secret sauce of your lending business success will be transparency and communication. The more open your business is, the more will be the chances of your consumers to choose alternative lending models. We can help you strategize your lending process digitalization. Contact our team of strategists.

strategies your digital product..