Mobile apps and digital transformation have brought a major disruption in our everyday lives. They have made various activities simpler, faster, and secure – including making payments.

Today, there are endless Peer-to-Peer (P2P) payment applications in the marketplace that enable users to transfer money to others via credit/debit card or other contactless ways. These applications not just aid in preventing visiting ATMs and banks, but are also emerging as the perfect companion in the field of splitting rents, sharing dinner bills, and splitting vacation’s bills.

A result of which is that the global P2P transactions are expected to hit USD 369.8 Bn by the end of this year, while the number of users are anticipated to be around 8 Mn by the next year. In fact, the global P2P payment market is said to be worth USD 3217.34 Mn by 2024.

This sudden rise in the usage of P2P apps over traditional ways and the revealing statistics have encouraged finance business leaders and mobile app developers to look forward to investing in Venmo like P2P payment app development. A detailed study of which we will be doing in this article.

But firstly, let’s quickly refresh our basics.

What is Peer to Peer payments?

Peer to Peer Payments or P2P Payments is an electronic transfer made by one individual to another with the help of a mechanism that is called P2P Payment Application. Through these applications, every individual account gets linked to the other user’s digital wallet. As soon as the transaction occurs, the account balance in the application records it and pulls money directly from one user’s bank account or app wallet and sends it to other’s.

When talking about it in detail, every P2P payment app falls among one of the three prime categories, with each having their own benefits and set of market leaders.

Types of Applications to Look at Before Investing in Peer to Peer App Development

1. Standalone Services (PayPal and Venmo)

These types of online mobile payments apps do not rely on banks. They have their own mechanism of storing and dealing with money, without any link to any financial institution. They all have the Wallet feature which makes it possible for users to store money before offloading in some bank account or sending it over to their peers.

PayPal’s user base, since its inception, has grown to more than 202 countries where around 286 Mn users make 36.9 transactions per year, on an average via 100 different currencies..Something that is enough to direct entrepreneurs and developers towards PayPal or Venmo like P2P payment app development.

2. Bank Centric (Dwolla, Zelle, and Popmoney)

Another app category to consider for taking advantage of P2P payment application development is Bank centric apps.

These mobile apps involve banks as one of the parties when doing transactions. While most of the banking institutions have their own apps, there are peer to peer payment apps that facilitate the fund transfer through its partner bank and credit unions. ClearXchange, who owns Zelle is developed by the top US banking institutions like BB&T, Chase, U.S. Bank, Wells Fargo, and Bank of America, making it one of the safest platforms, matching the safety standards of that of a banking establishment.These apps draw from and deposit directly into bank accounts instead of a stored currency account.

3. Social Media Centric (Facebook Messenger, SnapCash, Google Pay)

Social media centric apps are yet another type to consider when planning to develop mobile payment apps.

These types of mobile applications, launched by social media giants, enable users to transfer money using their credit/debit cards without exiting the platform. A few types are SnapCash, Softcard, and Google Pay.

Now while this has given you a clear understanding of what exactly a P2P mobile app is and what are the different types of mobile peer-to-peer payment apps, let’s move to the next step, i.e, the features to see when it comes to develop mobile payment apps.

Common Underlying Features in every successful P2P Payment Apps

There are some features that we, as a leading financial app development company, incorporate in the P2P payment app development process, every single time.These are the ones that you should have in the apps that you are all set to offer to the flourishing Fintech world.

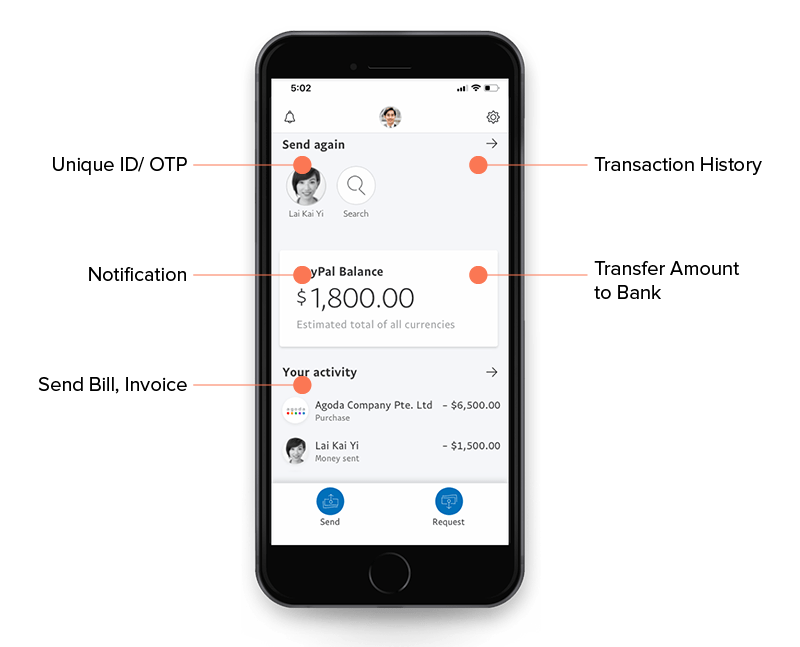

Unique ID/ OTP

Every Fintech app has an OTP or unique id that is sent to and verified by the sender before the money is deducted from his/her account or wallet. To make apps even more secure, some P2P Payment Service Providers even ask for the OTP every time one opens the app.

Technical Frameworks used – Third party SDKs like: Twilio, Firebase, Nexmo, Digimiles

Notification

This peer to peer payment app feature allows people to inform when the payment has been initiated and when it has been received. Using this, users are notified of any of their account or wallet activity. For apps that have extended their services from just peer to peer transactions to individual transactions like bill payment, ticket booking, etc. this can be used to notify the users of the upcoming bill due dates.

Technical Frameworks used – Rest APIs, Chrome notifications, Amazon SNS, Firebase cloud messaging, and APNS.

Send Bill, Invoice

There should be a feature to scan and send the bill to the person who needs to make the payment. Along with that, both the parties: Sender and Receiver should be able to receive a generated invoice of the transaction, which should be saved in the app itself.

Technical Frameworks used – Rest APIs, Bamboo invoice

Transaction History

Transaction history is again one of the important features to consider when looking into how to build a P2P payment app. This feature would give the users the summary of all their past money transactions made through the app.

Technical Frameworks used – Rest APIs

Chatbot

To build a payment wallet app like Venmo, considering chatbot as a prime feature is also a profitable decision.

This feature helps in dealing at various points of disputes that can come up when transacting funds through an app, from a lost internet connection in the middle of the transaction to the wrong deduction of amount from the wallet or account.

Technical Frameworks used – Third Party party SDKs – Zendesk, Microsoft Bot Framework, LUIS, Wit.ai, Api.ai, Chatfuel, Facebook Messenger Chatbot, and Amazon Lex

Transfer Amount to Bank

Generally, users look for a way to transfer the amount that they receive through the apps to their bank accounts. While every app has its own set of business model, this is one of the most preferred features of the P2P Payment applications.

Technical Frameworks used – ACH, Dwolla

This is about the features that should be added in the apps. But along with the must haves, there are scenarios that should be avoided as well. While most of them are not in your hands, there are some technical issues associated with peer to peer app development that you can easily overcome by being cautious.

So, let’s move to the next step related to how to design a P2P payment system like Venmo.

[Before moving to technological challenges, if you wish to know the cost of Venmo like app development, check this blog.]

Different Challenges in Developing P2P Payment App

Even though the world is now moving towards the digital money era, there are some challenges that the industry that persists and should be overcome for a P2P Payment App to survive in the mobile payments market. Let us look at both technical and non-technical challenges that are still staring at the P2P Payment industry –

Starting with Non – Technical first

Regional Limitations

The major players of the P2P industry are restricted in their geographical limitations. It is still not common for a P2P payment app development services provider to enable fund transfer between two nations. As the Fintech industry continues getting overcrowded, it is very important for a brand to expand their geographical reach in order to come out as an industry leader.

Lack of Open Loop Solutions

Presently, when making payments through P2P Apps, both the parties – one making the payment the other receiving it, should be on the same platform. While it is easier when we are transferring funds between people we know, there are times when we take or conduct one time payments with people we don’t know. The open loop platform enables the users to conveniently accept and transfer funds from/to anyone – eliminating the need for the involved parties to be connected through one platform or give-and-take personal information.

The cases of dispute

There are a number of disputes’ points that are associated with P2P Payment Apps. Suppose you initiate payment to someone and instead of going to him/her it goes to someone else or what would you do when an amount is debited from your wallet or account but the person it was supposed to reach, hasn’t received it. Like these, there are a number of things that can go wrong within the minutes of money leaving your wallet and reaching somebody else’s account. It is important that you keep a note of these issues before getting involved into the process to create a custom P2P payment app.

Slow changing Mindset

While people are adapting the methods of online payment and the increasing number of P2P apps, the industry is still growing at a slightly slow speed. People are still more comfortable in using cash and cards instead of mobile apps and the reason behind this is not the UI or accidental lagging, the reason is being unsure of the safety measures these apps follow to save confidential information.

While these were the non-technical issues hovering around the industry, let us now look at the technical challenges that can hinder P2P payment app user journey –

Now, the Technical ones

Security

One of the biggest technologies-related challenges that P2P app development companies face is security. Going by the track record, hackers have been able to get into some of the most secured institutions and platforms like NIC Asia Bank and PayPal. The high level of vulnerability has made Security one of the biggest challenges in the Mobile P2P Payment industry.With the huge number of confidential data being stored in one place, it is imperative for the P2P Payment service providers to create a secured data record management system.

Comply with PCI DSS

It is imperative for every brand dealing with confidential banking information to follow the PCI DSS Compliances. To be eligible for the certificate, the P2P Payment service providers should meet these criteria –

- Develop and Maintain secure system and network

- Have a vulnerability management system in place

- Create strong access control standards

- Safeguard confidential information

- Continuously test and monitor networks

- Maintain and update all information security policy

Currency Conversion

Another challenge that the P2P Payment Service providers face is calculating and converting currencies in real time. With 180 currencies across the world, it can get difficult for the service providers to create a mechanism that keeps everything on track.

Along with this, the money conversion and fund transfer needs to be done in the shortest time possible: an event which is easier when banking institutions are involved, but a little complex when it comes to a digitized market.

What’s the next level?

There are continuous symptoms of growth for blockchain and cryptocurrency use inside the mobile payments industry. The working behind bitcoin has even become one of the most talked about topics in the current times. Companies like Movile have already realized the scope of using bitcoin within in-game micro purchases. Bitcoin has even become an alternate mobile payment coinage in some developing economies such as Brazil.

{Read: List of Top 7 Most Frequently Used Mobile Payment Apps}

Let us look at what the Blockchain and Cryptocurrency is all about –

Blockchain technology

The Blockchain is an unsigned online ledger, which makes use of data structure to ease our transaction processes. It allows its users to edit the ledger securely without involving a third party.

While the bank’s ledger is linked with a centralized network, Blockchain is completely anonymous thus protecting its users’ identities. This anonymity makes the technology a secure way to do transactions. Blockchain is always implemented on distributed networks. The algorithm that it uses lowers the dependency on people to authenticate the transactions, giving Blockchain the potential to unsettle the prevalent financial systems.

The electronic record of transactions is incessantly maintained and then verified in the ‘blocks’ of records. Finally, the meddle-proof ledger is then shared between the parties on their computer servers by taking help of cryptography.

Blockchain is expected to lower down the inefficiencies and costs involved in dealing with the financial sector.

Cryptocurrency

Cryptocurrency is a digital currency that exists and operates in digital peer to peer networks. It is not a string of data like your regular MP3 and Video files that can be copied. Cryptocurrency is actually an entry on a global ledger known as Blockchain.

{Know more about cryptocurrency with our article – How Does Cryptocurrency Price Moves in the Market?}

How does it work?

When you are sending someone cryptocurrencies, you are not sending them a series of files. Instead, you are writing down the exchange in the ledger, a.k.a. Blockchain. Now even though Blockchain is a decentralized record, there’s no group of people who update the ledger, like what happens in banks. The mechanism is completely decentralized.

There are people who volunteer to keep the tracks of transactions and continuously maintain them in ‘Blocks’. So now when you want to transact currency, you will have to announce it to the table so that people who are maintaining the ledgers can update them.

Fintech along with its continuous advancements is all set to make Peer to Peer Payment much stronger and easier to adopt, giving a push to companies to get involved in the P2P payment app development process.

Are you ready for the move?

strategies your digital product..