Why do ICOs Fail? Are They Still Worth Investing in 2019-2020?

Contents:

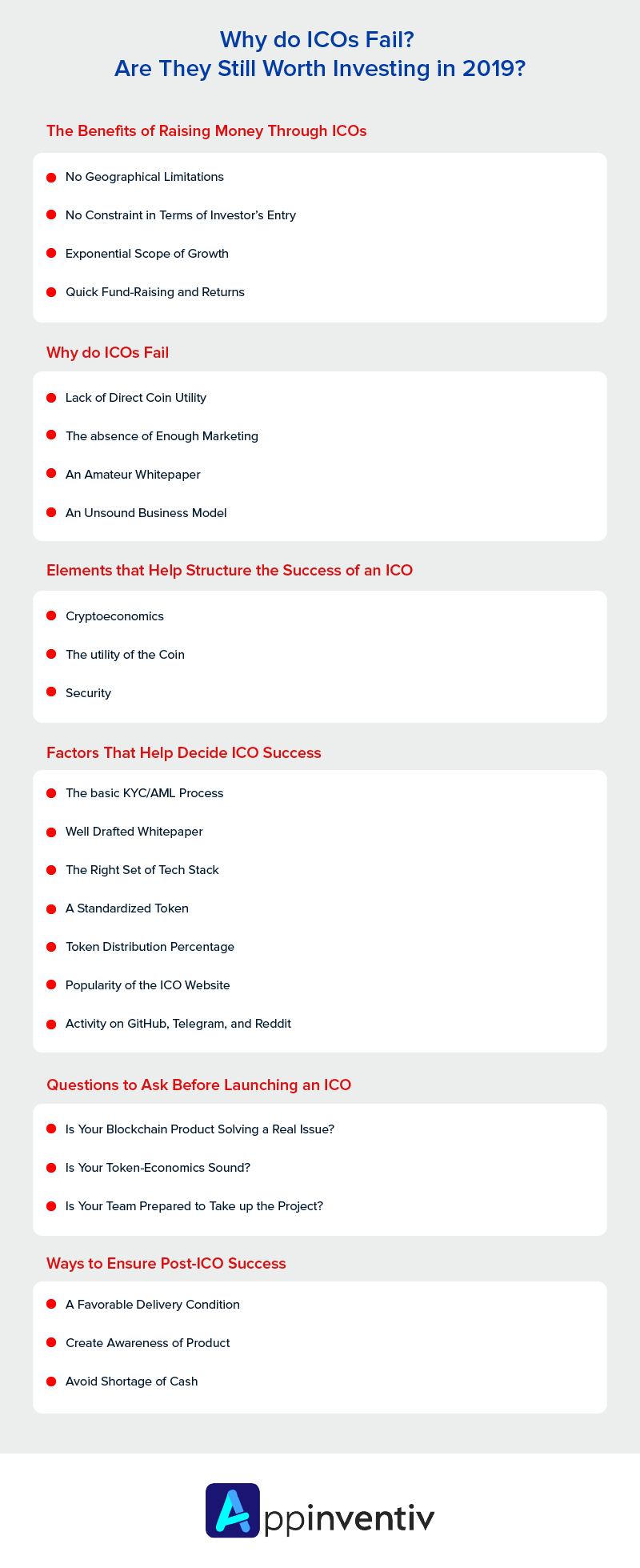

- The Benefits of Raising Money Through ICOs

- Why Did More than 50% ICOs Fail in the 2017-2018 Period?

- Elements that Help Structure the Success of an ICO

- Factors That Decides the Success of Your ICO

- Questions to Ask Before Launching an ICO

- Ways to Ensure Post-ICO Success

Let’s not keep surprises here.

The answer to the second part of the question is YES.

Yes, even in a world where there are multiple ICO failure stories around you, You should still invest in it in 2019 and 2020 for the even bigger benefits and business growth prospects that the fundraising mode has to offer.

Reason?

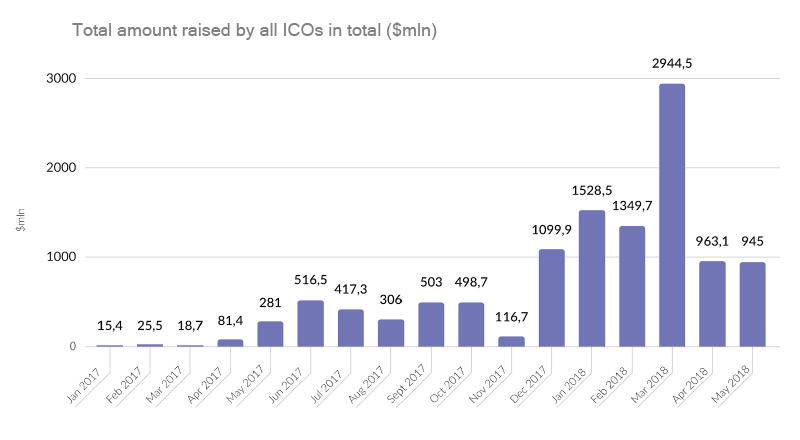

Because the whole of 2017 and a good portion of 2018 had several ICO success stories and share and 2019-2020 would be no different, especially when the industry has finally warmed up to the decentralization technology. Plus when you have news like $160M ICOs raised in the first half of January 2019 coming in, it is difficult to not be optimistic about the growing dominance of ICO in the funding industry.

The market scenario of Initial Coin Offering, with respect to the amount that the fund module has raised, that you just witnessed is in many ways the doing of the benefits that the fundraising medium offers to the entrepreneurs and the investors alike. The benefits that have removed the question ‘What is ICO’ from the frequented search queries

Something we are going to look into next before moving on to the reasons why ICOs fail and what you can do to ensure that yours meet success, and giving you the ways on how to launch a successful ICO in 2019-2020.

Well, the ride is going to be long. For those of you who stick by till the end, we have a surprise for you – A Bonus carrying additional information on how to have a successful post-launch scenario.

But before we look into the exact benefits that the ICOs have to offer especially in a VC vs ICO scenario, let us take a quick detour and look at what entrepreneurs who have raised money through the mode of fundraising have to say on it.

The Benefits of Raising Money Through ICOs

1. No Geographical Limitations

Unlike Venture Capitalism or any other form of raising funds that happen only within a set geographical boundary, ICOs can be held anywhere and between any two nations. For instance, you can raise an ICO in the US and investors from Australia or even the UK will be able to participate in the fundraising event.

2. No Constraint in Terms of Investor’s Entry

Unlike the traditional modes of fundraising events, Initial Coin Offering don’t put any restriction on the investors in terms of experience or market worth. An investor with any amount of bank balance can enter the ICO round and invest in an idea or project.

3. Exponential Scope of Growth

No one is a stranger to the possibilities of revenue that Cryptocurrencies bring with them. By investing in ICOs, the investors get a chance to get a hold of cryptocoins that carry the potential to become the next bitcoin or ethereum at a very early stage when the prices are still within their reach and then see it grow at a good rate in the future.

4. Quick Fund-Raising and Returns

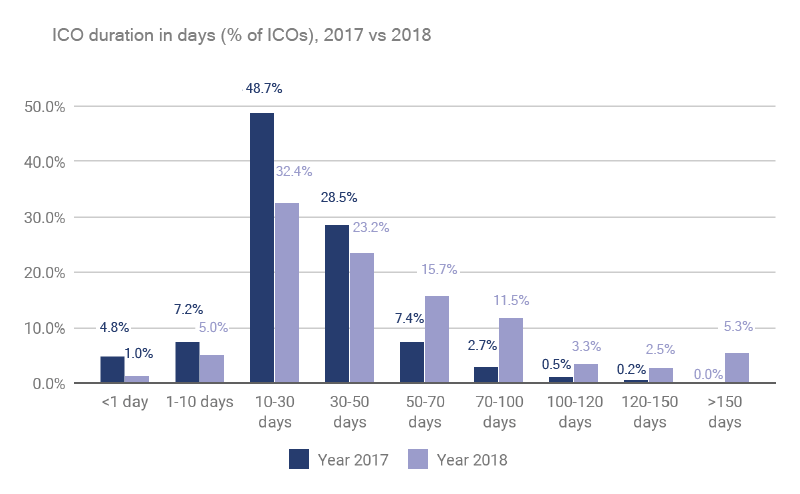

Unlike VCs, ICO generally lasts for around a month or two, thus being a medium that gives returns to the investors and funds to the entrepreneurs in the least possible time.

This promptness comes in very handy for the entrepreneurs especially as they get to launch their business in the least possible time.

Even amidst so many clear benefits of raising funds through the ICO route and the obvious fact that the method has proven beneficial for a number of investors in the world, the one thing that we cannot ignore is the alarming rate of failures that the ICO industry faces.

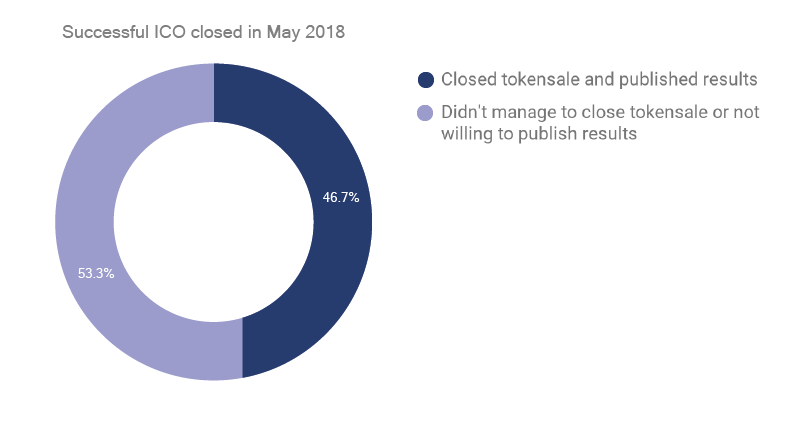

In a piece of not-so-recent news covered by Coinspeaker.com, around 50% of ICOs failed between 2017 and 2018.

While this 50% is only the last year’s picture, the rate has always been prevalent and high. A rate and rise that adds on to the notoriously scammy image of the Initial Coin Offering process.

But, just like all the misconceptions, there is only a half-truth in the statement that ICOs fail because of scams, when in fact there are a number of contributory factors behind the occurrence.

Let us look at some of the factors that played a pivotal role in setting the failure of ICOs in 2018 and might play a part in the failure of your ICO as well.

Why Did More than 50% ICOs Fail in the 2017-2018 Period?

There are quite many reasons behind the failure of an ICO, both in the pre and post-release stage. The ones beside scam and phishing that are generally held responsible are:

Lack of Direct Coin Utility

Entrepreneurs, most often than not are unable to show the direct usage of the cryptocoin. All they are able to portray is a picture where you hold the coin and then transfer it to someone else. This restricted rather lack of utility is what prepared the ICO for demise at a very early stage.

The absence of Enough ICO Marketing

Blockchain Entrepreneurs generally fail to pay enough attention to the marketing of ICO. They get too ahead of themselves and end up not paying enough attention to the marketing of the offering assuming the innovative idea itself will do the work for them.

Not marketing the offering enough almost always turns out to be a huge mistake that an entrepreneur can make in their whole Blockchain and ICO journey.

An Amateur Whitepaper

A whitepaper in many ways is an important part of the whole ICO pitch. After all, it is the document that documents all the different details of the whole process – the mode of raising money, how it would be utilized, the actual project plan.

For a document as important as this, it is beyond important to pay enough attention to the Whitepapers, failure to which can lead to the failure of the whole ICO process itself.

An Unsound Business Model

Even within this single point, there are two classic mistakes that entrepreneurs make – A. Getting into the whole ICO game only with the intention to raise funds and B. Assuming that the investors won’t smell the intention on them.

It is necessary that the business model you approach the investors with is well planned and shows a potential to survive even without any fundings, in the absence of it, chances are that you will have left the investors meeting with disappointment.

With the reasons that are the culprit behind low ICO success rate are now attended to, it is time to move ahead.

Now that we have looked into the absolute worst case scenario and the reasons that might act as the catalyst for the scenario, it is now the time to look at ways you can ensure that the same doesn’t happen with you and yours become one of the glorious ICO success stories.

But before we move on to the factors that will play a crucial role in deciding the success of your ICO, first we will have to look at the elements or rather pillars on which the whole success would ride on.

Elements that Help Structure the Success of an ICO

A. Cryptoeconomics

While there are two words that together make up the word “Cryptoeconomies”, it is the first part – ‘Cryptocurrency’ that is usually paid attention and not ‘Economics’.

And, it is not the developers who can be faulted here. In the case of FOMO, a number of investors and entrepreneurs alike have entered the Blockchain space, without actually understanding how it all works and what they can derive with it – A clarity which is given by properly outlayed Cryptoeconomics.

So, until you bring back the economics back to Cryptoeconomics, you cannot expect a high return from the ICO industry.

B. The utility of the Coin

Utility or Usage is usually defined as the satisfaction that is derived from the consumption of any goods or services. Now, even when the utility has become such an important element of the whole ICO process, very few entrepreneurs attend to it.

One way to judge if your coin is offering any utility is asking yourself “Will the business fall apart if I remove the Token”? If the answer is Yes, you should keep the idea, if not rework on your idea.

Another important thing to note here is whether or not the Token Velocity is long. In case of Long velocity, people hold on to the token for longer good, something that is treated as an ideal scenario in the crypto world and in the opposite scenario, people give away the token in short term – something that leads to your business failing sooner than what you would like.

C. Security

The moment you launch your ICO, you come in the public eye – a platform which is frequented by hackers on a very constant basis.

So, ask your team of Blockchain developers to work around these questions in order to ensure that the platform is 100% secure –

- Where will the users store their private key

- How will the wallets be protected?

- How will the customer’s tokens be protected in the ecosystem?

- Who all will have access to the multi-signature wallet keys?

With the pillars that define the success of an ICO now delved into, it is now time to look into the various factors that also have an impact on the success rate of your Initial Coin Offering, these factors are also the things to consider for an ICO.

Factors That Decides the Success of Your ICO

1. The Basic KYC/AML Process

We are living in a world that is majorly dominated by the traditional finance institutions – a world where it makes perfect sense to have a strong KYC and AML process instilled.

In the present market scenario where the Blockchain world is becoming yet another case study of hoaxes and phishing activities, it is even more important to have your project follow the KYC and AML process to ensure that they are safe for the investors and the presumably millions of end-users who will enter the segment.

2. Well Drafted Whitepaper

The ICO Whitepaper that you curate will be a roadmap of how the crypto project will be implemented by your team. It will offer the investors a look into the business and regulatory information of your crypto project along with step-by-step milestone and the details of tech stack you will be using to achieve that.

In many ways, a well-drafted whitepaper can be your only chance to truly get fundings from investors, so it’s beyond important that you work on it rather religiously.

3. The Right Set of Tech Stack

One thing that most definitely attracts investors is the set of technologies that you plan on working around in your Blockchain project. While technologies like Ethereum and Wave can be a great starting point, try to embed in more technologies in the picture as well, to showcase your extensive expertise in the Blockchain development domain.

Another crucial thing to note here is that in addition to having an extensive knowledge of multiple technologies might just not be enough. You will also have to have a working knowledge of the right tech stack that your project demands.

4. A Standardized Token

A common but sometimes ignored factor of a successful ICO is the usage of the ERC20 tokens for the fundraising activity. It is basically a standardized token that is issued on Ethereum Blockchain and has no need of own distributed ledger.

It allows your team to raise the amount on the Ethereum Blockchain itself before the value of tokens is transferred on your chain.

It also allows a fast transaction rate and makes it easy for web clients to communicate the ERC20 transaction with Blockchain. Also, because of the acceptance that ERC20 token shows it is accessible to a number of cryptocurrency investors.

5. Token Distribution Percentage

What happens is that normally 43% to 79% tokens are distributed through ICO. What is generally misinterpreted is that if you increase the amount of distributed income, you will be able to earn greater funds.

In reality, the more you demand, the more desperate you appear, something that can turn off your investors to a huge extent. So, what we suggest is having belief in your project in a way that you are sure you will make it in the market even with fewer funds.

6. The Popularity of the ICO Website

The popularity of your ICO website has a huge impact on the success of your project. The more the traffic your website gets, the better are its chances to get the attention and points from the investors.

So, as you prepare to launch your ICO in the market, work on the creation of the website as well as in many ways, it can be your only main platform to show the value that your offering holds.

7. Activity on GitHub, Telegram, and Reddit

Lately, your activity on communities like Telegram, Reddit, and GitHub etc have become directly proportionate to how much success your ICO receives.

Investors are paying more and more attention to these platforms to determine which project has the most potential – a decision that they are taking on the basis of the GitHub repository stars and size of active participants in the community.

The factors you just read although very helpful when it comes to deciding the success of your ICO can prove to be very ineffective until you have the answers to all the questions that should be considered before launching an ICO.

Although we should have attended to this section earlier while answering What Makes a Successful ICO but attending to them now will help you get a last-minute checklist to ensure that all the factors of success that you are working on are in line with the actual purpose that your ICO is going to solve – a mix of which will give you a clear edge in the pitch discussion and help you in understanding how to evaluate ICO.

Questions to Ask Before Launching an ICO

Is Your Blockchain Product Solving a Real Issue?

Instead of drawing a Blockchain solution around a problem that you think would come up after a period of time or is something purely co-incidental, focus your energy on developing a solution that would solve a real problem which exists today.

Is Your Token-Economics Sound?

Let’s be frank here. After all’s said and done, the investors are ultimately interested in the economics of your token.

As entrepreneurs, you will have to gauge how the token would be developed, used, and then grown eventually. You will be able to show the longevity of your token by showing what the token circulation would look like, the situation of increasing demand, usage, and growing scarcity which would ultimately lead to greater demand.

Is Your Team Prepared to Take up the Project

Now that we have seen the factors on how to launch a successful ICO , you will have to check whether or not your team is prepared to take up the work and if they have the skills to – a question that you won’t have to attend to if you let someone like our team of Blockchain developers handle the project.

Now that we have looked into the questions that you should normally attend to while preparing for the successful Initial Coin Offering launch, let us give you insights into the questions that the investors generally ask when checking the validity of your business idea or project.

Here’s a poster carrying the questions straight from the horses’ mouths. The answer to ‘What to Investors Look for in an ICO?’

Now that we have neared the end of the article on how to launch successful ICO, it is time to look into the Bonus Section that we promised you.

In this special segment, we are going to look beyond the successful Initial Coin Offering acceptance in the market, we are going to look into the factors that make the post-ICO launch success, more successful, thus ensuring that your idea that you got funded for stays in the market profitably for long.

Basically, we are going to take you from What makes a successful ICO to What makes a successful Business.

Let’s get to it.

*BONUS*

Ways to Ensure Post-ICO Success

It is very easy to get caught up in the whole ICO launch and getting funded process that entrepreneurs more often than not overlook the other most essential thing that would keep them in the business for the long run – The Factors to Ensure Post-ICO Success.

Let us help you with it.

Here are the factors that you should look at to ensure that your ICO remains successful.

A Favorable Delivery Condition

Poor execution is the risk that entrepreneurs usually face after Initial Coin Offering. Factoring in how you can deliver the project on time and as they are intended is something that can make yours a successful ICO.

Also, while at the fundraising stage, your project or idea must have already proved its feasibility with all the features well-tested, but you will still have to continue looking for feedback from your investors and probable consumers on what more they wish to see in the project.

In the end, the skills and visions that the core management or delivery team has for the project is something that should be robust enough for the whole group to follow up on and accomplish while helping them overcome all hardships faced in the execution stage.

Create Awareness of Product

Even at a stage where your product/idea has received validation from the investors and has established itself to be one that would get you success in the future while being of value to the end-users, the challenge still remains.

You will not be able to survive long with an investor validated idea. You will have to ensure that your idea or product reaches the masses as well, for ultimately your user base has to be much greater than just a set of 5 investors.

There are two ways to achieve this – A. Active Engagement within the Crypto-Sphere and B. A tight-knit User Base who would Invest their time in Your Project.

The first portion of the marketing effort can be solved by attending events that crypto-enthusiasts frequent. Events like Meetup or Conferences would help you in creating a strong network within the crypto community.

As for the second part, you should create communities or resources like blogs or podcasts or even videos on the internet to give the whole Blockchain community a platform to explore or discuss your offerings.

Avoid Shortage of Cash

The last stone that is left to be unturned is the risk of cash-shortage. After you have reached the hard cap and the coins are all cashed in, a new challenge emerges – management of funds as optimally as possible.

You should allocate enough money to the product development part as you would have planned in the business plan you made at the beginning along with taking some funds out in name of savings kept aside to solve unexpected issues.

This part is all about ensuring that there is no way you spend all the money before hitting the project’s milestone.

Now that you have seen it all, there is just one thing left to do – Raise an ICO.

Let us help you. Get in touch with our team of ICO Experts today.

strategies your digital product..